What is the Form B02-DN - income statement in Vietnam?

What is the Form B02-DN - income statement in Vietnam?

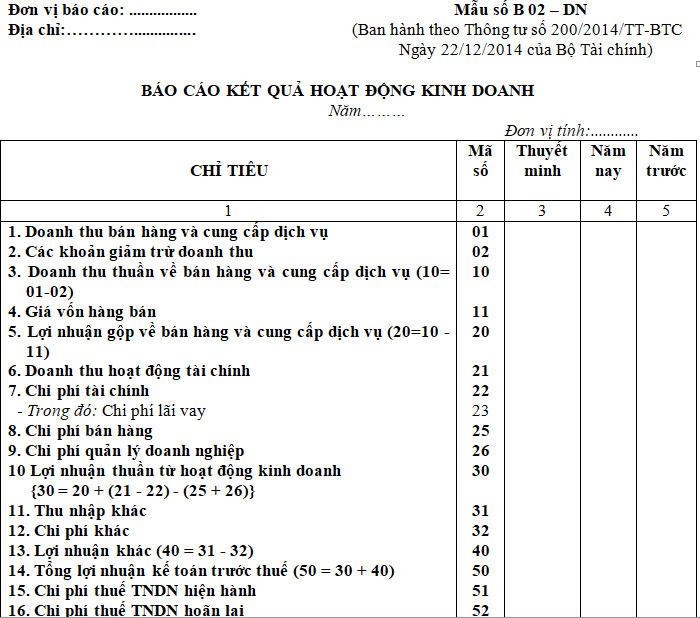

Currently, the income statement uses Form No. B02-DN issued along with Circular 200/2014/TT-BTC, structured as follows:

Download the income statement form here: Download

What is the Form B02-DN - income statement in Vietnam? (Image from Internet)

Vietnam: What does the content and structure of the Form B02-DN include?

Pursuant to Clause 1, Article 113 of Circular 200/2014/TT-BTC, the following regulations apply:

Guidelines for Preparing and Presenting the income statement (Form No. B02-DN)

1. Content and structure of the report:

a) The income statement reflects the status and results of business operations of the enterprise, including results from core business activities as well as financial and other activities of the enterprise.

When preparing a consolidated income statement between an enterprise and its subordinate unit without independent legal status, the enterprise must exclude all revenue, income, and expenses arising from internal transactions.

b) The income statement consists of 5 columns:

- Column 1: Report indicators;

- Column 2: Code of corresponding indicators;

- Column 3: Corresponding figures for these report indicators are described in the Notes to Financial Statements;

- Column 4: Total amount incurred during the reporting year;

- Column 5: Data of the previous year (for comparison).

2. Basis for report preparation

- Based on the income statement of the previous year.

- Based on the general and detailed accounting books during the period used for accounts ranging from type 5 to type 9.

The income statement reflects the status and results of business operations of the enterprise, including results from core business activities as well as financial and other activities of the enterprise.

When preparing a consolidated income statement between an enterprise and its subordinate unit without independent legal status, the enterprise must exclude all revenue, income, and expenses arising from internal transactions.

The income statement consists of 5 columns:

- Column 1: Report indicators;

- Column 2: Code of corresponding indicators;

- Column 3: Corresponding figures for these report indicators are described in the Notes to Financial Statements;

- Column 4: Total amount incurred during the reporting year;

- Column 5: Data of the previous year (for comparison).

How to calculate pre-tax profit on the income statement in Vietnam?

Pre-tax profit is the indicator code number 50 on the income statement according to Form No. B02-DN issued along with Circular 200/2014/TT-BTC.

Specifically, at Point 3.15, Clause 3, Article 113 of Circular 200/2014/TT-BTC:

Guidelines for Preparing and Presenting the income statement (Form No. B02-DN)

...

3. Content and method of preparing indicators in the income statement

...

3.15. Total Pre-Tax Accounting Profit (Code 50):

This indicator reflects the total accounting profit realized in the report year of the enterprise before deducting corporate income tax expenses from business operations, and other activities arising during the reporting period. Code 50 = Code 30 + Code 40.

Pre-tax profit reflects the total accounting profit realized in the report year of the enterprise before deducting corporate income tax expenses from business operations, and other activities arising during the reporting period.

Pre-tax profit includes all profit earned from production and business activities, financial profit, and other arising profit. Pre-tax profit is calculated by total revenue minus expenses.

The formula for calculating pre-tax profit is as follows:

| Total Pre-Tax Profit = Net Profit from Business Operations + (Other Income - Other Expenses) |