What is the Form 04-DK-TCT - Taxpayer Registration Form for joint venture management board in Vietnam from February 6, 2025?

What is the joint venture management board?

According to the provisions at point d, clause 4, Article 5 of Circular 86/2024/TT-BTC (Effective from February 6, 2025), a joint venture management board is established when a foreign contractor forms a joint venture with Vietnamese economic organizations to conduct business in Vietnam based on a contract.

The joint venture management board undertakes accounting tasks, maintains a bank account, and is responsible for issuing invoices; or the Vietnamese economic organization participating in the joint venture undertakes joint accounting and divides profits among the parties involved in the joint venture.

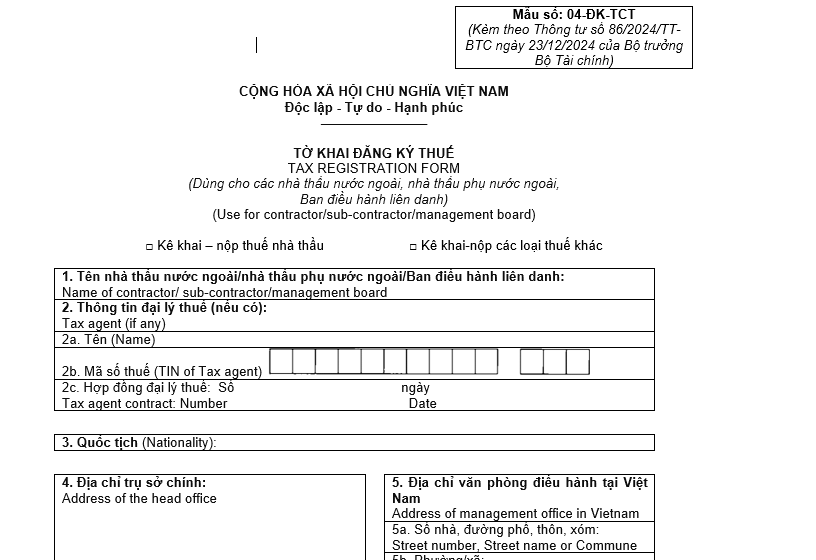

What is the Form 04-DK-TCT - Taxpayer Registration Form for joint venture management board in Vietnam from February 6, 2025? (Image from Internet)

What is the Form 04-DK-TCT - Taxpayer Registration Form for joint venture management board in Vietnam from February 6, 2025?

From February 6, 2025, the Taxpayer Registration Form for the joint venture management board is Form 04-DK-TCT, issued in conjunction with Circular 86/2024/TT-BTC.

Form 04-DK-TCT appears as follows:

DOWNLOAD HERE >>> Form 04-DK-TCT - Taxpayer Registration Form for joint venture management board

How to declare Form 04-DK-TCT - Taxpayer Registration Form for joint venture management board in Vietnam from February 6, 2025?

The method to declare Form 04-DK-TCT - Taxpayer Registration Form for joint venture management board from February 6, 2025 (in Vietnamese and English) is as follows:

The taxpayer must select one of the appropriate boxes before declaring detailed information. To be specific:

Contractor/sub-contractor/management board selects one of the appropriate boxes before declaring detailed information, as follows:

- “Kê khai-nộp thuế nhà thầu”: Applicable in instances where a foreign contractor, foreign subcontractor, or joint venture management board directly declares and pays contractor tax to the tax agency (VAT, CIT per the foreign contractor tax regulations and tax management law).

“Contractor tax declaration and payment”: Applicable when the Contractor/sub-contractor/management board directly declares and pays contractor tax to the tax department (VAT, CIT in accordance with the contractor tax law and tax management law).

- “Kê khai - nộp các loại thuế khác”: Applicable to cases where a foreign contractor, or foreign subcontractor directly declares personal income tax, license fees, etc., with the tax authorities, and the Vietnamese party declares, deducts, and pays on behalf of the foreign contractor in accordance with the foreign contractor tax regulations and tax management law.

“Other tax and fee declaration and payment”: Applicable when the Contractor/sub-contractor/management board directly declares PIT, and other fees and submits to the tax department, and Vietnamese entities deduct and pay on behalf of contractor/sub-contractor regarding VAT, CIT per the foreign contractor tax regulations and tax management law.

[1] Name of contractor/sub-contractor/management board: Write the full name (including abbreviated name) of the contractor or subcontractor or management board participating in business activities in Vietnam not stipulated under the Investment Law.

[2] Information of Tax agent: Provide complete information of the tax agent if the tax agent signs a contract with the taxpayer to conduct taxpayer registration procedures on behalf of the taxpayer as stipulated by the Tax Management Law.

Information of Tax agent: Write name, TIN, contract (number, date).

[3] Nationality: Clearly indicate the nationality of the foreign contractor or foreign subcontractor.

Nationality: Fill in clearly the nationality of the contractor/sub-contractor/management board.

[4] Address of head office: If the taxpayer is an individual, record the address, phone number, and fax number of the residency.

If the taxpayer is an organization or company, record the address, phone number, and fax number of the head office.

Address of head office:

- If contractor/sub-contractor is an individual, fill in address, telephone number, fax number of residency.

- If contractor/sub-contractor is an organization or company, fill in address, telephone number, fax number of the head office.

[5] Address of Management office in Vietnam:

If the taxpayer is an individual, write the address, phone number, and fax number of the individual residing in Vietnam to conduct operations.

If the taxpayer is organizations or companies, write the address, phone number, and fax number where the management office is located in Vietnam.

Address of Management office in Vietnam:

If contractor/sub-contractor is an individual, fill in address, phone number, fax number of the individual residing in Vietnam to do business.

If contractor/sub-contractor is an organization or company, fill in address, phone number, fax number of the management office in Vietnam.

[6] Business license in Vietnam: Based on the business license granted by the competent Government authority, fill in the relevant items in the form (if any).

Business license in Vietnam:

Based on the business license granted by the competent Government authority, fill in the relevant items in the form (if any).

[7] Contract for contractor/sub-contractor operation in Vietnam: Based on the signed contract, fill in the relevant items in the form if selected “Contractor tax declaration and payment”.

Contract for contractor/sub-contractor operation in Vietnam: Based on the signed contract, fill in the relevant items in the form if select “Contractor tax declaration and payment”.

[8] Contract objectives: Declare each operation objective of the contract concretely if selected “Contractor tax declaration and payment”.

Contract objectives: Declare each operation objective of the contract concretely if select “Contractor tax declaration and payment”.

[9] Location of business according to the contract: Declare each operation location of the contract concretely. In the case of conducting business at many different locations, the contractor/sub-contractor must fully declare the locations of business if selected “Contractor tax declaration and payment”.

Location of business according to the contract: Declare each operation location of the contract concretely. In case of doing business at many different locations, contractor/sub-contractor has to declare fully the location to do business if select “Contractor tax declaration and payment”.

[10] Contract duration: Record the contract execution time clearly from month, year to month, year if selected “Contractor tax declaration and payment”.

Contract duration: Fill in clearly contract duration from month, year to month, year if select “Contractor tax declaration and payment”.

[11] Foreign subcontractor: If there are foreign subcontractors performing a portion of the contract, it requires the full declaration of foreign subcontractors using the annex BK04-DK-TCT attached to the taxpayer registration form.

Do you have subcontractors: If there are subcontractors taking part in the contract, please declare fully in the Sub-contractor form of BK04-DK-TCT declare attached.

[12] Declare information of representative of contractor (or subcontractor): Clearly provide information about the representative of the contractor (or subcontractor).

Declare information of representative of contractor (or sub-contractor)

[13] Declare information of VAT calculation method if selected “Contractor tax declaration and payment”.

Declare information of VAT calculation method if select “Contractor tax declaration and payment”

[14] Declare information of CIT calculation method if selected “Contractor tax declaration and payment”.

Declare information of CIT calculation method if select “Contractor tax declaration and payment”

[15] Declare information of the financial year (From ... to ...) is the calendar year. If the financial year differs from the calendar year, declare the information from the starting quarter to the ending quarter, and the financial year must complete a full 12 months.

Declare information of financial year (From ... to ...) is calendar year. If financial year is different from the calendar year, declare information is from quarter to quarter and financial year must be full 12 months.

[16] Attachments: List all documents sent to the tax authority attached to the Taxpayer Registration Form.

Attachments: List all documents attached to the Tax Registration Form

[18] Staff tax agent: If the tax agent declares on behalf of the taxpayer, then this information is declared.

Staff tax agent: Staff tax agent declare name and certificate number in this area if tax agent declares on behalf of contractor/sub-contractor.