What is the Form No. 06 on list of duty-free exports and imports in Vietnam?

What is the Form No. 06 on list of duty-free exports and imports in Vietnam?

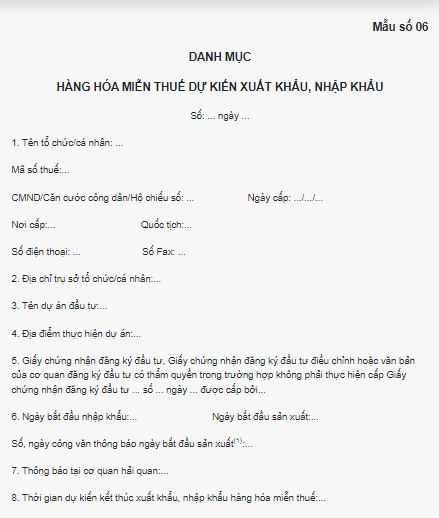

Based on Appendix 7 of the Tax Exemption, Reduction, Refund, and Non-Tax Collection Forms issued together with Decree 18/2021/ND-CP, the list of duty-free exports and imports, Form No. 06, is outlined as follows:

>>> Download Form No. 06 list of duty-free exports and imports.

What is the Form No. 06 on list of duty-free exports and imports in Vietnam? (Image from Internet)

What are principles for formulating a list of duty-free exports and imports in Vietnam?

According to the provisions of Article 30 of Decree 134/2016/ND-CP, the principles for creating the list of duty-free imports (hereinafter referred to as the duty-free list) are as follows:

- Organizations or individuals using the goods (project owners; production, business establishments; shipbuilding establishments; organizations, individuals conducting petroleum activities), hereinafter collectively referred to as project owners, are responsible for notifying the duty-free list for export and import duties to customs authorities.

If the project owner does not directly import duty-free goods but the main contractor, subcontractors, or financial leasing companies import the goods, the contractor or financial leasing company will use the duty-free list notified by the project owner to the customs authorities.

- The goods must fall under one of the exempt categories specified under Clauses 11, 12, 13, 14, 15, 16, and 18 of Article 16 of the Export and Import Duty Law 2016 as follows:

Tax Exemption

...

11. Goods imported to create fixed assets of entities eligible for investment incentives under investment laws, including:

a) Machinery, equipment; components, parts, detached parts, spare parts for complete assembly or use with machinery, equipment; raw materials, supplies for manufacturing or producing machinery, equipment or their components, parts, and spare parts;

b) Specialized transport vehicles in production line technology used directly for the project's production activities;

c) Building materials not produced domestically.

Import duty exemption for goods specified in this Clause applies to both new and expanded investment projects.

12. Plant varieties; animal breeds; fertilizers, plant protection drugs not produced domestically and necessary for import according to competent state agency regulations.

13. Raw materials, supplies, components not produced domestically imported for an investment project in sectors with special investment incentives or areas with extremely difficult socio-economic conditions under investment laws, high-tech enterprises, science and technology enterprises, and scientific and technological organizations, shall be exempt from import duties for a period of 5 years from the start of production.

This duty exemption does not apply to mineral mining projects; projects producing products with the total value of natural resources, minerals, and energy costs accounting for 51% or more of product cost; projects producing, trading goods, or services subject to special consumption tax.

14. Imported raw materials, supplies, components not produced domestically for manufacturing and assembling prioritized medical equipment, exempt from import duties for 5 years from the start of production.

15. Imported goods for petroleum activities, including:

a) Machinery, equipment, spare parts, special-purpose vehicles necessary for petroleum activities, including temporary import and re-export;

b) Components, parts, detached parts, spare parts for complete assembly or use with machinery, equipment; raw materials, supplies for manufacturing machinery, equipment or their components, parts, and spare parts necessary for petroleum activities;

c) Supplies necessary for petroleum activities not produced domestically.

16. Shipbuilding projects and establishments in the list of industries and trades eligible for investment incentives under investment laws, exempt from import duties for:

a) Goods imported to create fixed assets of shipbuilding establishments, including: machinery, equipment; components, parts, detached parts, spare parts for complete assembly or use with machinery, equipment; raw materials, supplies for manufacturing or producing machinery, equipment or their components, parts, and spare parts; special-purpose vehicles in production line technology used directly for shipbuilding activities; building materials not produced domestically;

b) Imported goods being machinery, equipment, raw materials, supplies, components, semifinished products not produced domestically for shipbuilding;

c) Exported ships.

...

18. Imported goods being raw materials, supplies, components not produced domestically for direct use in manufacturing IT products, digital content, and software products.

These goods must suit the industry, investment field, objectives, scale, and capacity of the project, production establishment, or activity using duty-free goods;

- The duty-free list is created once for the project, production establishment, activity using duty-free goods, or per phase, per item, per complex, production line according to actual conditions and project, production establishment, or activity documentation, hereinafter collectively referred to as the project.

When and where to notify the list of duty-free exports and imports in Vietnam?

According to the provisions of Clause 4 Article 30 of Decree 134/2016/ND-CP (as amended by Point c Clause 20 Article 1 of Decree 18/2021/ND-CP), the time and place to notify the list of duty-free exports and imports are as follows:

- The project owner is responsible for submitting the duty-free list notification dossier as stipulated in Clause 3 Article 30 of Decree 134/2016/ND-CP before registering the first import duty-free goods declaration;

- The place to receive the duty-free list notification is the Customs Department where the project is implemented, the Customs Department where the project owner's headquarters or centralized management area is located for projects implemented in multiple provinces and cities, or the Customs Department where the complex, production line is installed for duty-free goods to be imported under the complex, production line.