What is the Form 06/MGTH on application for exemption of resource royalty in Vietnam?

What is the Form 06/MGTH on application for exemption of resource royalty in Vietnam?

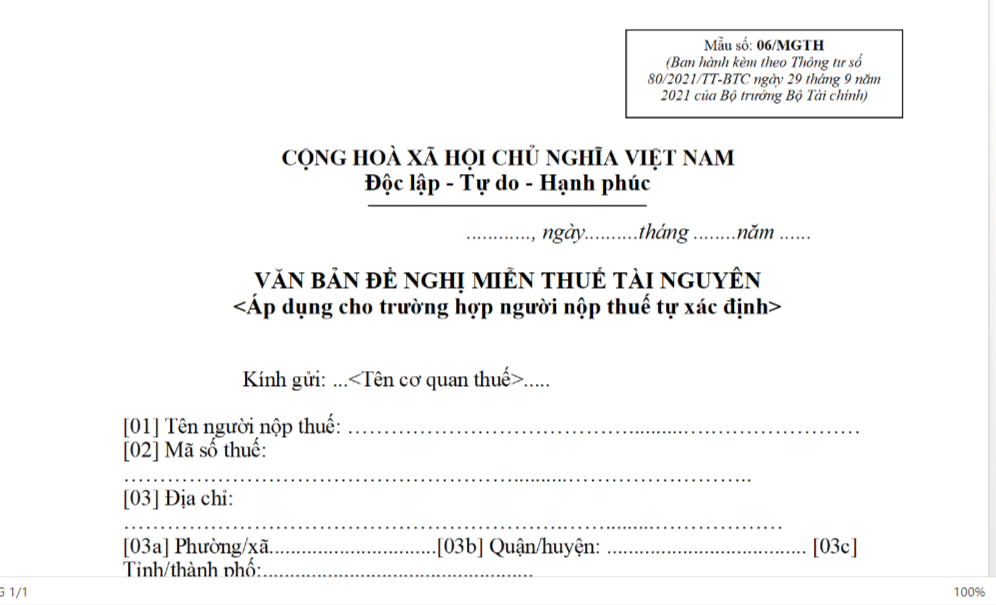

The application form for exemption of resource royalty is Form 06/MGTH issued along with Appendix 1 of Circular 80/2021/TT-BTC, as follows:

Download Form 06/MGTH application form for exemption of resource royalty: Download

What is the Form 06/MGTH application form for exemption of resource royalty in Vietnam? (Image from the Internet)

What are cases of exemption of resource royalty in Vietnam?

According to Article 10 of Circular 152/2015/TT-BTC, the cases eligible for exemption of resource royalty include:

- Exemption of resource royalty for organizations and individuals exploiting natural marine products.

- Exemption of resource royalty for organizations and individuals exploiting branches, tops, firewood, bamboo, rattan, nứa, mai, giang, tranh, vầu, lồ ô allowed to be exploited for personal use.

- Exemption of resource royalty for organizations and individuals exploiting natural water used for hydropower production serving household use.

- Exemption of resource royalty for natural water exploited by households and individuals for personal use.

- Exemption of resource royalty for land allocated or leased to organizations and individuals for local use within allocated or leased areas; land exploited for leveling and building defense, military, and embankment projects.

Land exploited for local use exempted from tax in this point includes sand, stone, gravel mixed within the soil but without specific identification and used in raw form for leveling and construction projects; If transported elsewhere for use or sale, resource royalty must be paid according to regulations.

- Other cases eligible for exemption of resource royalty, the Ministry of Finance will cooperate with relevant Ministries and sectors to report to the Government of Vietnam, which will present to the Standing Committee of the National Assembly for consideration and decision.

Which entities are obligated to pay resource royalty in Vietnam?

According to Article 3 of Circular 152/2015/TT-BTC, subjects obligated to pay resource royalty are organizations and individuals exploiting natural resources subject to tax according to Article 2 of Circular 152/2015/TT-BTC. The resource royalty payer (hereinafter referred to as the taxpayer - NNT) in some specific cases are regulated as follows:

- For mineral resource exploitation activities, the taxpayer is the organization or business household granted a mineral exploitation license by a competent state agency.

In case an organization granted a mineral exploitation license by a competent state agency cooperates with another organization or individual in resource exploitation with a separate tax payer regulation, the taxpayer will be defined according to that document.

In case an organization granted a mineral exploitation license by a competent state agency delegates the exploitation to its subordinate units, each exploitation unit will be a resource royaltypayer.

- Businesses exploiting natural resources formed from joint ventures will have the joint venture company as the taxpayer;

In case a Vietnamese partner and a foreign partner jointly implement a business cooperation contract for resource exploitation, the tax payment responsibility of the parties must be clearly defined in the cooperation contract;

If the business cooperation contract does not specifically define the responsible resource royalty payer, all participating parties must declare and pay the resource royalty or appoint a representative to pay the resource royalty for the business cooperation contract.

- Organizations or individuals contracted to construct projects that generate resource volumes during construction permitted by state management agencies or not contrary to laws on resource management and exploitation, when exploiting, using, or consuming, must declare and pay the resource royalty to local tax authorities where the resource is extracted.

- Organizations or individuals using water from irrigation works to generate electricity are resource royaltypayers according to the regulations of Circular 152/2015/TT-BTC, regardless of the source of investment capital for the irrigation works.

In case the organization managing the irrigation works supplies water to other organizations or individuals for the production of domestic water or other uses (excluding water for power generation), the organization managing the irrigation works is the taxpayer.

- For natural resources prohibited or illegally exploited and seized, which are subject to resource royalty and allowed to be sold, the assigned auctioning organization must declare and pay the resource royalty per each occurrence to the tax authority directly managing the auctioning organization before deducting related costs of seizure, auction, and reward pursuance to policy regulations.