What is the Form 29/TB-DKT on notification form requesting taxpayers to submit an application for TIN deactivation in Vietnam?

When is a tax identification number deactivated in Vietnam?

According to provisions in Clause 1 and Clause 2 of Article 39 Law on Tax Administration 2019, the taxpayer's tax identification number (TIN) will be deactivated in the following cases:

- For taxpayers who register for business/enterprise/ cooperative registration at the same time, the TIN will be deactivated in the following cases:

+ The taxpayer ceases business activities/dissolves/goes bankrupt.

+ The competent authority revokes the business registration certificate/ business license/cooperative registration certificate.

+ The business is split/merged/consolidated.

- For taxpayers who register directly with the tax authority, their TIN will be deactivated if they fall into one of the cases described below:

+ Cease business activities or no longer incur any tax obligations for non-business organizations.

+ The business registration certificate or equivalent license is revoked.

+ The business is split/merged/consolidated.

+ The tax authority issues a notice that the taxpayer is not operating at the registered address.

+ Foreign contractors upon contract completion.

+ Contractors or investors participating in petroleum contracts upon contract completion or transferring all their interests in the petroleum contract to another party.

+ Individuals who die/go missing/lose civil act capacity according to legal provisions.

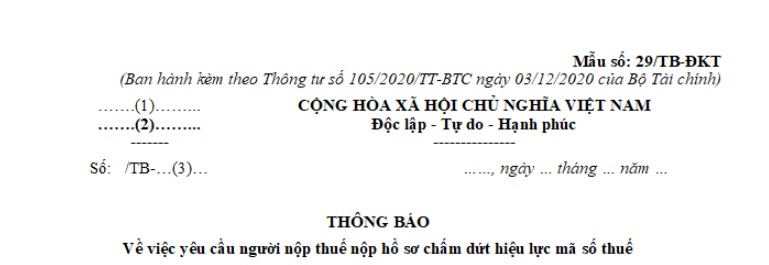

What is the Form 29/TB-DKT on notification form requesting taxpayers to submit an application for TIN deactivation in Vietnam? (Image from the Internet)

What is the Form 29/TB-DKT on notification form requesting taxpayers to submit an application for TIN deactivation in Vietnam?

The notification form requesting taxpayers to submit an application for TIN deactivation is Form 29/TB-DKT promulgated together with Circular 105/2020/TT-BTC as follows:

Download Form 29/TB-DKT requesting taxpayers to submit an application for TIN deactivation: Here

What are the dossier and procedures for deactivating an individual's TIN at the tax authority in Vietnam?

(1) Dossier for deactivating the TIN

In the case of not registering for electronic transaction accounts and not having a digital signature, the taxpayer shall carry out the procedures directly at the tax authority.

Based on the provisions of Article 14 Circular 105/2020/TT-BTC regarding the dossier for deactivating the TIN for taxpayers who register directly with the tax authority:

(1) Written request for TIN deactivation prescribed in Form 24/ĐK-TCT promulgated together with Circular 105/2020/TT-BTC according to the provisions of Article 38, Article 39 Law on Tax Administration 2019

(2) Other documents (if any):

- For business households; individual businesses; business locations of business households, and individual businesses according to the provisions of Point i Clause 2 Article 4 Circular 105/2020/TT-BTC, the dossier includes:

Copy of the decision to revoke the Business Registration Certificate (if any).

(2) Implementation Procedures:

Based on Clause 6 Article 39, Clause 3 Article 41 Law on Tax Administration 2019 on TIN deactivation, the responsibility for handling dossiers for taxpayer registration is as follows:

Step 1: Taxpayers who register directly with the tax authority submit the dossier for TIN deactivation to the directly managing tax authority within 10 working days from the date of the deactivation document or the cessation of business activities or contract completion date.

Step 2: The tax authority processes the taxpayer registration dossier following the regulations:

- In case the dossier is complete, a notification of dossier acceptance and resolution time for the taxpayer registration dossier must be issued no later than 3 working days from the date of receiving the complete dossier;

- In case the dossier is incomplete, a notification to the taxpayer must be issued no later than 2 working days from the date of receiving the dossier.