What is the Form 39/TB-DKT on notice of transfer of tax liabilities in Vietnam?

What is the Form 39/TB-DKT on notice of transfer of tax liabilities in Vietnam?

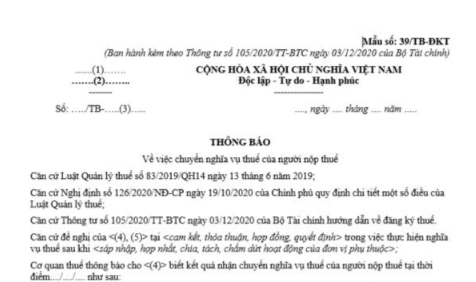

Form 39/TB-DKT, the notice of transfer of tax liabilities, is a form issued in conjunction with Circular 105/2020/TT-BTC as follows:

Download Form 39/TB-DKT notice of transfer of tax liabilities.

What is the Form 39/TB-DKT on notice of transfer of tax liabilities in Vietnam? (Image from the Internet)

Which entities are subject to direct tax registration with tax authorities in Vietnam?

According to Clause 2, Article 4 of Circular 105/2020/TT-BTC, taxpayers who are subject to direct tax registration with tax authorities include:

(1) Enterprises operating in fields such as insurance, accounting, auditing, law, notary work, or other specialized fields that are not required to register businesses through the business registration agency in accordance with specialized law (hereinafter referred to as Economic Organizations).

(2) Public service units, economic organizations of the armed forces, political organizations, socio-political organizations, social, socio-professional organizations involved in business activities as per law but not required to register businesses through the business registration agency; organizations from countries sharing land borders with Vietnam conducting activities such as buying, selling, exchanging goods at border markets, border gate markets, markets in border gate economic zones; representative offices of foreign organizations in Vietnam; cooperatives established and operating under the Civil Code (hereinafter referred to as Economic Organizations).

(3) Organizations established by a competent authority with no production or business activities but with obligations arising with the state budget (hereinafter referred to as Other Organizations).

(4) Foreign organizations and individuals and organizations in Vietnam utilizing humanitarian aid, non-refundable aid from abroad to purchase goods, services subject to value-added tax in Vietnam for non-refundable and humanitarian aid; diplomatic representative agencies, consular agencies, and representative offices of international organizations in Vietnam entitled to VAT refund under diplomatic exemption incentives; Project Management Units of ODA projects eligible for VAT refund, ODA Project Sponsors' Representative Offices, organizations assigned by foreign sponsors to manage ODA programs/projects (hereinafter referred to as Other Organizations).

(5) Foreign organizations not having legal status in Vietnam, foreign individuals practicing independent business in Vietnam complying with Vietnamese law with income arising in Vietnam or tax obligations arising in Vietnam (hereinafter referred to as Foreign Contractors, Foreign Subcontractors).

(6) Foreign suppliers without a permanent establishment in Vietnam conducting e-commerce, digital platform-based, and other services with organizations and individuals in Vietnam (hereinafter referred to as Overseas Suppliers).

(7) Enterprises, cooperatives, economic organizations, other organizations, and individuals responsible for withholding and paying taxes on behalf of other taxpayers must declare and determine tax obligations separately from the taxpayer's obligations according to tax management law (excluding income-paying agencies when withholding, paying personal income tax); Commercial banks, payment intermediary service providers, or organizations/individuals authorized by overseas suppliers to declare, withhold, and pay taxes on behalf of overseas suppliers (hereinafter referred to as Organizations, Individuals Withholding and Paying on Behalf). Income-paying organizations using the TIN already issued to declare and pay personal income tax withheld, paid on behalf.

(8) Operators, Joint Operating Companies, joint venture enterprises, organizations assigned by the Government of Vietnam to receive the share of Vietnam from overlapping oil and gas fields, contractors, investors participating in oil and gas contracts, parent companies - Vietnam Oil and Gas Group representing the host country to receive profit shares from oil and gas contracts.

(9) Households, individuals engaged in production and trading of goods and services, including individuals from countries sharing land borders with Vietnam conducting buy, sell, exchange activities at border markets, border gate markets, markets in the border economic zones (hereinafter referred to as Business Households, Business Individuals).

(10) Individuals with income subject to personal income tax (excluding business individuals).

(11) Individuals who are dependents according to the law on personal income tax.

(12) Organizations, individuals authorized to collect by the tax authority.

(13) Other organizations, households, and individuals with obligations towards the state budget.

Is it necessary to use the Form No. 39/TB-DKT - Notice form of transfer of tax liabilities in case of TIN deactivation in Vietnam?

Based on the provisions at point a Clause 1 Article 16 of Circular 105/2020/TT-BTC, the tax authority issues a notification regarding the transfer of tax obligations when handling the application for TIN deactivation in two cases. Specifically:

(1) In the case where a dependent unit deactivates its TIN but lacks the ability to fulfill outstanding obligations or debts after clearing or refunding, or offsetting according to the Tax Management Law and its guiding documents, if the managing unit has declared commitment to assume responsibility for inheriting all tax obligations of the dependent unit, the directly managing tax authority transfers the obligations of the dependent unit to the managing unit and issues the Notification on the Transfer of Tax Obligations of the Taxpayer Form No. 39/TB-DKT Download issued with Circular 105/2020/TT-BTC to the managing unit and dependent unit.

(2) In the case where a unit being split, merged, or consolidated deactivates its TIN but lacks the ability to fulfill outstanding obligations or debts after clearing or refunding, or offsetting according to the Tax Management Law and its guiding documents, the directly managing tax authority of the split, merged, or consolidated unit transfers obligations to the new unit and issues the Notification on the Transfer of Tax Obligations of the Taxpayer Form No. 39/TB-DKT Download issued with Circular 105/2020/TT-BTC to the taxpayer, the split, merged, or consolidated unit and the new unit.

Thus, it is evident that deactivating the TIN will require the use of the notice form of transfer of tax liabilities of the Taxpayer, Form No. 39/TB-DKT.