What is the Form 03/XKNB - Delivery and internal transfer note in Vietnam?

What is the Form 03/XKNB - Delivery and internal transfer note in Vietnam?

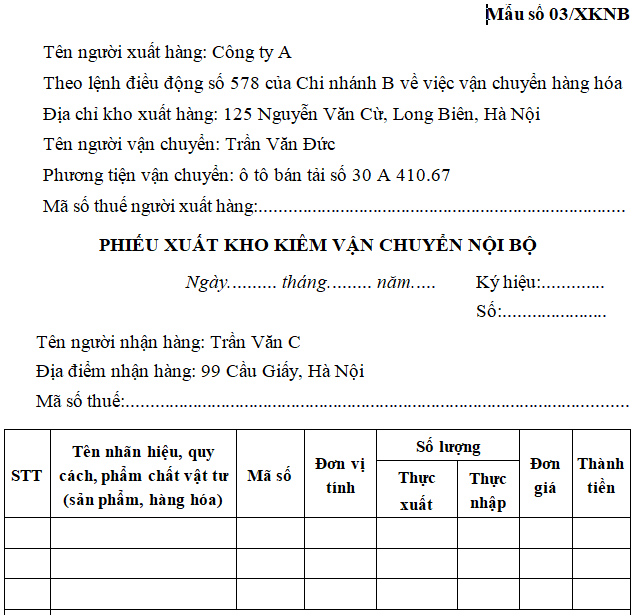

Currently, the delivery and internal transfer note is regulated under Form 03/XKNB issued in conjunction with Decree 123/2020/ND-CP, presented as follows:

Download Form 03/XKNB - delivery and internal transfer note: Here

What are regulations on Form 03/XKNB - Delivery and internal transfer note in Vietnam? (Image from the Internet)

Is the delivery and internal transfer note considered an invoice in Vietnam?

According to Article 89 of the Law on Tax Administration 2019, electronic invoices are regulated as follows:

Electronic Invoices

...

- Electronic invoices include value-added invoices, sales invoices, electronic stamps, electronic tickets, electronic cards, electronic collection vouchers, electronic delivery and internal transfer notes, or other names for electronic documents.

...

Moreover, according to Article 8 of Decree 123/2020/ND-CP, the guidance on types of invoices is as follows:

Types of Invoices

The invoices regulated under this Decree include the following types:

- Value-added invoice is designated for organizations declaring value-added tax by the deduction method for activities:

a) Sale of goods, provision of services within the domestic market;

b) International transportation activities;

c) Export to non-tariff zones and cases considered as exports;

d) Export of goods, provision of services abroad.

- Sales invoice is designated for organizations and individuals such as:

a) Organizations and individuals declaring and calculating value-added tax by the direct method for activities:

- Sale of goods, provision of services within the domestic market;

- International transportation activities;

- Export to non-tariff zones and cases considered as exports;

- Export of goods, provision of services abroad.

b) Organizations and individuals within non-tariff zones when selling goods, providing services to the domestic market and selling goods, providing services amongst each other within non-tariff zones, export of goods, provision of services abroad, noted on the invoice “For organizations and individuals in non-tariff zones.”

- Electronic invoice for selling public assets used when selling the following assets:

a) Public assets at agencies, organizations, units (including state-owned houses);

b) Infrastructure assets;

c) Public assets assigned for management by the state to enterprises without counting as state capital in the enterprise;

d) Project assets using state capital;

dd) Assets recognized as state ownership;

e) Public assets recovered by the decision of competent authorities;

g) Materials, supplies recovered from handling public assets.

- Electronic sales invoice for national reserve is used when agencies, units under the national reserve system sell national reserve goods as per the law.

- Other types of invoices, including:

a) Stamps, tickets, cards with form and content regulated under this Decree;

b) Air freight bill; documents collecting international carriage charges; bank service fee documents unless regulated under point a of this clause with form and content created according to international practices and relevant legal regulations.

- Documents printed, issued, used, and managed as invoices, including the delivery and internal transfer note and consigned merchandise release note.

...

Thus, the delivery and internal transfer note is printed, issued, used, and managed as an invoice, and the electronic delivery and internal transfer note is considered a form of electronic invoice.

What information is contained on the delivery and internal transfer note in Vietnam?

According to clause 14, Article 10 of Decree 123/2020/ND-CP, it is stipulated as follows:

Contents of Invoices

...

14. Some cases where electronic invoices do not need to contain all the information:

...

g) For the delivery and internal transfer note, the note displays information related to internal mobilization orders, the recipient, the issuer, the location of the warehouse from which goods are dispatched, the receiving location, and the means of transport. Specifically: the buyer’s name indicates the recipient, the buyer’s address indicates the receiving warehouse location; the seller’s name indicates the issuer, the seller’s address indicates the warehouse dispatch location and means of transport; does not show tax, tax rates, total payment amount.

For the Consigned Merchandise Release Note, it displays information such as the economic contract, transporter, means of transport, dispatching warehouse location, receiving warehouse location, product name, unit of measure, quantity, unit price, total amount. Specifically: recording the number, date of economic contract signed between organizations, individuals; transporter’s full name, transport contract (if any), seller's address indicating the dispatching warehouse location.

Accordingly, the delivery and internal transfer note contains information related to internal mobilization orders, the recipient, the issuer, the location of the warehouse from which goods are dispatched, the receiving location, and the means of transport.

To be specific: the buyer’s name indicates the recipient, the buyer’s address indicates the receiving warehouse location; the seller’s name indicates the issuer, the seller’s address indicates the warehouse dispatch location and means of transport; does not show tax, tax rates, total payment amount.