What is the form for the January 2025 VAT declaration in Vietnam? How to prepare the January 2025 VAT declaration?

What is the form for the January 2025 VAT declaration in Vietnam?

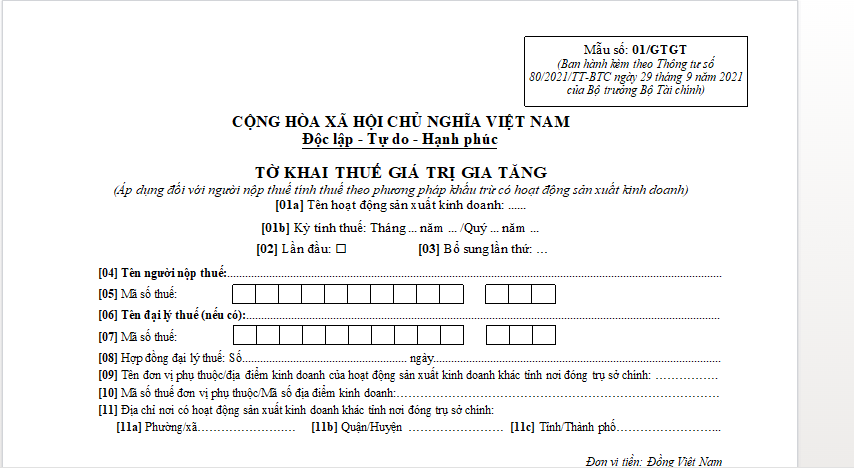

The current form for the January 2025 VAT declaration is Form No. 01/GTGT in Appendix II issued together with Circular 80/2021/TT-BTC.

Form No. 01/GTGT applies to taxpayers calculating tax by the deduction method with production and business activities. Additionally, Form No. 01/GTGT is used for VAT declarations on a monthly and quarterly basis.

Form No. 01/GTGT is as follows:

Download Form No. 01/GTGT: January 2025 VAT declaration

What is the form for the January 2025 VAT declaration in Vietnam? How to prepare the January 2025 VAT declaration? (Image from Internet)

What are instructions for preparing the January 2025 VAT declaration in Vietnam?

- Item [01a] - Name of production and business activity: The taxpayer must choose or record one of the following activities:

+ Regular production and business activities.

+ Traditional lottery, computerized lottery activities.

+ Oil and gas exploration and extraction activities.

+ Infrastructure investment projects, houses for transfer outside the province where the headquarters is located.

+ Power plants located outside the province where the headquarters is located.

- Item [01b] - Tax calculation period: Declare the period that generates tax obligations. If the taxpayer is approved by the tax authority to declare tax quarterly or the taxpayer is newly established, record the tax calculation period as the quarter that generates tax obligations.

- Items [02], [03]: Select "First time". If the taxpayer discovers that the initial tax declaration submitted has errors, they must provide a supplementary declaration according to the sequence of each addition.

- Items [04], [05]: Declare "Name of taxpayer and tax identification number" as per the taxpayer's business registration information.

- Items [06], [07], [08]: In case of the tax agency making a declaration: Declare "Tax agency's name, tax number" and "number, date of tax agency contract". The tax agency must have a taxpayer registration status of "Active" and the contract must be valid at the time of declaration.

- Items [09], [10], [11]: In cases where the taxpayer separately declares VAT for dependent units or business locations in a different province than the headquarters, as specified in points b, c clause 1 Article 11 of Decree No. 126/2020/ND-CP dated October 19, 2020, by the Government of Vietnam (except cases where the dependent unit directly declares VAT with the tax office managing the dependent unit).

- Item [21]: If no purchase or sale activities occur during the tax period, the taxpayer must still prepare and submit a declaration to the tax authority (except in cases of temporary cessation of activity). In the declaration, the taxpayer marks "X" in item [21]. The taxpayer should not enter the number 0 in items reflecting the value and VAT of goods or services purchased, sold during the period.

- Item [22]: The figure recorded in this item is the VAT amount still deductible to be carried over to the next period at item [43] of the previous VAT declaration form No. 01/GTGT.

- Item [23]: The figure in this item is the total value of goods and services purchased in the period excluding VAT (excluding the value of goods and services purchased for investment projects already declared in the VAT declaration for investment projects form No. 02/GTGT) on invoices, documents, payment slips to the State Treasury, tax payment receipts. If the taxpayer has fixed assets, goods, and services shared for production subject to VAT and not subject, not accounted separately for each type used for goods subject to VAT or not, they shall declare jointly in this item.

+ If the purchase invoice is a special type of invoice, document where the purchase price includes VAT such as stamps, transport fare tickets, the purchase price including VAT is used to calculate the purchase price excluding VAT as follows:

Purchase price excluding VAT = Selling price on invoice / (1+ Tax rate)

- Item [24]: The figure in this item is the total VAT of fixed assets, goods, and services purchased as per the invoices, documents, payment slips to the State Treasury, tax payment receipts (excluding input VAT for investment projects already declared in the VAT declaration for investment projects form No. 02/GTGT). Illegal invoices should not be recorded in this item.

- Items [23a], [24a]: The data recorded in these items is equivalent to the declaration manner of items [23], [24] but only declared separately for the purchase value and input VAT of imported goods and services.

- Item [25]: Declare the total VAT amount purchased that is declared in item [24] and meets the conditions for deduction as per VAT laws.

+ If the taxpayer has fixed assets, goods, and services purchased simultaneously used for producing and trading VAT-subjected and non-VAT-subjected goods and cannot account separately for the input VAT deductible and non-deductible, the taxpayer allocates as regulated to determine the input VAT deductible and declare in this item as follows:

Deductible input VAT = (VAT-subjected revenue / Total revenue) x Input VAT for jointly used fixed assets, goods, and services

- Item [26]: The data for this item is the value of goods and services sold without VAT as per the taxpayer's VAT invoices during the tax period.

Item [27] - Value of goods and services sold subject to VAT: Is determined by the formula [27] = [29]+[30]+[32]+[32a].

- Item [28] - VAT of goods and services sold subject to VAT: Is determined by the formula [28]=[31]+[33].

- Item [29] - Value of goods and services sold subject to 0% tax rate: The data for this item is the value of goods and services sold with a VAT rate of 0% on the taxpayer's VAT invoices during the tax period.

- Item [30] - Value of goods and services sold subject to 5% tax rate: Data for this item is the value of goods and services sold with a VAT rate of 5% on the taxpayer's VAT invoices during the tax period.

- Item [31] - VAT of goods and services sold subject to 5% tax rate: Data for this item is the VAT of goods and services sold with a VAT rate of 5% on the taxpayer's VAT invoices during the tax period.

- Item [32] - Value of goods and services sold subject to 10% tax rate: Data for this item is the value of goods and services sold with a VAT rate of 10% on the taxpayer's VAT invoices during the tax period.

- Item [32a]: Data for this item is the value of goods and services not subject to VAT declaration and calculation as regulated.

- Item [33] - VAT of goods and services sold subject to 10% tax rate: Data for this item is the VAT of goods and services sold with a VAT rate of 10% on the taxpayer's VAT invoices during the tax period.

- Item [34] - Total revenue of goods and services sold: Is determined by the formula [34]=[26]+[27].

- Item [35] – VAT of goods and services sold: Is determined by the formula [35]=[28].

- Item [36] - VAT arising during the period: Is determined by the formula [36]=[35]-[25].

- Items [37] and [38]: Data recorded in this item is the tax amount adjusted for increase/decrease at item II on supplementary declaration form No. 01/KHBS. In case of the tax authority, competent authorities have issued conclusions, tax handling decisions with corresponding adjustments for previous tax calculation periods, declare in the tax declaration file of the period receiving the conclusion, tax handling decision (no need for supplementary tax declaration).

- Item [39a]: Data recorded in this item is the VAT amount yet deductible not requesting refund of investment projects transferred to the taxpayer for continued deduction (the VAT amount yet deductible, not qualifying for refund, not refunded that the taxpayer has separately declared the investment project's tax declaration) when the investment project goes into operation or the VAT amount yet deductible not requesting refund of production and business activities of the dependent unit when ceasing operations,...

- Item [40] - VAT still payable during the period: Is determined by the formula [40]=[40a]-[40b].

- Item [40a] - VAT payable of production and business activities during the period: Is determined by the formula [40a]=([36]-[22]+[37]-[38]-[39a]) ≥ 0.

- Item [40b] - VAT input of investment projects offset with VAT still payable of production and business activities of the tax period: Data recorded in this item is the total VAT declared in items [28a] and [28b] of VAT declaration form No. 02/GTGT for the same tax period as this declaration.

- Item [41] - VAT not yet fully deductible for this period: Is determined by the formula [41]=([36]-[22]+[37]-[38]-[39a]) ≤ 0.

- Item [42] - VAT proposed for refund: The data recorded in this item is the VAT eligible for refund according to VAT regulations and tax management laws. The data in item [42] must be less than or equal to the data in item [41].

- Item [43] - VAT to be carried over to the subsequent period: Is determined by the formula [43]=[41]-[42].

What is the latest deadline for submitting the January 2025 VAT declaration in Vietnam?

According to clause 1, Article 44 of the Law on Tax Administration 2019 regarding the deadline for submitting VAT declarations:

Filing deadline for tax declarations

- Deadlines for filing tax declarations for taxes declared monthly, quarterly are regulated as follows:

a) No later than the 20th of the month following the month in which the tax obligation arises, for monthly declarations and payments;

b) No later than the last day of the first month of the quarter following the quarter in which the tax obligation arises for quarterly declarations and payments.

...

Thus, the deadline for submitting the January 2025 VAT declaration is no later than the 20th of the month following the month in which the tax obligation arises, which is February 20, 2025.