What is the Form 05-DK-TCT application form for tax registration for non-business individual in Vietnam?

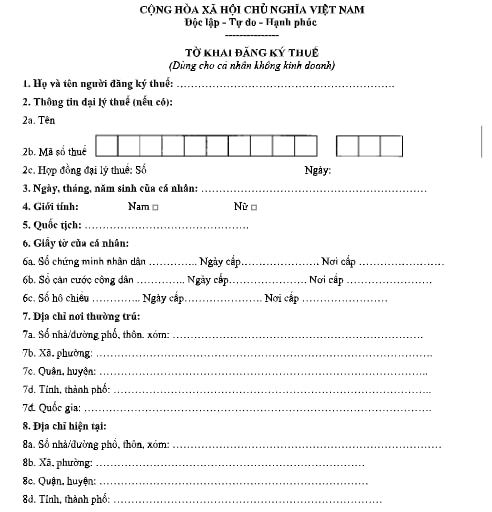

Form 05-DK-TCT application form for tax registration for non-business individual in Vietnam

The current application form for tax registration for non-business individual is Form 05-DK-TCT in Appendix 2 issued with Circular 105/2020/TT-BTC:

Form 05-DK-TCT application form for tax registration for non-business individual: Here

Form 05-DK-TCT application form for tax registration for non-business individual in Vietnam(Image from Internet)

Guidelines for filling out the application form for tax registration for non-business individual in Vietnam

Below are the guidelines for filling out the application form for tax registration according to Form 05-DK-TCT as follows:

(1) Full name of the taxpayer: Clearly and fully write the taxpayer's name in capital letters.

(2) Tax agent information: Provide full information about the tax agent in cases where the tax agent signs a contract with the taxpayer to perform the taxpayer registration procedures on their behalf as per the Law on Tax Administration.

(3) Date of birth: Clearly state the date of birth of the individual taxpayer.

(4) Gender: Tick one of the boxes Male or Female.

(5) Nationality: Clearly state the nationality of the individual taxpayer.

(6) Personal document details: Provide full information on the personal documents of the individual taxpayer as prescribed in Circular 105/2020/TT-BTC.

(7) Permanent address: Provide full information about the permanent address of the individual from the household registration book or the national population database.

(8) Current address: Provide full information about the current address of the individual (only if it is different from the permanent address).

(9) Contact phone number, email: Provide the phone number and email address (if any).

(10) Income-paying organization at the time of taxpayer registration: State the income-paying organization the individual is working with at the time of taxpayer registration (if any).

(11) Tax agent staff: In cases where the tax agent declares on behalf of the taxpayer, provide this information.

Procedure for initial taxpayer registration for non-business individual through tax declaration in Vietnam

According to subsection 2 Section 1 Part 2 of the Procedure issued with Decision 2589/QD-BTC in 2021, the initial taxpayer registration for non-business individual through tax declaration follows the procedure:

- Step 1: The individual submits the tax declaration within the legal deadline for tax administration to the Tax Sub-Department where the individual has arisen obligations to the state budget to perform the taxpayer registration procedures.

Place of submission: At the Tax Sub-Department where the individual has arisen obligations to the state budget.

+ For electronic taxpayer registration documents: The taxpayer accesses the e-portal of their choice (the General Department of Taxation's e-portal/state authority's e-portal including the national public service portal, ministerial-level public service portal, provincial public service portal as per the single-window department mechanism in administrative procedure resolution connected to the General Department of Taxation's e-portal/TVAN service provider's e-portal) to file the declaration and submit the prescribed e-documents (if any), sign electronically, and send to the tax authority via the chosen e-portal;

+ Taxpayer submits the application (taxpayer registration application simultaneously with business registration application under the single-window department mechanism) to the competent state authority. The competent state authority sends the received application information of the taxpayer to the tax authority via the General Department of Taxation's e-portal.

- Step 2: Tax authority reception:

+ For physical taxpayer application:

++ For applications submitted directly to the tax authority: Tax officials receive and stamp the reception on the taxpayer registration application, noting the date of receipt, the number of documents according to the document list for the case of direct submission at the tax authority. Tax officials issue an appointment slip detailing the date to return results and the processing period for the accepted application;

++ For taxpayer application sent by post: Tax officials stamp the reception, note the date of receipt on the application, and number it with the tax authority's dispatch number;

Tax officials check the taxpayer registration application. If the application is incomplete and requires explanation or additional information, the tax authority will notify the taxpayer using Form 01/TB-BSTT-taxpayer in Appendix II issued with Decree 126/2020/ND-CP within 2 working days from the date of receipt.

+ For electronic taxpayer application:

The Tax Authority accepts documents via the General Department of Taxation's e-portal, processes the documents through the tax authority's electronic data processing system:

++ Acceptance of the application: The General Department of Taxation's e-portal sends an acknowledgment of receipt to the taxpayer within 15 minutes from the submission of the electronic taxpayer registration application;

++ Checking and processing the application: The tax authority checks and processes the taxpayer's application as per the legal provisions on taxpayer registration and returns results through the chosen e-portal:

+++ In the case of a complete, timely, and correct application: The tax authority sends the resolution result to the chosen e-portal within the regulated time limit in Circular 105/2020/TT-BTC.

+++ In the case of an incomplete or incorrect application, the tax authority sends a notice of non-acceptance to the chosen e-portal within 2 working days from the date on the acknowledgment of receipt.