What is the Form No. 04/tk-sddpnn on non-agricultural land use tax declaration in Vietnam?

What is the Form No. 04/tk-sddpnn on non-agricultural land use tax declaration in Vietnam?

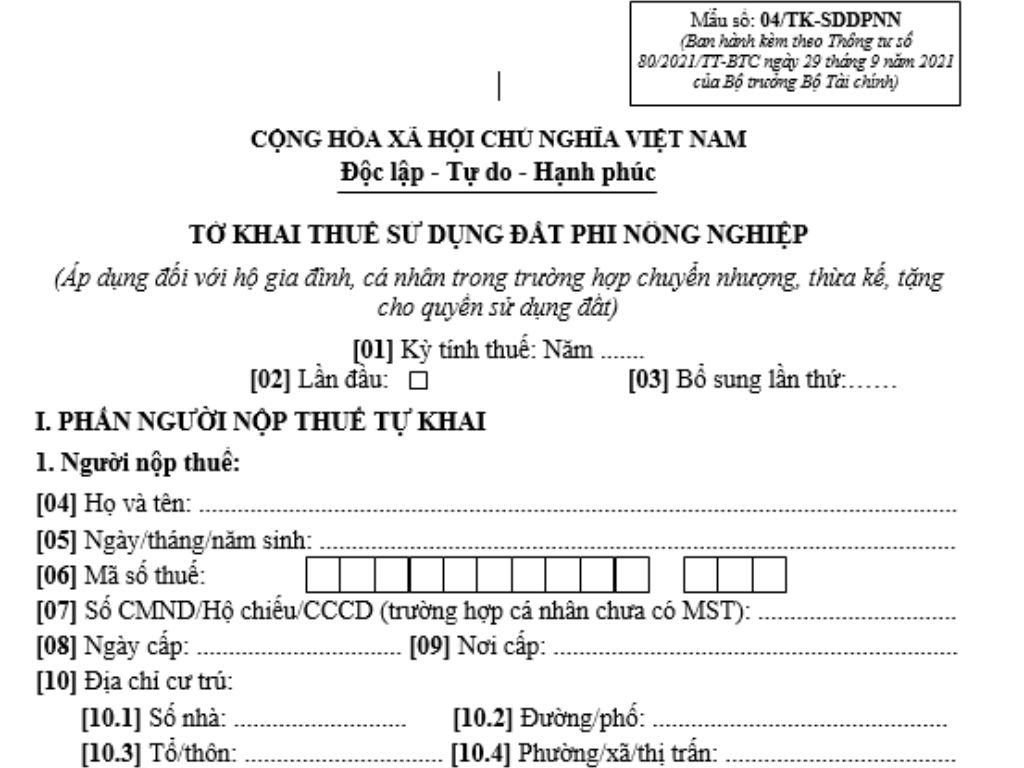

Currently, the non-agricultural land use tax declaration form is Form No. 04/tk-sddpnn, Appendix 2 issued along with Circular 80/2021/TT-BTC. The form is as follows:

Non-agricultural Land Use Tax Declaration Form No. 04/tk-sddpnn DOWNLOAD

What is the Form No. 04/tk-sddpnn on non-agricultural land use tax declaration in Vietnam? (Image from the Internet)

Which types of land are subject to non-agricultural land use tax in Vietnam?

Based on Article 2 of the 2010 Non-agricultural Land Use Tax Law, the objects subject to non-agricultural land use tax are stipulated as follows:

Taxable Objects

1. Residential land in rural areas, homestead land in urban areas.

2. Non-agricultural production and business land including land for industrial park construction; land for building production and business premises; land for mineral exploitation and processing; land for producing building materials, pottery.

3. Non-agricultural land specified in Article 3 of this Law used for business purposes.

And based on Article 3 of the 2010 Non-agricultural Land Use Tax Law, it is stipulated as follows:

Non-taxable Objects

Non-agricultural land not used for business purposes includes:

1. Land used for public purposes including transportation, irrigation; land for building cultural, health, education and training, sports works serving public interests; land with historical-cultural relics, scenic spots; land for building other public utilities according to the regulations of the Government of Vietnam;

2. Land used by religious entities;

3. Land for cemeteries, graveyards;

4. Rivers, canals, streams, ponds and specialized water surfaces;

5. Land with structures like communal houses, temples, shrines, hermitages, ancestral houses, clan worship houses;

6. Land for building office headquarters, career institutions’ works, land used for defense and security purposes;

7. Other non-agricultural land as stipulated by law.

Thus, based on the above regulations, the types of land subject to non-agricultural land use tax include:

- Residential land in rural areas, homestead land in urban areas.

- Non-agricultural production and business land including land for industrial park construction; land for building production and business premises; land for mineral exploitation and processing; land for producing building materials, pottery.

- Non-agricultural land specified in Article 3 of the 2010 Non-agricultural Land Use Tax Law used for business purposes.

What is the price of a square meter of taxable land for non-agricultural land use tax calculation in Vietnam?

According to Article 6 of Circular 153/2011/TT-BTC, the price of a square meter of taxable land for calculating non-agricultural land use tax is regulated as follows:

The price of a square meter of taxable land for tax calculation is the land price according to the usage purpose of the taxable parcel as prescribed by the provincial People's Committee and is stabilized in a five-year cycle starting from January 1, 2012.

- In the event of a change in taxpayer or factors resulting in changes to the price per square meter of taxable land within the stabilization cycle, it is not necessary to re-determine the price for the remaining time of the cycle.

- When the State allocates land, leases land, or converts land use from agricultural to non-agricultural land, or from non-agricultural production and business land to homestead land within the stabilization cycle, the price per square meter of taxable land is the price determined by the provincial People’s Committee at the time of land allocation, leasing, or conversion and is stabilized for the remaining time of the cycle.

- If the land is used for unintended purposes or illegally occupied, the price per square meter for tax calculation is the price for the current usage purpose as prescribed by the provincial People's Committee for that locality.

Who is the taxpayer for non-agricultural land use tax?

According to Article 4 of the 2010 Non-agricultural Land Use Tax Law, the regulation is as follows:

Taxpayer

1. The taxpayer is the organization, household, individual having the right to use the land subject to tax as prescribed in Article 2 of this Law.

2. In case an organization, household, or individual has not been granted a Certificate of land use rights, ownership of residential housing and other assets attached to land (hereinafter referred to as Certificate), the current land user is the taxpayer.

3. Taxpayer in several specific cases is regulated as follows:

a) In case the State leases land for investment project implementation, the homestead land lessee is the taxpayer;

b) In case the land use right holder leases land under a contract, the taxpayer is determined according to the agreement in the contract. If the contract does not contain an agreement on the taxpayer, the land use right holder is the taxpayer;

c) In case the land has been granted a Certificate but is disputed, prior to dispute resolution, the current land user is the taxpayer. Tax payment is not a basis for resolving land use right disputes;

d) In case of multiple persons jointly having the land use right to a parcel, the taxpayer is the legal representative of those jointly having the right to use the parcel;

đ) In case the land use right holder contributes capital for business by land use right forming a new legal entity with the land use right subject to tax prescribed in Article 2 of this Law, the new legal entity is the taxpayer.

Thus, the taxpayer is an organization, household, or individual having the right to use the land subject to tax (in cases where a Certificate has not been issued, the current land user is the taxpayer).