What is the Form 03/TNDN - Corporate income tax finalization in Vietnam?

What is the Form 03/TNDN - Corporate income tax finalization in Vietnam?

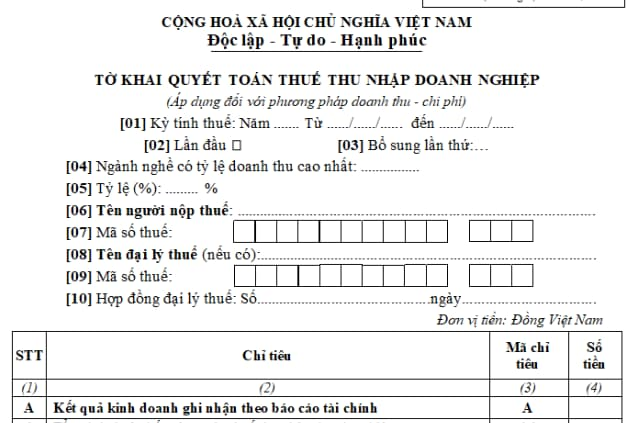

The corporate income tax finalization form applied for the revenue-expense method is currently prescribed in Form 03/TNDN in Section 6 Annex 2 issued together with Circular 80/2021/TT-BTC, as follows:

Download Form 03/TNDN corporate income tax finalization for the revenue-expense method: Here

What is the Form 03/TNDN - Corporate income tax finalization in Vietnam? (Image from the Internet)

When is the annual corporate income tax finalization deadline?

According to Article 44 of the Tax Management Law 2019, the regulations are as follows:

Tax declaration submission deadlines

1. The deadlines for submitting tax declaration dossiers for monthly and quarterly declared taxes are as follows:

a) No later than the 20th day of the month following the month in which the tax liability arises for monthly declarations;

b) No later than the last day of the first month of the quarter following the quarter in which the tax liability arises for quarterly declarations.

2. The deadlines for submitting tax declaration dossiers for annually declared taxes are as follows:

a) No later than the last day of the third month from the end date of the calendar year or fiscal year for annual tax finalization dossiers; no later than the last day of the first month of the calendar year or fiscal year for annual tax declaration dossiers;

b) No later than the last day of the fourth month from the end date of the calendar year for personal income tax finalization dossiers of individuals directly finalizing taxes;

c) No later than December 15 of the preceding year for tax declaration dossiers of households and individuals paying taxes according to the presumptive method; in case of new business households or individuals, the deadline for submitting tax declaration dossiers is no later than 10 days from the starting date of business.

Therefore, the annual corporate income tax finalization deadline is no later than the last day of the third month from the end of the calendar year (i.e., March 31) or fiscal year (for businesses that choose a fiscal year different from the calendar year).

Vietnam: What does the annual corporate income tax finalization dossier include?

According to point b paragraph 3 Article 43 of the Tax Management Law 2019, Circular 200/2014/TT-BTC, Circular 80/2021/TT-BTC, and Decree 132/2020/ND-CP, the annual corporate income tax finalization dossier for private enterprises includes:

(1) corporate income tax finalization form according to Form 03/TNDN issued together with Circular 80/2021/TT-BTC.

(2) Annual financial statements, including:

- Balance Sheet (Form B01-DN issued together with Circular 200/2014/TT-BTC);

- Income Statement (Form B02-DNN issued together with Circular 200/2014/TT-BTC);

- Cash Flow Statement by direct and indirect methods (issued together with Circular 200/2014/TT-BTC);

- Notes to the Financial Statements (Form B09-DN issued together with Circular 200/2014/TT-BTC);

(3) Authorization letter for procedures if not carried out by the legal representative.

Additionally, based on the actual business situation, enterprises must submit the following documents:

(4) Appendix of production and business results issued together with Circular 80/2021/TT-BTC:

- Form 03-1A/TNDN for enterprises in manufacturing, commerce, and services sectors.

- Form 03-1B/TNDN for enterprises in banking, credit sectors.

- Form 03-1C/TNDN for securities companies, fund management companies.

(5) Loss carryforward appendix (Form 03-2/TNDN issued together with Circular 80/2021/TT-BTC).

(6) Corporate income tax incentive appendices (issued together with Circular 80/2021/TT-BTC):

- Form 03-3A/TNDN for newly established businesses from investment projects, relocating businesses, or new investment projects.

- Form 03-3B/TNDN for businesses investing in new production lines, expanding scale, modernizing technology, improving ecological environment, increasing production capacity (expansion investment).

- Form 03-3C/TNDN for businesses employing ethnic minorities or those operating in manufacturing, construction, transport sectors with high female labor use.

- Form 03-3D/TNDN for science and technology companies or those transferring technology in prioritized fields.

Supporting documents for tax declaration and payment for Vietnamese enterprises investing abroad for income from overseas projects include:

- A photocopy of the foreign income tax declaration form certified by the taxpayer;

- A photocopy of the tax payment receipt abroad certified by the taxpayer or the original certification from the foreign tax authority on the paid tax amount, or a photocopy of equivalent documents certified by the taxpayer.