What is the Form 12/KTT - Tax inspection record in Vietnam?

What is the Form 12/KTT - Tax inspection record in Vietnam?

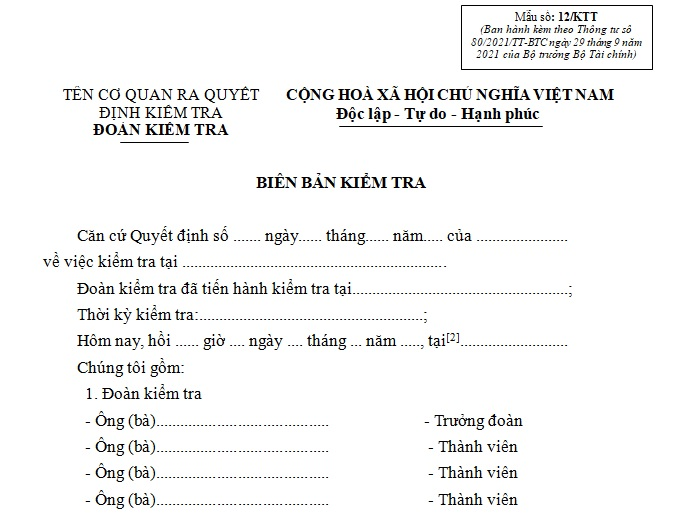

The tax inspection record form is Form 12/KTT issued together with Appendix 1 of Circular 80/2021/TT-BTC. To be specific:

Download Form 12/KTT tax inspection record: Here

What is the Form 12/KTT - Tax inspection record in Vietnam? (Image from the Internet)

What are cases of tax inspection on taxpayers’ premises in Vietnam?

According to Clause 1, Article 110 of the Tax Administration Law 2019, tax inspections on taxpayers’ premises are conducted under the following circumstances:

- In case the dossier is subject to pre-tax refund inspection; post-tax refund inspection for dossiers eligible for pre-tax refund.

- Cases specified at point b, clause 2, Article 109 of the Tax Administration Law 2019:

+ If the tax dossier contains contents that need clarification related to the payable tax amount, exempted tax amount, reduced tax amount, deductible tax amount carried forward, refundable tax amount, or non-collectible tax amount, the tax authority shall notify the taxpayer, requesting explanations or additional information and documents.

In case the taxpayer has provided explanations and additional information, proving that the declared tax amount is correct, the tax dossier will be accepted; if the provided documents are insufficient to prove the correctness of the declared tax amount, the tax authority will request the taxpayer to amend the declaration.

+ If the taxpayer fails to provide explanations, additional information, or revised tax dossiers within the stipulated time notified by the tax authority or submits incorrect additional tax dossiers and explanations:

The head of the tax authority may decide the payable tax amount or issue a decision for tax inspection at the taxpayer’s premises or use it as a basis for planning inspection and auditing based on the risk management principle in tax administration.

- Post-clearance inspection at the customs declarant's premises in accordance with the customs law;

- Cases with signs of legal violations;

- Cases selected according to plans and special topics;

- Cases recommended by the State Audit, State Inspectorate, or other competent authorities;

- Cases of division, separation, merger, consolidation, transformation of business type, dissolution, cessation of activities, equitization, cessation of tax code validity, relocation of business locations, and other extraordinary inspections and inspections as directed by the competent authority, except for cases of dissolution and cessation of activities where the tax authority is not required to finalize tax enforcement according to the law.

What are procedures for tax inspection in Vietnam?

According to Subsection 2, Section 3, Part 2 of the tax inspection procedure under Decision 970/QD-TCT of 2023, enterprises selected for on-site inspection planning at their premises will be based on the results of risk ranking from highest to lowest and include enterprises not inspected or audited for over 5 years.

A tax inspection on taxpayers’ premises will include 2 phases. To be specific:

Phase 1: Preparation for inspection on taxpayers’ premises:

- Issue the Inspection Decision.

- The Inspection Decision must be sent to the taxpayer no later than 03 (three) working days from the date of issuance.

If the tax authority or a non-direct management unit conducts the inspection, one copy must be sent to the tax authority or the unit directly managing the taxpayer for coordinating related departments.

- Before announcing the Inspection Decision, the Head of the Inspection Team must assign members to carry out the inspection according to the contents recorded in the Inspection Decision using Form 07/QTKT attached to the tax inspection procedure.

- Revoke the Inspection Decision; postpone or suspend the inspection; adjust the Inspection Decision if it is proven that the declared tax amount is accurate and the payable tax amount has been fully paid.

- If the taxpayer is still operating and declaring tax normally but refuses to receive the Inspection Decision or evades the inspection, the inspection team shall make an administrative violation record per Article 15 of Decree 125/2020/ND-CP;

Based on the administrative violation record of the taxpayer's non-compliance with tax inspection, the inspection team reports to the issuer of the Inspection Decision to impose administrative penalties, apply tax management measures (if any), and implement tax determination steps following Articles 14, 15, and 16 of Decree 126/2020/ND-CP.

The administrative violation record, if the violator or the representative of the violating unit is not present or deliberately avoids or due to objective reasons does not sign the record, it must have the signature of the local authority representative or at least one witness confirming it.

In the absence of confirmation from the local authority or a witness, the reason must be noted in the record.

Phase 2: Inspection on taxpayers’ premises:

- Announce the Tax Inspection Decision.

- Perform the inspection on taxpayers’ premises.

- Make a tax inspection record.

- Process the inspection results on taxpayers’ premises.

- Record the inspection log.

- Supervise the inspection team.

- Monitor and urge the implementation of post-inspection results.

- In cases where the tax authority's data system and information technology application, as well as the taxpayer, meet the requirements for working via electronic transactions, online working, the inspection team and the taxpayer may carry out the inspection through electronic transactions, online working, or a combination of working methods during the inspection at the taxpayer’s premises (direct working on taxpayers’ premises, electronic transactions, online working).

It is encouraged for the inspection team and taxpayers to work through electronic transactions and online methods.