What is the Form 04/TNDN on corporate income tax declaration applied to the revenue-based method in Vietnam?

What is the Form 04/TNDN on corporate income tax declaration applied to the revenue-based method in Vietnam?

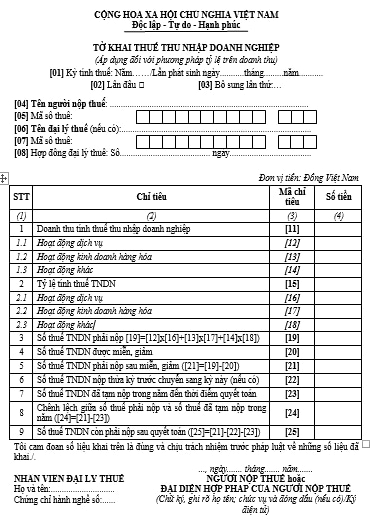

Form 04/TNDN is stipulated in Appendix 2 issued with Circular 80/2021/TT-BTC as follows:

Download Form 04/TNDN: Here

What is the Form 04/TNDN on corporate income tax declaration applied to the revenue-based method in Vietnam? (Image from Internet)

When is corporate income tax declared according to the revenue-based method in Vietnam?

Based on clause 5 Article 3 of Circular 78/2014/TT-BTC, it is stipulated as follows:

Tax Calculation Method

...

5. Public service providers, other organizations that are not enterprises established and operating under the laws of Vietnam, enterprises paying value-added tax by the direct method that conduct business activities involving goods and services generating taxable corporate income but can determine revenue but cannot determine the costs and income from such business activities shall declare and pay corporate income tax according to the percentage on the sales revenue of goods and services, specifically:

+ For services (including interest on deposits, interest on loans): 5%.

Exclusive of educational, healthcare and performing arts activities: 2%.

+ For trading goods: 1%.

+ For other activities: 2%.

Example 3: Public service provider A has a rental operation with an annual rental revenue of 100 million VND but cannot determine the costs and income from the rental operation. Therefore, the unit opts to declare and pay corporate income tax according to the percentage on the sales revenue of goods and services as follows:

Corporate income tax payable = 100,000,000 VND x 5% = 5,000,000 VND.

6. Enterprises with revenue, costs, and other income denominated in a foreign currency must convert the foreign currency into Vietnamese dong according to the average interbank exchange rate published by the State Bank of Vietnam at the time of revenue, cost, and other income generation in foreign currency, except where otherwise provided for by law. For foreign currencies without an exchange rate with Vietnamese dong, conversion must be through a foreign currency with an exchange rate with Vietnamese dong.

Thus, public service providers, other organizations that are not enterprises established and operating under the laws of Vietnam, enterprises paying value-added tax by the direct method conducting business activities involving goods and services generating taxable corporate income but can determine revenue but cannot determine the costs and income from such business activities shall declare and pay corporate income tax according to the percentage on the sales revenue.

What type of tax is declared according to the revenue-based method in Vietnam?

Based on clause 4 Article 8 of Decree 126/2020/ND-CP, it is stipulated as follows:

Types of taxes declared monthly, quarterly, yearly, at each occurrence of tax obligation, and for tax finalization

...

4. Types of taxes and other amounts payable to the state budget declared at each occurrence include:

a) Value-added tax of the taxpayer as prescribed in clause 3 Article 7 of this Decree or taxpayers declaring value-added tax by the direct method on the increased value according to value-added tax law but incurring value-added tax obligations on real estate transfer activities.

b) Special consumption tax of taxpayers engaging in export business without having paid special consumption tax in the production phase and then not exporting but selling domestically. Special consumption tax of business establishments purchasing domestically produced cars, airplanes, yachts that are not subject to special consumption tax but later change the usage purpose to those subject to special consumption tax.

c) Export and import duties including: export tax, import tax, safeguard duty, anti-dumping duty, countervailing duty, special consumption tax, environmental protection tax, value-added tax. For export and import goods that do not require a declaration at each occurrence, follow the Ministry of Finance’s guidance.

d) Resource tax for organizations authorized to sell seized or confiscated resources; irregularly exploiting resources licensed or exempted from licensing under the law.

dd) Value-added tax, corporate income tax not frequently arising declared by the taxpayer applying the direct method on the increased value according to the value-added tax law and percentage on revenue according to the corporate income tax law; except where the taxpayer has multiple occurrences in a month, then it can be declared monthly.

Thus, according to the above regulation, corporate income tax declared according to the revenue-based method is a tax declared at each occurrence.