What is the form for the CIT declaration when transferring real estate separately in Vietnam?

What is the form for the CIT declaration when transferring real estate separately in Vietnam?

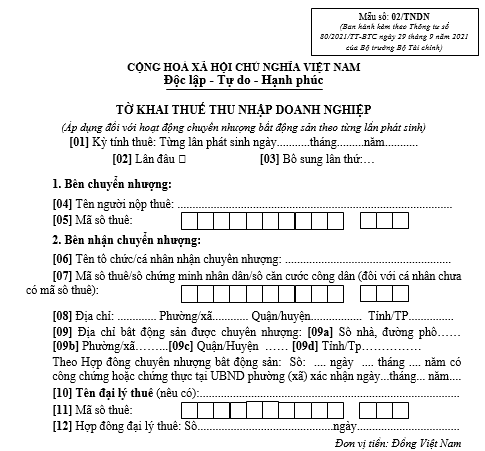

The CIT declaration form when transferring real estate separately is Form 02/CIT according to Appendix 2 issued with Circular 80/2021/TT-BTC as follows:

>>> Download the CIT declaration form for transferring real estate separately.

What is the form for the CIT declaration when transferring real estate separately in Vietnam? (Image from Internet)

What is the deadline for submitting the CIT declaration for taxes declared separately in Vietnam?

Based on Article 44 of the Tax Administration Law 2019 the regulations are as follows:

Deadline for submitting tax declarations

1. The deadline for submitting tax declarations for taxes declared monthly or quarterly is as follows:

a) No later than the 20th of the following month for monthly declarations and payments;

b) No later than the last day of the first month of the following quarter for quarterly declarations and payments.

2. The deadline for submitting tax declarations for taxes calculated annually is as follows:

a) No later than the last day of the third month since the end of the calendar year or fiscal year for annual tax finalization dossiers; no later than the last day of the first month of the calendar year or fiscal year for annual tax declarations;

b) No later than the last day of the fourth month since the end of the calendar year for individual personal income tax finalization dossiers;

c) No later than December 15 of the preceding year for presumptive tax declarations of household businesses or individual businesses taxed on a presumptive basis; for new businesses, no later than 10 days from the start of business.

3. The deadline for submitting tax declarations for taxes declared and paid separately is no later than the 10th day from the date the tax obligation arises.

4. The deadline for submitting tax declarations for cessation of operations, termination of contracts, or reorganization of enterprises is no later than the 45th day from the occurrence of such an event.

...

Thus, according to the above regulations, the deadline for submitting tax declarations for taxes declared and paid separately is no later than the 10th day from the date the tax obligation arises.

Vietnam: How many days after receiving a request for an extension of the tax declaration shall the tax authority issue a notice?

According to Article 46 of the Tax Administration Law 2019, the regulations on extension of tax declarations are as follows:

Extension of tax declarations

1. Taxpayers who are unable to submit tax declarations on time due to natural disasters, catastrophes, epidemics, fires, unexpected accidents will be granted an extension by the head of the directly managing tax authority.

2. The extension shall not exceed 30 days for monthly, quarterly, annual tax declaration, and per-occurrence tax obligation declarations; 60 days for annual tax finalization dossiers from the due date of the tax declaration.

3. Taxpayers must send a written request for an extension of the tax declaration to the tax authority before the deadline, stating the reasons for the extension request with confirmation from the commune-level People's Committee or Police where the extension is applicable as stipulated in clause 1 of this Article.

4. Within 3 working days from receiving the request for an extension of the tax declaration, the tax authority must reply in writing to the taxpayer regarding the acceptance or non-acceptance of the extension.

Thus, within 3 working days from receiving the request for an extension of the tax declaration, the tax authority must reply in writing to the taxpayer regarding the acceptance or non-acceptance of the extension.

What expenses are deductible and non-deductible when determining taxable corporate income in Vietnam?

According to Article 9 of the Corporate Income Tax Law 2008 (amended and supplemented by Clause 5, Article 1 of the Amended Corporate Income Tax Law 2013; amended and annulled certain provisions by the Law Amending Tax Laws 2014), the determination of taxable corporate income includes the following deductible and non-deductible expenses:

- Except for expenses specified in Clause 2, Article 9 of the Corporate Income Tax Law 2008, businesses are entitled to deduct all expenses when determining taxable income if they satisfy the following conditions:

+ Actual expenses incurred related to production and business activities of the enterprise; expenses for vocational education activities; expenses for performing national defense and security tasks as prescribed by law;

+ Expenses with sufficient invoices and documents as prescribed by law. For invoices of goods and services purchased on each occasion with a value of twenty million dong or more, there must be non-cash payment documents, except for cases where non-cash payment documents are not mandatory according to the law.

- Non-deductible expenses when determining taxable income include:

+ Expenses not meeting the conditions specified in Clause 1, Article 9 of the Corporate Income Tax Law 2008, except for the value portion of losses due to natural disasters, epidemics, and other force majeure cases not compensated;

+ Fines for administrative violations;

+ Expenses offset by other funding sources;

+ The part of business management expenses allocated by foreign enterprises to their permanent establishments in Vietnam exceeding the amount calculated according to the allocation method prescribed by Vietnamese law;

+ The portion of expenses exceeding the prescribed amount for setting up provisions;

+ The portion of interest expenses on loans for production and business from entities other than credit institutions or economic organizations exceeding 150% of the prime interest rate announced by the State Bank of Vietnam at the time of borrowing;

+ Depreciation of fixed assets that do not conform to the law;

+ Provisions made in advance that do not conform to the law;

+ Salaries and wages of private business owners; remuneration paid to the founders of the enterprises not directly involved in the management of production and business activities; salaries, wages, other expense allocations for employees that are not actually paid or have no invoices and documents as prescribed by law;

+ Interest on loans corresponding to the insufficient capital;

+ Input value-added tax already deducted, value-added tax paid under the credit method, corporate income tax;

+ Donations, except donations for education, healthcare, scientific research, disaster recovery, solidarity houses, gratitude houses, housing for policy beneficiaries as prescribed by law, donations under State programs for localities in areas with special socio-economic difficulties;

+ Contributions to voluntary pension funds or social security funds, purchasing voluntary pension insurance for employees exceeding the legal regulations;

+ Expenses of banking, insurance, lottery, securities, and other specialized business operations as prescribed by the Minister of Finance.