What is the Form 24/DK-TCT TIN deactivation application in Vietnam according to Circular 86?

What is the Form 24/DK-TCT TIN deactivation application in Vietnam according to Circular 86?

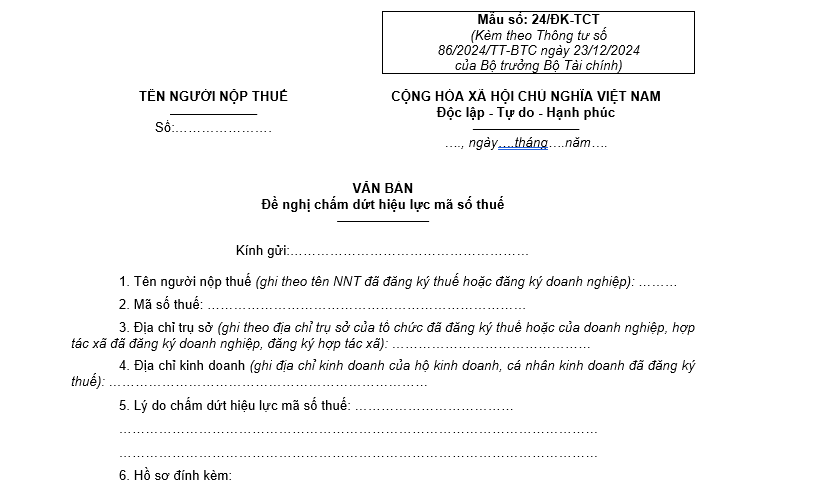

The latest form for requesting the TIN deactivation is Form 24/DK-TCT as stipulated in Appendix II issued with Circular 86/2024/TT-BTC, effective from February 6, 2025.

Form 24/DK-TCT is structured as follows:

* Instructions on how to complete Form 24/DK-TCT TIN deactivation application:

[1] Name of taxpayer: Accurately enter the full name as registered by the taxpayer or enterprise.

[2] TIN: Enter the exact TIN that was issued.

[3] Head office address: Enter the head office address of the organization that completed taxpayer registration or of the enterprise, cooperative that completed enterprise registration, cooperative registration.

[4] Business address: Enter the business address of the individual business or household business that has completed taxpayer registration.

[5] Reason for TIN deactivation: Specifically state the reason, e.g., cessation of business operations, business merger, transformation of business model, or other personal reasons.

[6] Attached documents: List all relevant documents attached for each taxpayer as specified in Article 14 and Article 29 of Circular 86/2024/TT-BTC.

What is the Form 24/DK-TCT TIN deactivation application in Vietnam according to Circular 86?

When shall the organization registered directly with the tax authority deactivate TIN in Vietnam?

According to Clause 2, Article 39 of the Law on Tax Administration 2019, the cases where a taxpayer's TIN is deactivated are as follows:

TIN deactivation

- Taxpayers registered with enterprise registration, cooperative registration, business registration shall deactivate TIN in the following cases:

a) deactivation or dissolution, bankruptcy of business activities;

b) Withdrawal of enterprise registration certificate, cooperative registration certificate, business registration certificate;

c) Division, merger, consolidation.

- Taxpayers registered directly with the tax authority shall deactivate TIN in the following cases:

a) deactivation of business activities, with no obligation for non-business tax;

b) Withdrawal of business registration certificate or equivalent permit;

c) Division, merger, consolidation;

d) Issued a notice by the tax authority stating the taxpayer is not active at the registered address;

dd) Individual deceased, missing, incapacitated according to the law;

e) Foreign contractor upon contract deactivation;

g) Contractor, investor involved in petroleum contract upon contract deactivation or transfer of full rights in the petroleum contract.

...

Thus, taxpayers registered directly with the tax authority deactivate TIN in the following cases:

- deactivation of business operations, not incurring tax obligations for non-business entities;

- Withdrawal of business registration certificate or equivalent permit;

- Division, merger, consolidation;

- Tax authority issues a notice that the taxpayer is not active at the registered address;

- Individual deceased, missing, incapacitated according to the law;

- Foreign contractor upon contract deactivation;

- Contractors and investors involved in petroleum contracts upon contract deactivation or full rights transfer in a petroleum contract.

What are the documents required for deactivating TIN for organizations registering directly with the tax authority in Vietnam from February 6, 2025?

Based on Clause 1, Article 14 of Circular 86/2024/TT-BTC (effective from February 6, 2025), the documents required for deactivating TIN for organizations registered directly with the tax authority include:

The TIN deactivation application for organizations registered directly with the tax authority is Form 24/DK-TCT issued with Circular 86/2024/TT-BTC as stipulated in Articles 38 and 39 of the Law on Tax Administration 2019 and the additional documents as follows:

- For economic organizations, other organizations as specified in points a, b, c, d, n, Clause 2, Article 4 of Circular 86/2024/TT-BTC:

+ For the parent entity, the documents are one of the following: A copy of the dissolution decision, a copy of the division decision, a copy of the merger contract, a copy of the consolidation contract, a copy of the decision to revoke the operating certificate by the competent authority, a copy of the notice of cessation of activities, a copy of the transformation decision.

(i) In case the parent entity has dependent units with a 13-digit TIN, the parent entity must have a notice of cessation of activities sent to the dependent units to require them to complete procedures to deactivate the TIN with the tax office managing the dependent units before the deactivation of the parent entity’s TIN.

(ii) If the dependent unit deactivates TIN but cannot fulfill tax obligations to the state budget according to the Law on Tax Administration and guiding documents, the parent entity must issue a declaration of commitment to take full responsibility for inheriting all tax obligations of the dependent unit and submit it to the tax authority managing the dependent unit; continue fulfilling the tax obligations of the dependent unit with the tax authority managing the tax obligations of the dependent unit even after the dependent unit's TIN has been deactivated.

+ For dependent units, the documents are one of the following: A copy of the decision or notice deactivating the activities of the dependent unit, a copy of the decision to revoke the operating registration certificate for the dependent unit by the competent authority.

- For contractors, investors involved in petroleum contracts, the parent company - Vietnam National Oil and Gas Group representing the host country to receive the share of profit from petroleum contracts; foreign contractors, foreign subcontractors as specified in points đ, h, Clause 2, Article 4 of Circular 86/2024/TT-BTC (except foreign contractors, foreign subcontractors issued with TINs per Point e, Clause 4, Article 5 of Circular 86/2024/TT-BTC), the documents are: A copy of the contract deactivation document, or a copy of the document regarding the transfer of the entire capital contribution portion in participating in the petroleum contract for the investor involved in the petroleum contract.