What is the Form 16/TXNK - Application for cancellation of outstanding tax, late payment interest and fines for imports and exports in Vietnam?

What is the Form 16/TXNK - Application for cancellation of outstanding tax, late payment interest and fines for imports and exports in Vietnam?

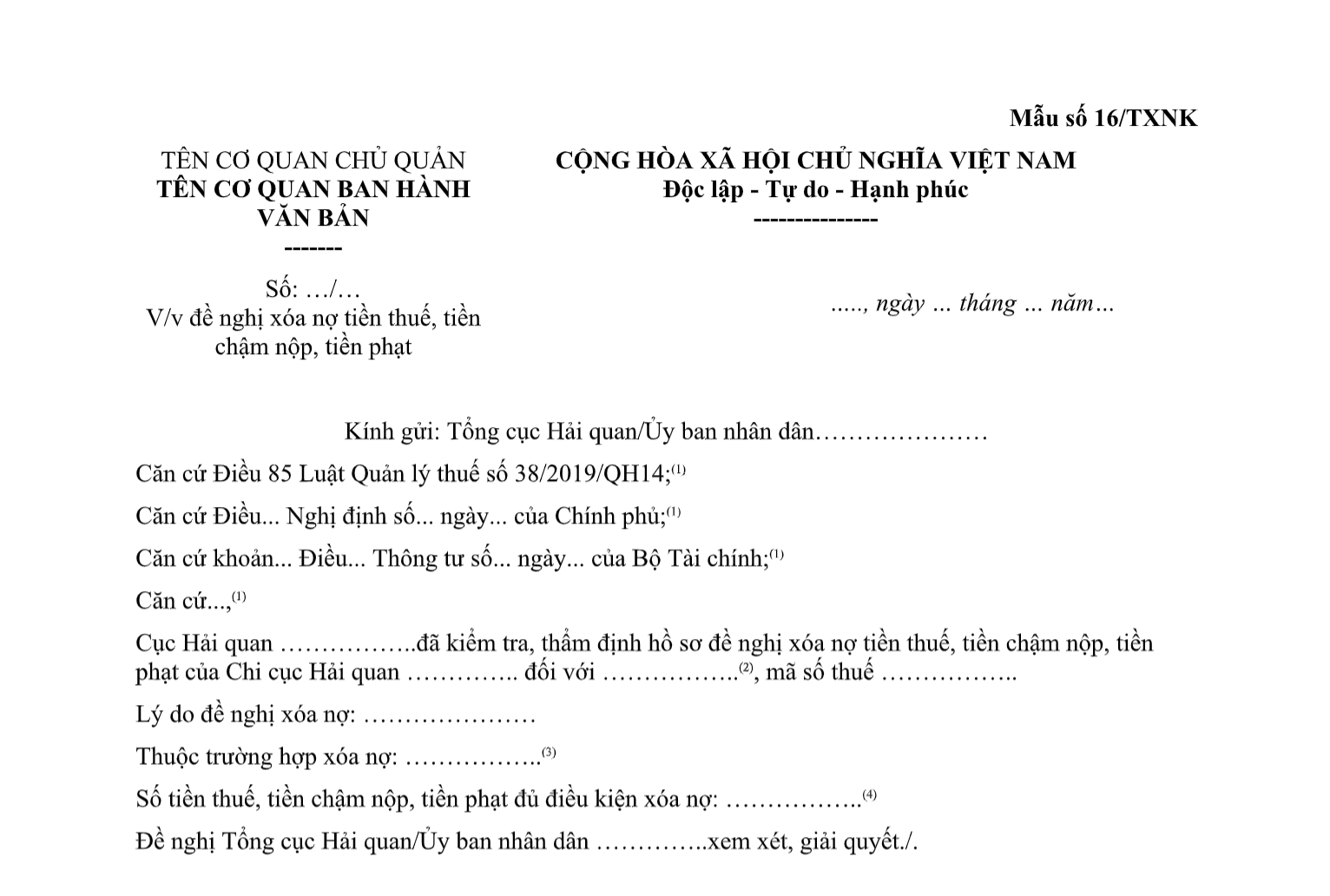

The Form 16/TXNK on Application for cancellation of outstanding tax, late payment interest and fines for imports and exports is currently regulated in Appendix 1 issued together with Circular 06/2021/TT-BTC.

Download Form 16/TXNK on Application for cancellation of outstanding tax, late payment interest and fines for imports and exports here: Here

What is the Form 16/TXNK on Application for cancellation of outstanding tax, late payment interest and fines for imports and exports in Vietnam? (Image from the Internet)

What documents are required for cancellation of outstanding tax, late payment interest and fines for imports and exports in Vietnam?

According to Article 16 of Circular 06/2021/TT-BTC, the documents required for cancellation of outstanding tax, late payment interest and fines for imports and exports include:

(1). Official Dispatch requesting cancellation of outstanding tax, late payment interest and fines:

- Official Dispatch requesting cancellation of outstanding tax, late payment interest and fines from the Customs Department where the taxpayer owes tax, late payment, and penalties (for cases under the authority of the Director General of the General Department of Customs, the Minister of Finance, and the Prime Minister of the Government of Vietnam) according to Form No. 16/TXNK in Appendix 1 issued together with Circular 06/2021/TT-BTC: 1 original copy;

- Official Dispatch requesting cancellation of outstanding tax, late payment interest and fines from the Customs Department or the Customs Sub-Department (in provinces where the Customs Department does not have its headquarters) where the taxpayer owes tax, late payment, and penalties (for cases under the authority of the Chairman of the Provincial People's Committee) according to Form No. 16/TXNK in Appendix 1 issued together with Circular 06/2021/TT-BTC: 1 original copy.

(2). Depending on the cases of cancellation of outstanding tax, late payment interest and fines as stipulated in Article 85 of Law on Tax Administration 2019, the debt write-off documents include the following:

- Decision of the competent state agency declaring bankruptcy for businesses in cases as stipulated in Clause 1, Article 85 of Law on Tax Administration 2019: 1 copy certified by the agency requesting the debt write-off;

- Death certificate, death notice or court decision declaring a person deceased; court decision declaring a person missing or legally incapacitated, or other competent state documents proving a person is deceased, missing, or legally incapacitated for cases as stipulated in Clause 2, Article 85 of Law on Tax Administration 2019: 1 copy certified by the agency requesting the debt write-off;

- Notification from the competent authority about the revocation of Business Registration Certificate, Business Registration Certificate, Cooperative Registration Certificate, Household Business Registration Certificate, Investment Registration Certificate, Establishment and Operation License, or Practicing License for cases as stipulated in Clause 3, Article 85 of Law on Tax Administration 2019: 1 copy certified by the agency requesting the debt write-off;

- Execution or enforcement decisions or records of enforcement measures for the administrative decision on tax administration for taxpayers who are businesses or organizations (if any): 1 copy certified by the agency requesting the debt write-off;

- Official documents from the competent state agency confirming cases affected by natural disasters, catastrophes, or epidemics as stipulated in Clause 4, Article 85 of Law on Tax Administration 2019: 1 copy certified by the agency requesting the debt write-off.

What are cases of cancellation of outstanding tax, late payment interest and fines in Vietnam?

According to Article 85 of Law on Tax Administration 2019, the cases of cancellation of outstanding tax, late payment interest and fines include:

- Enterprises and cooperatives declared bankrupt that have settled obligations in accordance with bankruptcy law and have no remaining assets to pay tax, late payment, and penalties.

- Individuals who have passed away or are declared deceased, legally incapacitated by the court, have no assets, including inherited assets, to pay the owed tax, late payment, and penalties.

- Tax debts, late payment, penalties of taxpayers not falling under the above two categories that the tax administration has enforced measures stipulated in Point g, Clause 1, Article 125 of Law on Tax Administration 2019 and these debts have been outstanding for over 10 years from the due date but are unrecoverable.

Taxpayers who are individuals, individual businesses, household heads, household businesses, sole proprietors, and single-member limited liability companies that have had their tax, late payment, and penalties written off under the previous regulations must repay the written-off debts before resuming business or establishing a new business.

- Tax, late payment, and penalties in cases of widespread impact due to natural disasters, catastrophes, or epidemics that have been considered for late payment exemption under Clause 8, Article 59 of Law on Tax Administration 2019 and tax payment deferment under Point a, Clause 1, Article 62 of Law on Tax Administration 2019 but still suffer losses and cannot recover business activities, making it impossible to pay tax, late payment, and penalties.