What is the Form 06/TNCN personal income tax return in Vietnam in 2025?

What is the Form 06/TNCN personal income tax return in Vietnam in 2025?

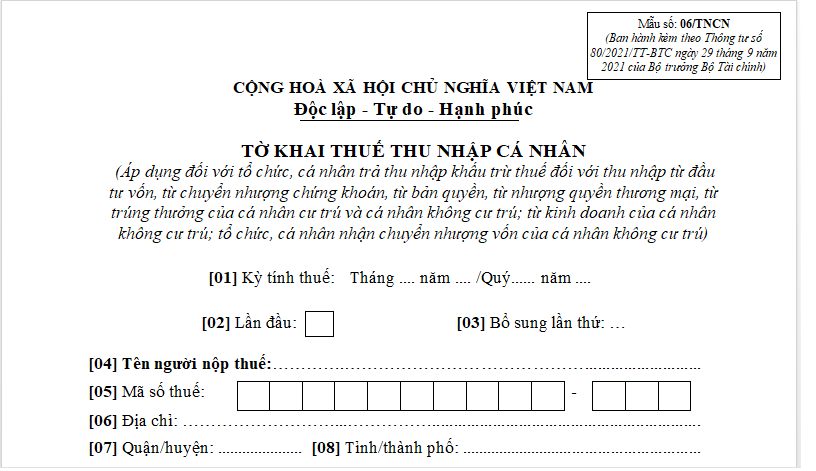

The latest 2025 personal income tax return form is Form 06/TNCN in Appendix 2 issued with Circular 80/2021/TT-BTC.

Form 06/TNCN applies to the following subjects:

- Organizations and individuals paying income subject to tax withholding from capital investment, securities transfer, royalties, franchise, lotteries for both resident and non-resident individuals; and business profits of non-resident individuals;

- Organizations and individuals receiving capital transfer from non-resident individuals.

Download the latest 2025 Form 06/TNCN personal income tax return

What is the Form 06/TNCN personal income tax return in Vietnam in 2025? (Image from the Internet)

How to fill out Form 06/TNCN personal income tax return in Vietnam?

Below are the instructions for filling out Form 06/TNCN:

* General Section:

[01] Tax Period: Clearly specify the month, year or quarter, year during which the tax declaration is executed. In case of monthly declaration, strike out the quarter, and in case of quarterly declaration, strike out the month.

[02] First Time: Mark “x” if filing the tax declaration for the first time.

[03] Amendments: If not the first time, it shall be considered as an amendment, and the number of amendments should be noted in the blank. The number of amendments is noted in natural numbers (1, 2, 3…).

[04] Taxpayer's Name: Fully record the name of the tax withholding organization as per the Establishment Decision or Business Registration Certificate or Taxpayer Registration Certificate. For individual withholding tax declaration, fill in the full name as per the Taxpayer Registration or the Personal Identity Card/CCCD/Passport of the individual.

[05] Tax ID: Record the full tax ID of the withholding organization/individual.

[06] Address: Fill in the full address of the withholding organization/individual.

[07] District: Fully state the district of the tax withholding organization/individual.

[08] Province/City: Fully state the province/city of the withholding organization/individual.

[09] Phone: Fill in the phone number of the withholding organization/individual.

[10] Fax: Fill in the full fax number of the withholding organization/individual.

[11] Email: Provide the full email address of the withholding organization/individual.

[12] Name of Substitute Organization (if applicable): Fully record the name of the substitute organization (per Establishment Decision or Business Registration Certificate or Taxpayer Registration Certificate).

[13] Tax ID: Provide the full tax ID of the substitute tax declaration and payment organization (if reporting indicator [12]).

[14] Address: Fill in the full address of the substitute tax declaration and payment organization (if reporting indicator [12]).

[15] District: Fully list the district of the substitute tax declaration and payment organization (if reporting indicator [12]).

[16] Province/City: Fully list the province/city of the substitute tax declaration and payment organization (if reporting indicator [12]).

[17] Phone: Provide the phone number of the substitute tax declaration and payment organization (if reporting indicator [12]).

[18] Fax: Fill in the full fax number of the substitute tax declaration and payment organization (if reporting indicator [12]).

[19] Email: Provide the full email address of the substitute tax declaration and payment organization (if reporting indicator [12]).

[20] Name of Tax Agent (if any): If the withholding organization/individual authorizes a Tax Agent to declare taxes, the full name of the Tax Agent must be written as per their Establishment Decision or Business Registration Certificate.

[21] Tax ID: Provide the full tax ID of the tax agent (if reporting indicator [20]).

[22] Tax Agency Contract: Provide the full number and date of the Tax Agent Contract between the individual and the tax agent (active contract) (if reporting indicator [20]).

* Detailed Section:

** Income from Capital Investment:

[23] Total number of individuals earning income:

- Arising number: is the total number of individuals with income from capital investment that the withholding organization/individual paid during the declaration period.

- Cumulative number is the total number of individuals with income from capital investment that has been deducted cumulatively from the beginning of the year to the declaration period.

[24] Total taxable income:

- Arising is the total sum of income from capital investments in various specified forms that the organization, individual paying the income has paid to individuals during the declaration period.

- Cumulative is the total sum of income from capital investments in various specified forms that the income-paying organization, individual has paid to individuals cumulatively from the beginning of the year to the declaration period.

[25] Total personal income tax (TNCN) already withheld:

- Arising: is the total TNCN withheld (5%) on income from capital investments paid to individuals during the period. Indicator [25] = [24] x 5%.

- Cumulative: is the total TNCN withheld (5%) on income from capital investments that has been paid cumulatively up to the declaration period.

** Income from Securities Transfer:

[26] Total number of individuals earning income:

- Arising number: is the total number of individuals earning income from securities transfer paid by the withholding organization/individual during the declaration period.

- Cumulative number is the total number of individuals earning income from securities transfers that has been deducted cumulatively from the beginning of the year to the declaration period.

[27] Total taxable income:

- Arising is the total transaction value from securities transfers during the declaration period.

- Cumulative is the total transaction value from securities transfers cumulatively from the beginning of the year to the declaration period.

[28] Total personal income tax (TNCN) already withheld:

- Arising: is the withheld tax amount of 0.1% on total transaction value from securities transfers that the withholding organization has deducted during the period. Indicator [28] = [27] x 0.1%.

- Cumulative: is the withheld tax amount of 0.1% on total transaction value from securities transfers that has been deducted cumulatively up to the declaration period.

** Income from Royalties, Franchises:

[29] Total number of individuals earning income:

- Arising is the total number of individuals earning income from royalties, franchises paid by the withholding organization/individual during the declaration period.

- Cumulative is the total number of individuals earning income from royalties, franchises cumulatively from the beginning of the year to the declaration period.

[30] Total taxable income:

- Arising: Is the total amount paid from royalties, franchises exceeding 10 million dongs according to the transfer agreement, regardless of payment times or receipts.

- Cumulative is the total amount paid from royalties, franchises exceeding 10 million dongs according to the transfer agreement, regardless of payment times or receipts, cumulatively up to the declaration period.

[31] Total personal income tax (TNCN) already withheld:

- Arising: is the withheld tax amount of 5% on total taxable income from royalties, franchises. Indicator [31] = [30] x 5%.

- Cumulative: is the withheld tax amount of 5% on total taxable income from royalties, franchises cumulatively up to the declaration period.

** Income from Winning Prizes:

[32] Total number of individuals earning income:

- Arising: is the total number of individuals earning income from winnings paid by the withholding organization/individual during the declaration period.

- Cumulative is the total number of individuals earning income from winnings that has been deducted cumulatively from the beginning of the year to the declaration period.

[33] Total taxable income:

- Arising: Is the total prize income exceeding 10 million dongs actually paid by the income-paying organization or individual to the person in the period.

- Cumulative is the total prize income exceeding 10 million dongs actually paid by the income-paying organization or individual cumulatively up to the declaration period.

[34] Tax already withheld:

- Arising: is the withheld tax amount of 10% on total taxable income from winnings that the income-paying organization or individual has paid to the person in the period. Indicator [34] = [33] x 10%.

- Cumulative: is the withheld tax amount of 10% on total taxable income from winnings that has been paid cumulatively up to the declaration period.

** Business Revenue of Non-resident Individuals:

[35] Total number of individuals earning income:

- Arising: is the total number of non-resident individuals earning business income during the declaration period.

- Cumulative is the total number of non-resident individuals earning business income cumulatively from the beginning of the year to the declaration period.

[36] Total taxable revenue paid to the individual:

- Arising: is the total amount paid by the income-paying organization or individual to non-resident individuals providing goods and services during the period.

- Cumulative: is the total amount paid by the income-paying organization or individual to non-resident individuals providing goods and services cumulatively up to the declaration period.

[37] Total personal income tax (TNCN) already withheld:

- Arising: is the total tax withheld from income from business revenue paid to non-resident individuals, excluding tax reductions in economic zones (if any).

- Cumulative: is the total tax withheld from business revenue paid to non-resident individuals cumulatively up to the declaration period, excluding tax reductions in economic zones (if any).

** Income from Capital Transfer of Non-resident Individuals:

[38] Total number of individuals earning income:

- Arising: is the total number of non-resident individuals earning capital transfer income during the declaration period.

- Cumulative is the total number of non-resident individuals earning capital transfer income cumulatively from the beginning of the year to the declaration period.

[39] Total capital transfer value:

- Arising: is the total capital transfer value that the recipient organization or individual has actually transferred from non-resident individuals within the period according to the transfer contract.

- Cumulative is the total capital transfer value that the recipient organization or individual has actually transferred from non-resident individuals according to the transfer contract cumulatively up to the declaration period.

[40] Total tax already withheld:

- Arising: is the tax withheld at 0.1% on total capital transfer value within the period by the recipient organization or individual. Indicator [40] = [39] x 0.1%.

- Cumulative is the tax withheld at 0.1% on total capital transfer value cumulatively up to the declaration period by the recipient organization or individual.

Who is subject to personal income tax in Vietnam under the current regulations?

Based on Article 2 of the Law on Personal Income Tax 2007 stipulating personal income tax payment as follows:

Personal income tax payers are resident individuals with taxable income specified in Article 3 of the Law on Personal Income Tax 2007 arising inside and outside Vietnam, and non-resident individuals with taxable income specified in Article 3 of the Law on Personal Income Tax 2007 occurring within Vietnam. Among these:

- Resident individuals are those who meet one of the following conditions:

+ Have stayed in Vietnam for 183 days or more within a calendar year or 12 consecutive months from the first day present in Vietnam;

+ Have a permanent residence in Vietnam, including registered permanent residency or rented house for living in Vietnam under a lease contract with a definite term.

- Non-resident individuals are those who do not meet the above conditions:

+ Have stayed in Vietnam for 183 days or more within a calendar year or 12 consecutive months from the first day present in Vietnam;

+ Have a permanent residence in Vietnam, including registered permanent residency or rented house for living in Vietnam under a lease contract with a definite term.