What is the Form 03/HTQT - Application for confirmation of tax paid in Vietnam for foreign residents?

What is the Form 03/HTQT - Application for confirmation of tax paid in Vietnam for foreign residents?

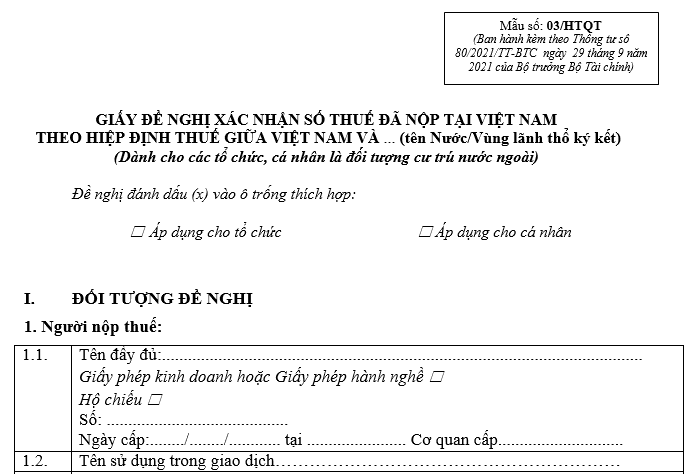

The application for confirmation of tax paid in Vietnam for foreign residents is Form 03/HTQT, part of Appendix I issued in conjunction with Circular 80/2021/TT-BTC. To be specific:

Download Form 03/HTQT - Application for confirmation of tax paid in Vietnam for foreign residents: Here

What is the Form 03/HTQT - Application for confirmation of tax paid in Vietnam for foreign residents? (Image from the Internet)

What are cases where foreigners wish to have confirmation of tax paid in Vietnam?

Based on Article 70 of Circular 80/2021/TT-BTC, the regulations are as follows:

Tax Obligation Certification

...

2. Certification of Taxes Paid in Vietnam for foreign residents:

In cases where a resident of a Country that has signed a Tax Treaty with Vietnam is liable to pay income tax in Vietnam according to the provisions of the Tax Treaty and Vietnamese tax law, and wishes to certify the taxes paid in Vietnam to be deducted from the tax payable in the country of residence, they need to follow the procedures below:

a) When a taxpayer requests certification of taxes paid in Vietnam, they should submit the request dossier to the Tax Department of the province or centrally-run city where the tax is registered. The dossier includes:

a.1) A application for confirmation of tax paid in Vietnam according to the Tax Treaty using Form 03/HTQT issued in Appendix I of this Circular, providing information on transactions related to taxable income and the tax amount arising from those transactions within the scope of the Tax Treaty;

a.2) The original (or certified copy) Certificate of Residence issued by the tax authority of the residence country (clearly stating the term for which the individual is a resident) and legalized;

a.3) A Power of Attorney if the taxpayer authorizes a legal representative to carry out the procedures for applying the Tax Treaty.

Within 7 working days from the date of receiving the dossier, the Tax Department where the individual is registered will issue a certificate of income tax paid in Vietnam using Form 04/HTQT or Form 05/HTQT issued in Appendix I of this Circular. Form 04/HTQT is used to certify personal income tax and corporate income tax; Form 05/HTQT is used to certify tax on dividend income, interest income, royalties, or technical service fees.

If additional information or supplementary documents are needed during the dossier processing, the tax authority will send a Notice requesting explanation or supplementary information/documents using Form 01/TB-BSTT-NNT issued in conjunction with Decree 126/2020/ND-CP to the taxpayer.

Within 10 working days from the date the tax authority issues the Notice, the taxpayer must submit a written explanation or provide the supplementary information/documents as requested by the tax authority.

...

Thus, foreigners who are citizens of a Country that has signed a Tax Treaty with Vietnam and are liable to pay income tax in Vietnam according to the Tax Treaty and Vietnamese tax law, and wish to certify the taxes paid in Vietnam to be deducted from the tax payable in their country of residence, need to complete the tax obligation certification procedure.

What are procedures for confirming tax paid in Vietnam for resident of member state that has entered into a Double Taxation Agreement with Vietnam?

According to Article 70 of Circular 80/2021/TT-BTC, which provides regulations on tax obligation certification procedures, it is stated that in cases where taxpayers request certification of the tax amount incurred in Vietnam but not payable due to tax incentives and want it to be considered as the tax paid in order to deduct the flat tax amount in the country of residence, they need to submit a request dossier to the Tax Department for certification. The dossier includes:

- A application for confirmation of tax paid in Vietnam according to the Tax Treaty using Form 03/HTQT from Appendix I issued in conjunction with Circular 80/2021/TT-BTC, providing information on transactions related to taxable income, the tax amount incurred, and the tax incentives for those transactions within the scope of the Tax Treaty;

- The original (or certified copy) Certificate of Residence issued by the tax authority of the residence country (clearly stating the term for which the individual is a resident) and legalized;

- A Power of Attorney if the taxpayer authorizes a legal representative to carry out the procedures for applying the Tax Treaty.

Within 7 working days from the date of receiving the complete dossier, the Tax Department is responsible for certifying the tax amount incurred in Vietnam but not payable due to tax incentives for the requesting subject.

If additional information or supplementary documents are needed during the dossier processing, the tax authority will send a Notice requesting explanation or supplementary information/documents using Form 01/TB-BSTT-NNT issued in conjunction with Decree 126/2020/ND-CP to the taxpayer.

Within 10 working days from the date the tax authority issues the Notice, the taxpayer must submit a written explanation or provide the supplementary information/documents as requested by the tax authority.