What is the Form for the decision on appointment of chief accountant 2024 in Vietnam? When is the cut-off time for data to the chief accountant to prepare tax accounting reports in Vietnam?

What is the Form for the decision on appointment of chief accountant 2024 in Vietnam?

Based on Article 53 of the Accounting Law 2015 which provides regulations regarding the chief accountant. Specifically:

- The chief accountant is the head of the accounting apparatus within the unit, responsible for organizing and executing accounting tasks within the accounting unit.

- The chief accountant of state agencies, organizations, public service providers utilizing the state budget, and enterprises where the State holds more than 50% of charter capital, in addition to the aforementioned duties, is also tasked with assisting the legal representative of the accounting unit in overseeing financial matters within the unit.

- The chief accountant is under the leadership of the legal representative of the accounting unit; if there is a superior accounting unit, they are also subject to the guidance and inspection by the chief accountant of the superior accounting unit regarding professional expertise.

Moreover, a chief accountant must meet the standards and conditions stipulated in Article 54 of the Accounting Law 2015, specifically:

- Must have professional ethics, integrity, honesty, and a sense of legal compliance;

- Must have accounting expertise from an intermediate level or higher;

- Must possess a chief accountant training certificate;

- Must have at least 2 years of practical accounting experience for those with a university level of expertise and at least 3 years for those with intermediate or college level expertise.

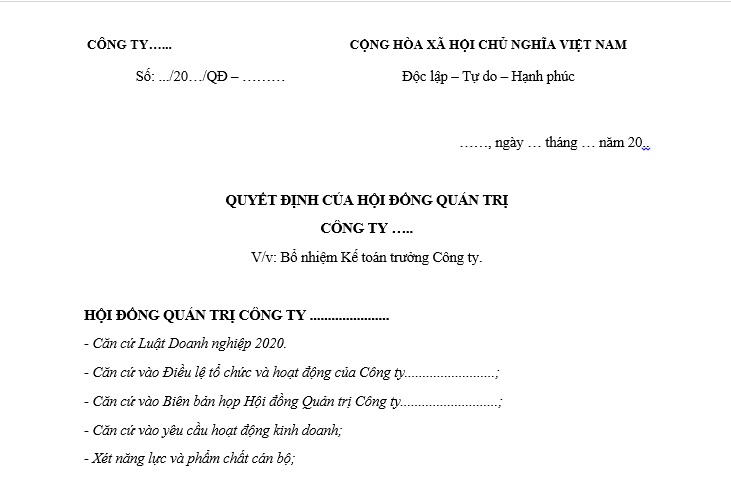

Currently, there are no legal regulations regarding a Form for the decision on the appointment of a chief accountant. Hence, units can refer to the following Form:

The Form for the decision on the appointment of a chief accountant is as follows:

Form for the decision on appointment of chief accountant...Download

Note: The information is for reference only!

What is the Form for the decision on appointment of chief accountant 2024 in Vietnam? (Image from the Internet)

Is a chief accountant legally responsible if the business owner commits tax fraud in Vietnam?

According to Article 55 of the Accounting Law 2015 which provides regulations on the responsibilities and rights of a chief accountant:

Responsibilities and Rights of the Chief Accountant

- The chief accountant has the following responsibilities:

a) To implement legal regulations on accounting and finance within the accounting unit;

b) To organize and direct the accounting apparatus in accordance with this Law;

c) To prepare financial statements in compliance with accounting policies and standards.

- The chief accountant has professional independence regarding accounting expertise.

- The chief accountant of state agencies, organizations, public service providers utilizing the state budget, and enterprises where the State holds more than 50% of charter capital, in addition to the rights stipulated in clause 2 of this Article, also has the following rights:

a) To provide written opinions to the legal representative of the accounting unit regarding the recruitment, transfer, salary increase, commendation, and discipline of accountants, storekeepers, and treasurers;

b) To require relevant departments within the accounting unit to fully and promptly provide documents related to accounting work and the financial supervision of the chief accountant;

c) To preserve professional opinions in writing when they differ from the decision-maker's opinions;

d) To report in writing to the legal representative of the accounting unit upon discovering any legal violations related to finance or accounting within the unit; if the decision must still be followed, to report to the immediate superior of the decision-maker or the competent state authority and not be legally responsible for the consequences of executing that decision.

Thus, when detecting tax fraud, the chief accountant is not legally liable for the consequences if they have reported it in writing to the legal representative. If the decision still needs to be executed, the chief accountant must report to the immediate superior of the decision-maker or the competent state authority and will not be responsible for the consequences of executing that decision.

When is the cut-off time for data to the chief accountant to prepare tax accounting reports in Vietnam?

According to Article 30 of Circular 111/2021/TT-BTC it is stipulated:

The Cut-off Time for Data to Compile Tax Accounting Reports

1. The cut-off time for data to compile tax accounting reports is the close of the tax accounting period as stipulated in Article 8 of this Circular.

- In case errors or omissions are discovered after the close of the tax accounting period but before the tax accounting report is submitted to the competent state authority, adjustments to the tax accounting report shall be made as follows:

a) For adjustments based on written requests from competent authorities, adjust prior year data according to the request, with specific explanations.

b) For adjustments due to tax authorities detecting errors, adjust prior year data if approved in writing by the General Director of the General Department of Taxation, with specific explanations.

- After the tax accounting report has been approved by the competent state authority, any adjustments that arise will be incorporated into the current year's report.

Thus, the cut-off time for data for the chief accountant to compile tax accounting reports is the close of the tax accounting period.