What is the form for the confirmation of fulfillment of tax obligations in Vietnam?

What is the form for the confirmation of fulfillment of tax obligations in Vietnam?

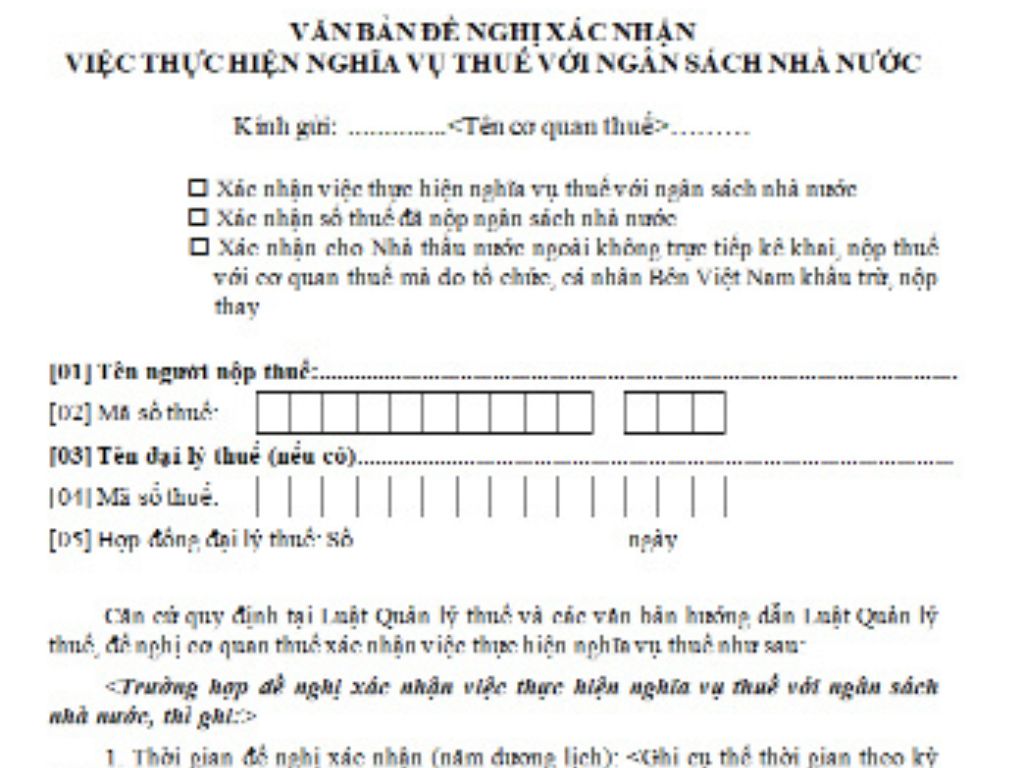

Pursuant to Section 10 Appendix I issued together with Circular 80/2021/TT-BTC, the prescribed form for the confirmation of fulfillment of tax obligations is Form 01/DNXN.

>>Download the form for the confirmation of fulfillment of tax obligations here

What is the form for the confirmation of fulfillment of tax obligations in Vietnam? (Image from the Internet)

What are instructions for writing the confirmation of fulfillment of tax obligations in Vietnam?

Instructions for writing the confirmation of fulfillment of tax obligations according to Appendix I issued together with Circular 80/2021/TT-BTC are as follows:

- The taxpayer is only allowed to choose one of the three checkboxes for the confirmation request.

- In the case of confirmation for a foreign contractor who does not directly declare and pay tax to the tax authority but is withheld and paid by a Vietnamese organization or individual, select the box for confirmation for foreign contractors not directly declaring and paying tax to the tax authority but withheld and paid by a Vietnamese organization or individual.

- Column for Tax code, Taxpayer name in the table:

The taxpayer writes according to the tax code and the name of the taxpayer requesting confirmation, including dependent units of the taxpayer.

In cases where the box "Confirmation for foreign contractors not directly declaring and paying tax to the tax authority but withheld and paid by a Vietnamese organization or individual" is checked, fill in the information at indicator [02] as the tax code for substitute payment by the Vietnamese side, while the Column for Tax code and Taxpayer name in the table records the foreign contractor's tax code needing tax obligation confirmation.

- In cases requesting confirmation of tax amounts paid to the state budget, the taxpayer is only allowed to choose one of two confirmation requests: by type of tax or by tax payment voucher.

- The note column (14) in the table According to the tax payment voucher at Point 2.

Information on the tax amount paid to the state budget requested for confirmation is used to record changes in information in cases where the tax payment voucher has been adjusted through review or other cases that alter the initial tax payment voucher information.

When does the taxpayer receive documents related to tax obligations in Vietnam?

Pursuant to Article 16 of the Law on Tax Administration 2019 which stipulates the rights of taxpayers:

Rights of taxpayers

1. To be supported and guided in fulfilling tax obligations; provided with information and documents to fulfill tax obligations and benefits.

2. To receive documents related to tax obligations from competent authorities during inspections, examinations, and audits.

3. To request tax administration agencies to explain tax calculations and assessments; request appraisal of quantity, quality, and types of exported and imported goods.

4. To keep information confidential, except for information that must be provided to competent state agencies or publicly disclosed according to the law.

5. To enjoy tax incentives and tax refunds according to the tax law; be informed of the time limit for processing tax refunds, the refund amount, and the legal basis for non-refunded tax amounts.

6. To enter into contracts with businesses providing tax procedure services and customs procedure agents to perform tax agency services and customs procedure agency services.

7. To receive tax decisions, tax inspection minutes, and tax audit minutes; request explanations of tax decisions; retain opinions in tax inspection and audit minutes; receive tax inspection, audit findings, and post-inspection tax decisions from tax authorities.

8. To be compensated for damages caused by tax administration agencies or tax management officials according to the law.

9. To request tax administration agencies to confirm the fulfillment of their tax obligations.

10. To complain and file lawsuits against administrative decisions and acts that affect their legitimate rights and interests.

11. Not to be penalized for tax administrative violations and not subject to late payment interest in cases where the taxpayer acts according to tax authority or competent state agency guidelines and decisions on tax obligation determination.

12. To report violations of the law by tax management officials and other organizations or individuals as regulated by law on denunciations.

13. To consult, view, and print all electronic vouchers sent to the tax administration agency's electronic portal according to this Law and the law on electronic transactions.

14. To use electronic documents in transactions with tax administrations and related agencies and organizations.

Taxpayers receive documents related to tax obligations from competent authorities during inspections, examinations, and audits.