What is the Form 25/DK-TCT on application for TIN reactivation in Vietnam?

What is the Form 25/DK-TCT on application for TIN reactivation in Vietnam?

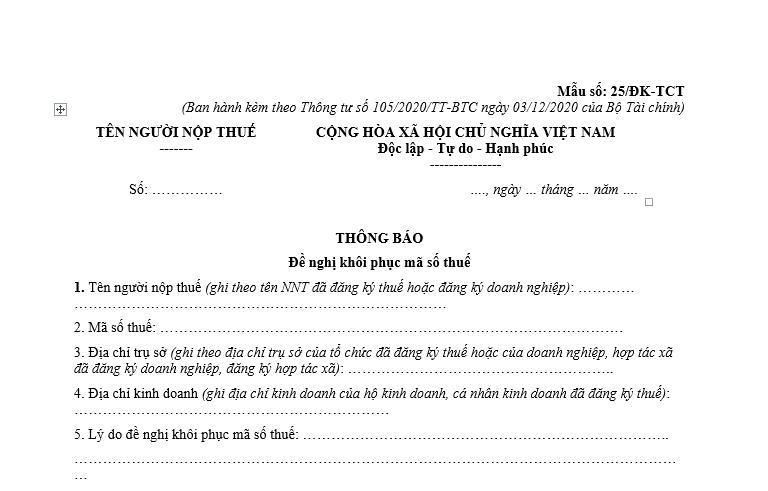

The current request form for reactivating a TIN is Form 25/DK-TCT issued with Circular 105/2020/TT-BTC.

Download the current request form for reactivating a TIN here: Here

Vietnam: What does the application for TIN reactivation include?

According to Article 18 of Circular 105/2020/TT-BTC, the application for TIN reactivation is as follows:

(1). Application for TIN reactivation of the taxpayer

* Taxpayers specified in Clause 2, Article 4 of Circular 105/2020/TT-BTC whose establishment and operation licenses or business registration certificates or equivalent permits have been revoked by competent authorities, the tax authorities have terminated the TIN as prescribed, but later the competent authorities issue a document to cancel the revocation document, the taxpayer must submit the application for TIN reactivation to the direct managing tax authority no later than 10 (ten) working days from the issuance of the cancelation document by the competent authority.

The dossier includes:

- A document requesting the reactivation of the TIN, Form 25/DK-TCT issued with Circular 105/2020/TT-BTC;

- A copy of the document canceling the revocation of the establishment and operation license or equivalent permit from the competent authority.

* After the tax authority issues a Notice about the taxpayer not operating at the registered address as prescribed in Article 17 of Circular 105/2020/TT-BTC but the business registration certificate, cooperative registration certificate, branch office operation registration certificate, business household registration certificate, establishment and operation license or equivalent permit has not been revoked and the TIN has not been terminated, the taxpayer must submit a Document Requesting the reactivation of the TIN, Form 25/DK-TCT, issued with Circular 105/2020/TT-BTC to the direct managing tax authority before the tax authority issues the Notice of TIN Termination as prescribed.

* Taxpayers specified in Clause 2, Article 4 of Circular 105/2020/TT-BTC that wish to continue business activities after submitting the dossier for TIN termination to the tax authority but before the tax authority issues the Notice of TIN Termination as prescribed in Articles 14 and 16 of Circular 105/2020/TT-BTC, must submit a Document Requesting the reactivation of the TIN, Form 25/DK-TCT issued with Circular 105/2020/TT-BTC to the direct managing tax authority before the tax authority issues the Notice of TIN Termination.

* Taxpayers who have submitted dossiers for TIN termination due to division, merger, consolidation to the tax authority as prescribed in Article 14 of Circular 105/2020/TT-BTC, but later receive a document canceling the Decision of Division, Merger, Consolidation Contract, and the business registration authority or cooperative registration authority has not yet terminated the operation of the divided, merged, consolidated enterprises, cooperatives, must submit the application for TIN reactivation to the direct managing tax authority before the tax authority issues the Notice of TIN Termination as prescribed in Article 16 of Circular 105/2020/TT-BTC.

The dossier includes:

- A document requesting the reactivation of the TIN, Form 25/DK-TCT issued with Circular 105/2020/TT-BTC;

- A copy of the document canceling the Decision of Division, Merger Contract, Consolidation Contract.

(2). Application for TIN reactivation according to the decision, notice, or other documents of the competent state authority

- Notice transaction of reactivating the legal status of the enterprises, cooperatives, dependent units from the business registration authority, cooperative registration authority.

- Court's decision canceling the declaration of an individual as deceased, missing, or incapacitated.

When does the taxpayer directly register with the tax authority to submit the application for TIN reactivation to the direct managing tax authority in Vietnam?

According to Clause 2, Article 40 of the Law on Tax Administration 2019, the taxpayer directly registers with the tax authority to submit the application for TIN reactivation to the direct managing tax authority in the following cases:

- The competent authority issues a document canceling the revocation document of the business registration certificate or equivalent permit;

- When there is a need to continue business activities after submitting the dossier for TIN termination to the tax authority but before the tax authority issues the Notice of TIN Termination;

- When the tax authority issues a notice that the taxpayer is not operating at the registered address but the permit has not been revoked, and the TIN has not been terminated.