What is the Form 08-MST: Application form for amendments to tax registration in Vietnam according to the Circular 86?

Download Form 08-MST: Application form for amendments to tax registration in Vietnam according to the Circular 86

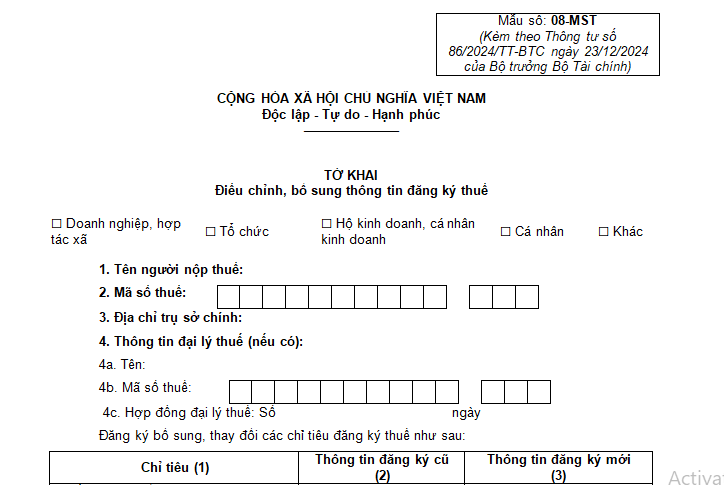

Pursuant to Article 10 and Article 25 of Circular 86/2024/TT-BTC (effective from February 6, 2025) providing for documents on amendments to tax registration for organizations and individual/household businesses, the application form for amendments to tax registration is Form 08-MST issued in Appendix 2 attached to Circular 86/2024/TT-BTC.

Specifically, Form 08-MST: application form for amendments to tax registration is formatted as follows:

Download Form 08-MST: application form for amendments to tax registration.

Download Form 08-MST: Application form for amendments to tax registration in Vietnam according to the Circular 86? (Image from the Internet)

How long does a taxpayer have to notify amendments to tax registration to the tax authority in Vietnam?

Pursuant to Article 36 of the Law on Tax Administration 2019, taxpayers must notify amendments to tax registration to the tax authority within the following timeframes:

- Taxpayers who register taxpayer registration together with enterprise registration, cooperative registration, or business registration must notify the amendments to tax registration concurrently with changes in enterprise registration, cooperative registration, or business registration as prescribed by law when there is any change in taxpayer registration information.

In case the taxpayer changes the head office address resulting in a change in the managing tax authority, the taxpayer must complete tax-related procedures with the current managing tax authority as prescribed by this Law before registering changes with the enterprise registration agency, cooperative registration agency, or business registration agency.

- Taxpayers who directly register with the tax authority must notify the managing tax authority within 10 working days from the date of the change in taxpayer registration information.

- In cases where individuals authorize an organization or individual paying income to register amendments to tax registration for the individual and their dependents, the individual must notify the income-paying organization or individual no later than 10 working days from the date of the change. The income-paying organization or individual must notify the managing tax authority no later than 10 working days from the date of receiving the individual's authorization.

What are regulations on handling of application for amendments to tax registration for individual/household businesses in Vietnam?

According to Article 26 of Circular 86/2024/TT-BTC (effective from February 6, 2025), the handling of application for amendments to tax registration for individual/household businesses is as follows:

(1) Households and individuals changing taxpayer registration information as stipulated in Clause 1 and Clause 4, Article 25 of Circular 86/2024/TT-BTC

- In case the change does not appear on the Taxpayer Registration Certificate or the Tax Identification Number Notice: Within 02 working days from the date of receipt of the complete file from the taxpayer, the directly managing tax authority is responsible for updating the changes into the Taxpayer Registration application system.

- In case the change affects the Taxpayer Registration Certificate or the Tax Identification Number Notice: Within 03 working days from the date of receipt of the complete file from the taxpayer, the directly managing tax authority is responsible for updating the changes into the Taxpayer Registration application system; simultaneously, issuing the updated Taxpayer Registration Certificate or Tax Identification Number Notice.

(2) Business households, household businesses, and business individuals changing taxpayer registration information as stipulated in Clause 2 and Clause 3, Article 25 of Circular 86/2024/TT-BTC

- At the tax authority from which they are transferring:

+ Within 05 working days from the date of signing the tax administrative violation sanction decision or inspection conclusion (for files requiring inspection at the taxpayer's premises) or 07 working days from the date of receipt of the file from the taxpayer (for files not requiring inspection at the taxpayer's premises), while the taxpayer has fulfilled obligations with the transferring tax authority as stipulated in Clause 3, Article 6 of Decree 126/2020/ND-CP, the tax authority issues a Notice of Taxpayer Relocation, Form 09-MST issued together with Circular 86/2024/TT-BTC to the taxpayer and the tax authority to which the taxpayer is relocating.

+ Beyond the above period, if the taxpayer has not fulfilled obligations with the transferring tax authority, the issuance period for the Notice of Taxpayer Relocation, Form 09-MST issued with Circular 86/2024/TT-BTC is reset to 03 working days from the date the taxpayer fulfills obligations with the transferring tax authority.

+ The determination of taxpayers requiring inspection at their premises is in accordance with tax management laws.

- At the tax authority to which they are relocating:

+ Within 03 working days from the date of receipt of the complete file from the taxpayer, the receiving tax authority is responsible for updating the changes into the Taxpayer Registration application system, issuing the updated Taxpayer Registration Certificate or Tax Identification Number Notice to the taxpayer.

(3) In cases where business households or business individuals change taxpayer registration information as stipulated in Clause 2 and Clause 3, Article 25 of Circular 86/2024/TT-BTC and have completed procedures at the transferring tax authority but have not submitted the address change file at the business registration agency (for business households under the one-stop mechanism) or at the tax authority to which they are relocating (for business individuals as stated in Point i, Clause 2, Article 4 of Circular 86/2024/TT-BTC), the tax authority shall handle similarly to Clause 3, Article 11 of Circular 86/2024/TT-BTC.