What is the Form for declaring VAT reduction in Vietnam?

What is the Form for declaring VAT reduction in Vietnam?

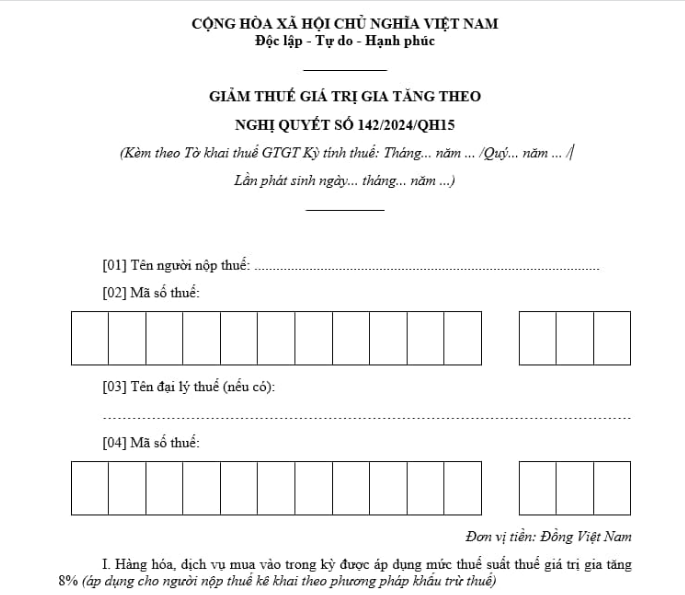

The VAT reduction declaration form is Form No. 01 as stipulated in Appendix 4 issued with Decree 72/2024/ND-CP as follows:

Download the VAT reduction declaration form effective from July 1, 2024, as per Decree 72/2024/ND-CP.

What is the Form for declaring VAT reduction in Vietnam? (Image from the Internet)

What are regulations on the level of VAT reduction and goods eligible for VAT reduction according to Decree No. 72 in Vietnam?

According to Article 1 of Decree 72/2024/ND-CP on VAT reduction policy as in Resolution 142/2024/QH15:

[1] VAT Reduction Rate

- Business entities calculating VAT using the credit method are entitled to apply the VAT rate of 8% for goods and services specified in Clause 1, Article 1 of Decree 72/2024/ND-CP.

- Business entities (including household and individual businesses) calculating VAT based on the percentage of revenue are entitled to a 20% reduction in the percentage used to calculate VAT when issuing invoices for goods and services subject to VAT reduction specified in Clause 1, Article 1 of Decree 72/2024/ND-CP.

[2] Goods and Services Not Subject to VAT Reduction

In Article 1 of Decree 72/2024/ND-CP, VAT reduction is applied to groups of goods and services subject to a 10% VAT rate, except for the following groups:

- Telecommunications, financial activities, banking, securities, insurance, real estate business, metals, and finished metal products, mining products (excluding coal mining), coke, refined petroleum, and chemical products.

Details in Appendix 1 issued with Decree 72/2024/ND-CP.

- Goods and services subject to special consumption tax.

Details in Appendix 2 issued with Decree 72/2024/ND-CP.

- Information technology as per information technology law.

Details in Appendix 3 issued with Decree 72/2024/ND-CP.

- The VAT reduction for each type of good and service specified in Clause 1, Article 1 of Decree 72/2024/ND-CP applies uniformly at importation, production, processing, and commercial business stages. Coal mining products sold (including cases where coal is mined and then screened, classified through a closed process before being sold) are subject to VAT reduction.

Coal products in Appendix I issued with Decree 72/2024/ND-CP, at stages other than the mining sale stage, are not eligible for VAT reduction.

State-owned corporations and economic conglomerates that follow a closed process before selling are also subject to VAT reduction for coal mining products sold.

In cases where goods and services listed in Appendices 1, 2, and 3 issued with Decree 72/2024/ND-CP are not subject to VAT or are subject to a 5% VAT rate as per the VAT Law, the provisions of the VAT Law shall apply, and they will not be eligible for VAT reduction.

How long does the 8 percent VAT reduction last in Vietnam?

According to Clause 2, Article 1 of Decree 72/2024/ND-CP, the VAT reduction is as follows:

- Business entities calculating VAT using the credit method are entitled to apply the VAT rate of 8% for goods and services specified in Clause 1, Article 1 of Decree 72/2024/ND-CP.

- Business entities (including household and individual businesses) calculating VAT based on the percentage of revenue are entitled to a 20% reduction in the percentage used to calculate VAT when issuing invoices for goods and services subject to VAT reduction specified in Clause 1, Article 1 of Decree 72/2024/ND-CP.

Based on the provisions of Clause 1, Article 2 of Decree 72/2024/ND-CP as follows:

Effective date and implementation

1. This Decree shall take effect from July 1, 2024, to December 31, 2024.

2. Ministries by function and task and Provincial People's Committees shall direct relevant agencies to disseminate, guide, inspect, and supervise so that consumers understand and benefit from the VAT reduction stipulated in Article 1 of this Decree, focusing on solutions to stabilize the supply-demand of goods and services subject to VAT reduction to maintain market price stability (pre-VAT prices) from July 1, 2024, to December 31, 2024.

3. Any issues arising during implementation shall be addressed by the Ministry of Finance.

4. Ministers, Heads of ministerial-level agencies, Heads of agencies under the Government of Vietnam, Chairpersons of Provincial People's Committees, and related enterprises, organizations, and individuals shall be responsible for implementing this Decree.

Thus, Decree 72/2024/ND-CP is effective from July 1, 2024, to December 31, 2024. This means the regulation reducing VAT to 8% will be applicable until December 31, 2024.

From January 1, 2025, goods subject to VAT reduction will revert to the 10% rate.