What is the Form 04-DK-TCT - Application form for tax registration for foreign contractors, foreign sub-contractors, and joint venture management board in Vietnam?

What is the Form 04-DK-TCT - Application form for tax registration for foreign contractors, foreign sub-contractors, and joint venture management board in Vietnam?

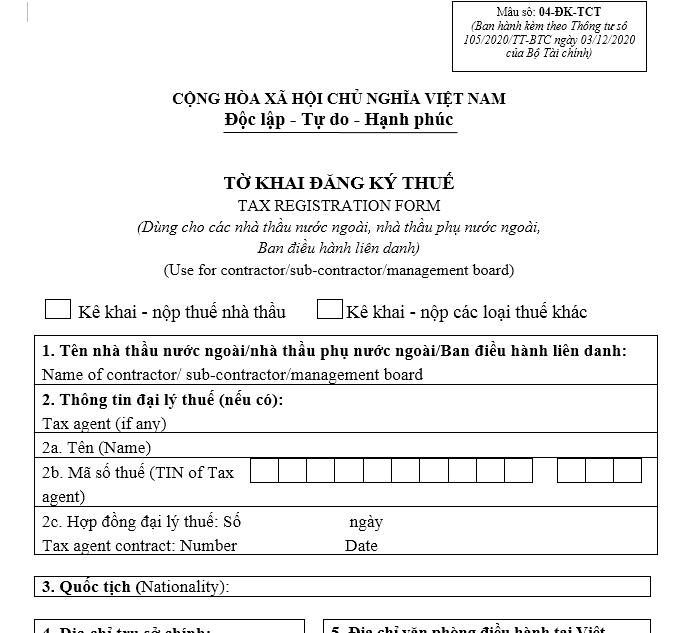

Based on Appendix I, List of TIN Status Issued with Circular 105/2020/TT-BTC, Form 04-DK-TCT is designated as the Application form for tax registration for foreign contractors, foreign sub-contractors, and joint venture management board as issued below:

Download Form 04-DK-TCT Application form for tax registration for foreign contractors, foreign sub-contractors, and joint venture management board.

What is the Form 04-DK-TCT - Application form for tax registration for foreign contractors, foreign sub-contractors, and joint venture management board in Vietnam? (Image from Internet)

What are the instructions for filling out Form 04-DK-TCT - Application form for tax registration for foreign contractors, foreign sub-contractors, and joint venture management board in Vietnam?

According to Appendix I, List of TIN Status Issued with Circular 105/2020/TT-BTC, the instructions for completing Form 04-DK-TCT Download Application form for tax registration for foreign contractors, foreign sub-contractors, and joint venture management board are as follows:

| INSTRUCTIONS FOR COMPLETING FORM 04-DK-TCT

GUIDANCE FOR DECLARATION

Taxpayers must select one of the appropriate boxes before entering detailed information. To be specific:

Contractor/sub-contractor/management board select one of the appropriate boxes before declaring detailed information, as follows:

- “Contractor tax declaration and payment”: Applicable for cases where the foreign contractor, foreign subcontractor, Joint Operation Board directly declares and pays contractor tax with the tax authority (VAT, CIT per contractor tax laws and tax management laws).

“Contractor tax declaration and payment”: Applicable to the Contractor/sub-contractor/management board direct contractor tax declaration and payment and submits to tax department (VAT, CIT in accordance with the contractor tax law and tax management law).

- “Other tax and fee declaration and payment”: Applicable to cases where the foreign contractor, foreign subcontractor directly declares personal income tax, license fees, etc. with the tax authority and the Vietnamese party declares, deducts, pays contractor tax on behalf of the foreign contractor according to contractor tax laws and tax management laws.

“Other tax and fee declaration and payment”: Applicable to the Contractor/sub-contractor/management board directs PIT, other fees declaration and payment and submits to tax department and Vietnamese parties deduct and pay on behalf of contractor/sub-contractor regarding VAT, CIT in accordance with the contractor tax law and tax management law.

... [Continued with the same format for each instruction ...] ...

- Tax Agent Employee: In case the tax agent declares on behalf of the taxpayer, provide information in this section.

Staff tax agent: Tax agent staff declares name and certificate number in this area if tax agent declares on behalf of the contractor/sub-contractor. || --- |

Download Appendix issued with Circular 105/2020/TT-BTC.

What is the structure of a TIN in Vietnam?

According to Article 5 Circular 105/2020/TT-BTC, the structure of a TIN is as follows:

N1N2N3N4N5N6N7N8N9N10 - N11N12N13

Where:

- The first two digits N1N2 represent the tax number range.

- Seven digits N3N4N5N6N7N8N9 are determined by a fixed structure, increasing gradually from 0000001 to 9999999.

- Digit N10 serves as a check digit.

- Three digits N11N12N13 are sequential numbers from 001 to 999.

- The hyphen (-) is used to separate the group of the first 10 digits from the last 3 digits.

Furthermore, the enterprise code, cooperative code, codes for dependent units of enterprises, and cooperatives issued under the law on enterprise registration and cooperative registration serve as TINs.