What is the Form 11/TTrT - Record of sealing documents related to tax evasion and tax fraud in Vietnam under Circular 80?

What is the Form 11/TTrT - Record of sealing documents related to tax evasion and tax fraud in Vietnam under Circular 80?

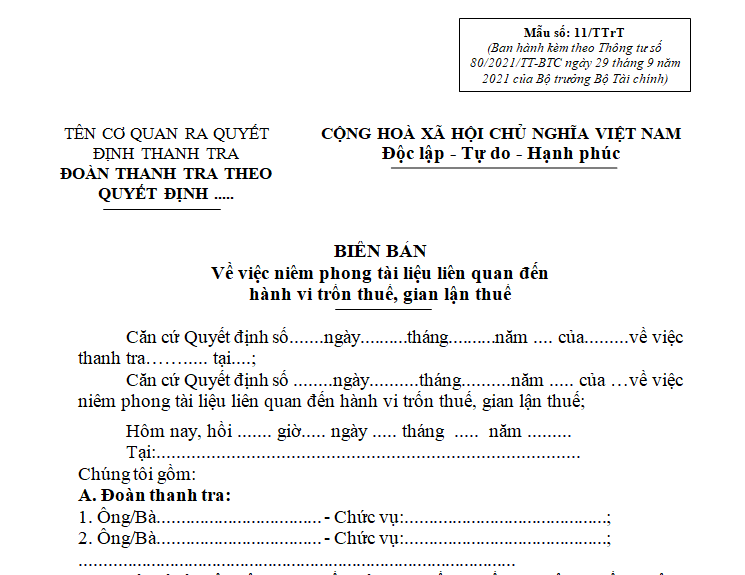

Form 11/TTrT for recording the sealing of documents related to tax evasion and tax fraud is issued in accordance with Circular 80/2021/TT-BTC. This form is used when documents or exhibits need to be sealed and must be executed in the presence of the person in possession of the documents or exhibits, a family representative or organizational representative, a local government representative, and a witness.

Download Form 11/TTrT for recording the sealing of documents related to tax evasion and tax fraud.

Form 11/TTrT for recording the sealing of documents related to tax evasion and tax fraud is formatted as follows:

What is the Form 11/TTrT - Record of sealing documents related to tax evasion and tax fraud in Vietnam under Circular 80? (Image from the Internet)

Who has the authority to decide on sealing documents and exhibits related to tax evasion in Vietnam?

Based on Clause 1, Article 117 of the Law on Tax Administration 2019, the duties and powers of the head of the tax inspection team are outlined as follows:

Duties and Powers of the Head of the Tax Inspection Team and Members of the Tax Inspection Team

- The head of the tax inspection team has the following duties and powers:

a) Organize and direct the members of the tax inspection team to implement the contents of the tax inspection decision accurately;

b) Recommend to the decision-maker of the inspection to apply measures within the duties and powers of the decision-maker as prescribed by the law on inspection to ensure the assigned tasks are performed;

c) Request the inspected entities to present practice licenses, business registration certificates, enterprise registration certificates, cooperative registration certificates, investment registration certificates, and licenses for establishment and operation, and provide information, documents, and written reports to clarify issues related to the inspection content;

d) Draw up a record of the violations of the inspected entity;

đ) Inventory assets related to the inspection content of the inspected entity;

e) Request other agencies, organizations, or individuals with relevant information and documents to provide such information and documents;

g) Request competent authorities to temporarily detain funds, objects, or licenses used illegally when it is deemed necessary to immediately prevent law violations or to verify circumstances serving as evidence for conclusions and handling;

h) Decide to seal the documents of the inspected entity when there is evidence of legal violations;

...

Therefore, the authority to decide on sealing documents and exhibits related to tax evasion and tax fraud belongs to the head of the tax inspection team.

What are procedures for sealing documents and exhibits related to tax evasion in Vietnam?

Based on Clause 4, Article 122 of the Law on Tax Administration 2019, the procedure for temporarily holding documents and exhibits related to tax evasion is as follows:

Temporary Holding of Documents and Exhibits Related to tax evasion

...

- When temporarily holding documents and exhibits related to tax evasion, the head of the tax inspection team must draw up a record of temporary holding. This record must clearly state the name, quantity, and type of temporarily held documents and exhibits; the signature of the person executing the temporary holding, and the individual managing the violated documents and exhibits. The decision-maker of the temporary holding is responsible for safeguarding the temporarily held documents and exhibits and is legally responsible if the documents or exhibits are lost, sold, substituted, or damaged.

If the documents and exhibits need to be sealed, the sealing must be carried out immediately in front of the person possessing the documents and exhibits; if the person is absent, the sealing must be conducted in front of a family representative or organizational representative, a local government representative, and a witness.

...

Therefore, the sealing of documents and exhibits related to tax evasion must be executed according to the following principles:

- Conducted immediately in front of the person possessing the documents and exhibits.

- If the person is absent, the sealing must be conducted in front of a family representative or organizational representative, a local government representative, and a witness.

Is public recording allowed during the collection of information related to tax evasion in Vietnam?

Based on Article 121 of the Law on Tax Administration 2019, the collection of information related to tax evasion is regulated as follows:

Collection of Information Related to tax evasion

- The head of the tax administration agency has the authority to request agencies, organizations, and individuals with information relevant to tax evasion to provide information in writing or to respond directly.

- If a written information request is made, agencies, organizations, and individuals are responsible for providing information with accurate content, within the specified time limit, to the requested address and bear responsibility for the accuracy and truthfulness of the information provided; if information cannot be provided, a written response with reasons must be given.

- If a request is made for direct responses, the person asked to provide information must be present at the time and place stated in the document to provide information as requested and is responsible for the accuracy and truthfulness of the information provided; if they cannot be present, the information must be provided in writing.

During the process of collecting information by direct response, the tax inspection team members must draw up a work record and public recordings may be made.

Therefore, during the collection of information related to tax evasion, the tax inspection team members are permitted to publicly record.