What is the form for sealing documents relevant to tax evasion and tax fraud in Vietnam?

What is the form for sealing documents relevant to tax evasion and tax fraud in Vietnam?

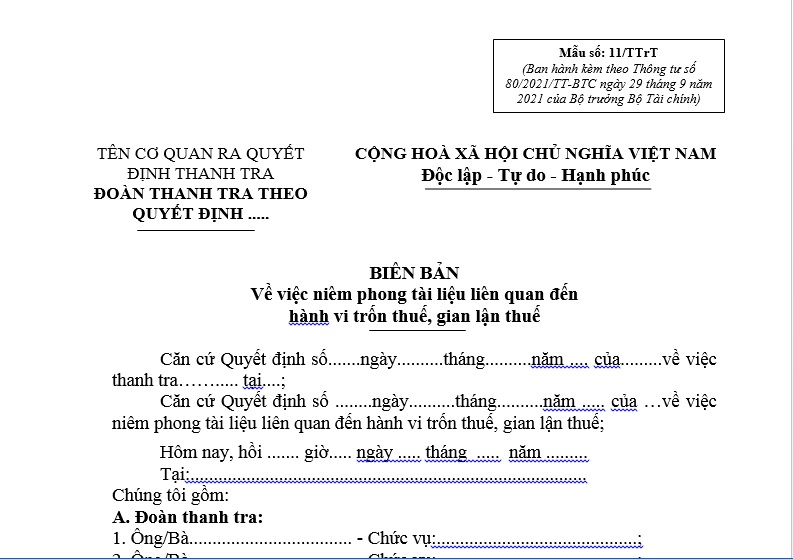

The latest Form for sealing documents relevant to tax evasion and tax fraud is Form 11/TTrT in Appendix 1 issued together with Circular 80/2021/TT-BTC.

Below is the Form for sealing documents relevant to tax evasion and tax fraud:

Form for sealing documents relevant to tax evasion and tax fraud...Download

What is the form for sealing documents relevant to tax evasion and tax fraud in Vietnam? (Image from the Internet)

What are regulations on the impoundment of documents relevant to tax evasion in Vietnam?

Based on Article 122 of the Law on Tax Administration 2019 which regulates the impoundment of documents and items relevant to acts of tax evasion as follows:

- The head of the tax administration agency and the head of the tax inspection team decide to temporarily detain documents and items relevant to acts of tax evasion.

- The impoundment of documents and items relevant to acts of tax evasion is applied when it is necessary to verify details as a basis to make processing decisions or to immediately prevent acts of tax evasion.

- During the tax inspection, if the inspected entity shows signs of dispersing or destroying documents and items relevant to acts of tax evasion, the head of the tax inspection team performing the duty has the right to temporarily detain such documents and items.

Within 24 hours from the time of impoundment of documents and items, the head of the tax inspection team must report to the head of the tax administration agency to issue a decision to detain the documents and items; within 08 working hours from receiving the report, the authorized person must consider and issue a decision on the detention.

If the authorized person does not agree with the detention, the head of the tax inspection team must return the documents and items within 08 working hours from the time the authorized person disagrees.

- When temporarily detaining documents and items relevant to acts of tax evasion, the head of the tax inspection team must make a record of detention. The detention record must specify the name, quantity, and types of documents and items detained; the signatures of the person performing the detention and the person managing the violating documents and items.

The person who issues the detention decision is responsible for safeguarding the detained documents and items, and is liable under the law if the documents or items are lost, sold, swapped, or damaged.

In cases where documents and items need to be sealed, the sealing must be performed immediately in the presence of the person possessing the documents and items; if the person is absent, the sealing must be done in the presence of a family representative, or a representative of the organization and the local government authority, and witnesses.

- Items that are Vietnamese currency, foreign currencies, gold, silver, precious stones, precious metals or items subject to special management must be kept according to legal regulations; items that are goods or perishable items, the person who issues the detention decision must promptly make a record and organize a sale to prevent loss, and the proceeds must be deposited into the holding account opened at the State Treasury to ensure sufficient collection of tax, late payment interest, fines.

- Within 10 working days from the date of detention, the person who issues the detention decision must handle the detained documents and items according to the measures specified in the processing decision or return them to the individual or organization if no confiscation sanction is applied to the detained documents and items.

The detention period for documents and items may be extended for complex cases that require investigation but must not exceed 60 days from the date of detention. The extension of the detention period must be decided by the authorized person as regulated in Clause 1, Article 122 of the Law on Tax Administration 2019.

- The tax administration agency must provide one copy of the detention decision, the record of detention, and the decision to process documents and items relevant to acts of tax evasion to the organization or individual whose documents and items are detained.

When should the search of premises for documents and items relevant to tax evasion not be conducted in Vietnam?

According to Clause 4, Article 123 of the Law on Tax Administration 2019, it is regulated as follows:

Search of premises for documents and items relevant to tax evasion

...

- When searching places concealing documents and items, the owner of the place being searched and witnesses must be present. In case the owner is absent and the search cannot be postponed, there must be a representative of the local government and 02 witnesses.

- It is prohibited to search places concealing documents and items relevant to acts of tax evasion at night, on public holidays, on Tet holidays, and when the owner of the place is having a funeral or a wedding, except for flagrante delicto cases and reasons must be recorded in the report.

...

Thus, the search of places concealing documents relevant to acts of tax evasion should not be conducted at night, on holidays, on Tet holidays, or when the owner of the place is having a funeral or a wedding, except in the case of flagrante delicto, and the reason must be clearly stated in the record.