What is the Form No. 09 - Tax refund claim for re-imported exports in Vietnam?

What is the Form No. 09 - Tax refund claim for re-imported exports in Vietnam?

Pursuant to point a, clause 2, Article 33 of Decree 134/2016/ND-CP as amended by clause 18, Article 1 of Decree 18/2021/ND-CP which regulates the dossier for tax refund for goods imported for re-export as follows:

Tax Refund for re-imported exports

...

- Tax refund dossier includes:

a) tax refund claim for exported or imported goods sent through the electronic data processing system of the customs authority as per the information criteria in Form No. 01 Appendix VIIa, or an tax refund claim according to Form No. 09 Appendix VII issued with this Decree: 01 original.

...

Thus, in the case where the taxpayer submits an tax refund claim for re-imported exports through the electronic data processing system of the customs authority, it shall be based on the information criteria in Form No. 01 Appendix VIIa issued with Decree 18/2021/ND-CP.

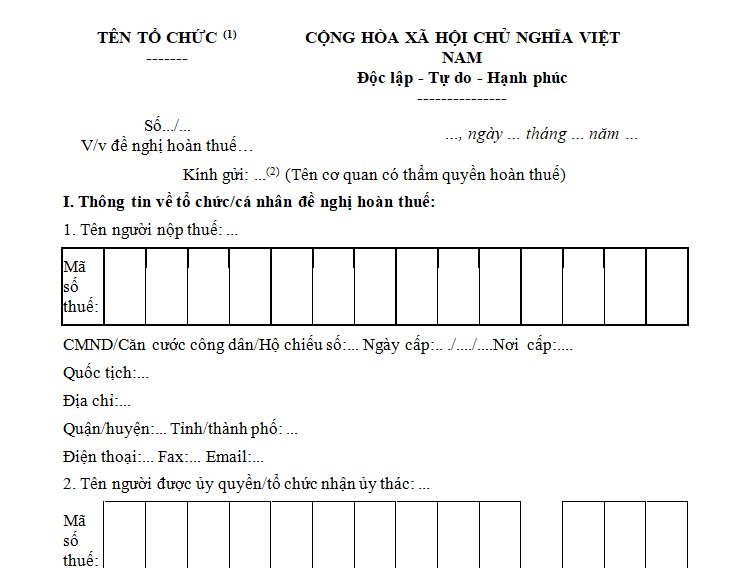

In case the taxpayer submits an tax refund claim for re-imported exports in paper form, they shall fill out Form No. 09 of the tax refund claim issued with Decree 18/2021/ND-CP.

Download Form No. 09 of the tax refund claim issued with Decree 18/2021/ND-CP.

What is the Form No. 09 - Tax refund claim for re-imported exports in Vietnam? (Image from the Internet)

Which re-imported exports which have been paid duties are eligible for an export duty refund and exempt from import duty in Vietnam?

Based on clause 1, Article 33 of Decree 134/2016/ND-CP, exported goods that have been subject to export tax but must be re-imported are entitled to an export duty refund and exempted from import duty, including:

- Goods that have been exported but need to be re-imported back to Vietnam;

- Exported goods sent by organizations or individuals in Vietnam to organizations or individuals abroad via postal services and international express services that have paid taxes but could not be delivered to the recipient, requiring re-importation.

Taxpayers are responsible for accurately and honestly declaring on the customs declaration about the re-imported goods as previously exported goods; information regarding the contract number and date, and the name of the purchasing partner in the case there is a goods sales contract.

Customs authorities are responsible for checking the declaration content of taxpayers and clearly recording the inspection results to facilitate tax refund processing.

What is the procedure for tax refunds for re-imported exports in Vietnam?

Based on clause 3, Article 33 of Decree 134/2016/ND-CP (some content annulled by point a clause 2 Article 2 Decree 18/2021/ND-CP) which regulates the procedure for tax refunds for re-imported exports as follows:

Tax Refund for re-imported exports

...

- The filing, receipt, and processing of tax refund dossiers shall be implemented in accordance with the provisions of the law on tax administration.

Simultaneously, based on clause 3, Article 12 of Circular 06/2021/TT-BTC which provides guidelines on the procedure for tax refunds for re-imported exports as follows:

(1) In case of pre-tax refund:

The customs authority at the place where the tax refund arises shall conduct an inspection at the headquarters of the customs authority according to regulations at clause 1, Article 74 of Law on Tax Administration 2019, check information in the tax refund request dossier with information in the System to determine tax refund conditions and the tax amount to be refunded.

- If eligible for a tax refund, the Tax Refund Decision is issued as stipulated in point c, clause 3, Article 12 of Circular 06/2021/TT-BTC.

- If the dossier does not fully provide the information for issuing the Tax Refund Decision, the customs authority shall notify the taxpayer to supplement the necessary information through the System according to Form No. 4 Appendix 2 issued with Circular 06/2021/TT-BTC; in case of paper dossiers, notify according to Form No. 05/TXNK Appendix 1 issued with Circular 06/2021/TT-BTC;

- If not eligible for a tax refund, the customs authority shall notify the taxpayer of the reason for non-refund through the System according to Form No. 5 Appendix 2 issued with Circular 06/2021/TT-BTC; in case of paper dossiers, notify according to Form No. 06/TXNK Appendix 1 issued with Circular 06/2021/TT-BTC.

- Transfer dossiers eligible for pre-tax refund to those requiring prior inspection.

Dossiers eligible for pre-tax refund but beyond the time limit set by the customs authority's written notification and the taxpayer does not justify, supplement the tax refund dossier or justifies, supplements but does not prove the correctness of the declared tax, the customs authority shall notify through the System according to Form No. 4 Appendix 2 or paper according to Form No. 05/TXNK Appendix 1 to the taxpayer regarding the transfer of the dossier from pre-tax refund to prior inspection at the taxpayer's headquarters according to point đ clause 2 Article 73 of Law on Tax Administration 2019. The inspection process is implemented in accordance with point b clause 3 Article 12 of Circular 06/2021/TT-BTC.

(2) In the case of prior inspection before tax refund:

- Inspection procedure

+ Within 03 working days from the date of the notification to the taxpayer regarding acceptance of the dossier for prior inspection before tax refund, the Head of the Customs Department where the tax refund dossier is received shall issue an Inspection Decision at the taxpayer's headquarters according to Form No. 07/TXNK Appendix 1 issued with Circular 06/2021/TT-BTC and send it to the taxpayer within 03 working days from the date of issuance.

+ Within 05 working days from the date of issuance of the Inspection Decision, the customs authority must conduct the inspection at the taxpayer's headquarters. The inspection duration shall not exceed 05 working days. Before conducting the inspection, the head of the inspection team must announce the Inspection Decision, prepare a Record of Announcement of the Inspection Decision according to Form No. 08/TXNK Appendix 1 issued with Circular 06/2021/TT-BTC with the authorized representative of the taxpayer.

+ In the case of complex tax refund dossiers that cannot conclude inspection within 05 working days, the inspection team needs to extend the verification period to gather documents and, at the latest, 01 working day before the end of the inspection period, the head of the inspection will report in writing to the signatory of the Inspection Decision to issue a Decision to extend the inspection period according to Form No. 09/TXNK Appendix 1 issued with Circular 06/2021/TT-BTC, the extension period shall not exceed 05 working days. The head of the inspection team shall announce the Decision to extend the inspection period and prepare a Record of Announcement of the Decision to extend the inspection period.

- Inspection content

+ Inspect customs dossiers, tax refund dossiers, documents, accounting books, payment vouchers, warehouse entry and exit slips; compare the requested refund tax amount with the tax amount collected on the Customs centralized accounting system, information in the tax refund dossier, and information on the System related to export and import declarations with the tax amount requested for refund.

+ In cases of tax refund as stipulated in Article 35 of Decree 134/2016/ND-CP, the customs authority evaluates the taxpayer's declarations on depreciation rate and the calculation method of depreciation rate.

+ For tax refunds as prescribed in Article 36 of Decree 134/2016/ND-CP, the customs assesses the consistency between the norms reported by the taxpayer in the material, resource tax calculation report for import duty refund Form No. 10 Appendix VII issued with Decree 134/2016/ND-CP and the actual production norms, books, accounting documents, technical materials related to the imported materials and resources requested for tax refund.

In the case of initial inspection or absence of production base inspection conclusion, the customs must inspect the production base, the right to use machinery, and equipment at the production base.

+ Check other documents, materials, and data concerning exported and imported goods as regulated in clause 6 Article 1 of Circular 39/2018/TT-BTC.

+ Upon concluding the inspection, the customs must determine the tax amount eligible for refund per tax type, the tax amount not eligible for refund, reasons for not meeting refund conditions.

For imported goods eligible for a tax refund under Article 36 of Decree 134/2016/ND-CP, the taxpayer has paid import duty according to customs declarations and has also paid import duty according to Customs tax imposition Decisions, customs must specify the import duty refund amount as per the customs declaration and the import duty refund amount according to the tax imposition Decisions.

+ Prepare an inspection report according to Form No. 10/TXNK Appendix 1 issued with Circular 06/2021/TT-BTC within 05 working days from the date of inspection conclusion at the taxpayer's headquarters.

+ Prepare a draft inspection conclusion and send it to the taxpayer within 03 working days from the date of drafting the inspection report according to Form No. 11/TXNK Appendix 1 issued with Circular 06/2021/TT-BTC or send via fax, registered mail, or hand-deliver to the taxpayer.

In case the taxpayer does not agree with the draft inspection conclusion of the customs authority, within 03 working days from receiving the draft inspection conclusion, the taxpayer must explain to the customs authority through the System, in writing, or directly. If the taxpayer explains directly, the customs authority must prepare minutes of the meeting according to Form No. 12/TXNK Appendix 1 issued with Circular 06/2021/TT-BTC.

+ Within 03 working days from the end of the taxpayer's explanation period, the Head of the customs authority who issued the Inspection Decision shall issue the inspection conclusion.

If not meeting refund conditions, the customs authority shall notify through the System according to Form No. 5 Appendix 2 issued with Circular 06/2021/TT-BTC or notify in writing to the taxpayer regarding ineligibility for tax refund according to Form No. 06/TXNK Appendix 1 issued with Circular 06/2021/TT-BTC.(3) Issuance of Tax Refund Decision

- The Head of the Customs Sub-department issues the Tax Refund Decision according to Form No. 13/TXNK in Appendix 1 issued together with Circular 06/2021/TT-BTC. A scanned copy of the Tax Refund Decision is sent to the taxpayer and related agencies (if any) through the System, with the original Tax Refund Decision sent to the taxpayer and related agencies (if any). The time limit for issuing the Tax Refund Decision is conducted according to the provisions in Article 75 of the Law on Tax Administration 2019.

- In the case of imported goods subject to tax refund according to Article 36 of Decree 134/2016/ND-CP, where the taxpayer has paid import duty according to the customs declaration and has also paid import duty according to the Tax Assessment Decision of the customs authorities, the refunded tax amount for a customs declaration includes both the tax paid according to the customs declaration and the tax paid according to the Tax Assessment Decision. The issuance of the Tax Refund Decision is conducted as follows:

+ The Head of the Customs Sub-department where the customs declaration is registered issues the Tax Refund Decision for the amount of tax the taxpayer has paid according to the customs declaration.

+ The Head of the customs authority that issued the Tax Assessment Decision following the provisions of Clause 7, Article 17 of Decree 126/2020/ND-CP issues the Tax Refund Decision for the amount of tax the taxpayer has paid according to the Tax Assessment Decision.