What is the Form 03-DK-TCT - taxpayer registration application for household and individual businesses in Vietnam as per Circular 86?

What is the Form 03-DK-TCT - taxpayer registration application for household and individual businesses in Vietnam as per Circular 86?

Pursuant to item a.2 point a clause 1, item a.2 point a clause 2 Article 22 of Circular 86/2024/TT-BTC (effective from February 6, 2025) which stipulates the first-time taxpayer registration dossier for individual and household businesses as follows:

Place of submission and first-time taxpayer registration dossier

- For households and individual and household businesses specified in points i, k, l, n clause 2 Article 4 of this Circular who use personal identification numbers in lieu of tax identification numbers as stipulated in clause 5 Article 5 of this Circular

a) In the case of household and individual businesses as specified at point i clause 2 Article 4 of this Circular

...

a.2) Taxpayer registration dossier:

A taxpayer registration application Form No. 03-DK-TCT issued together with this Circular, or tax declaration dossier according to the provisions of the tax management law.

...

- For individual and household businesses specified in points i, k, l, n clause 2 Article 4 of this Circular in cases where the tax agency assigns tax identification numbers as stipulated at point a clause 4 Article 5 of this Circular

a) In the case of individual and household businesses as specified at point i clause 2 Article 4 of this Circular

...

a.2) Taxpayer registration dossier:

- A taxpayer registration application Form No. 03-DK-TCT issued together with this Circular, or tax declaration dossier according to the provisions of the tax management law.

...

Thus, the first-time taxpayer registration application for household and individual businesses is Form No. 03-DK-TCT issued in Appendix 2 attached to Circular 86/2024/TT-BTC.

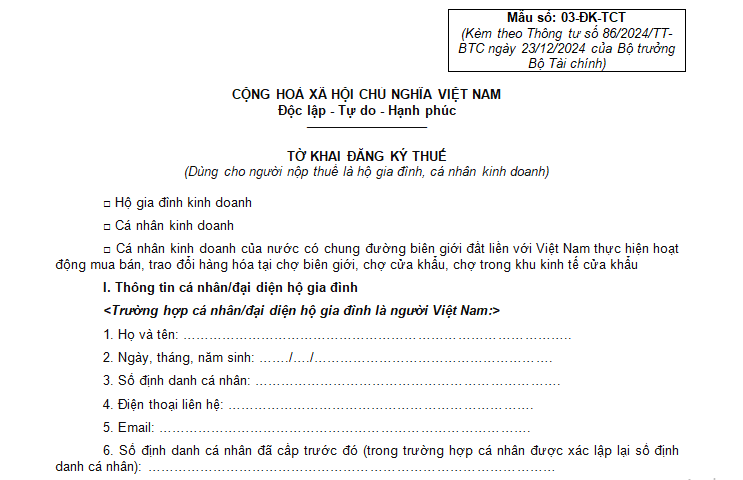

Specifically, the first-time taxpayer registration application Form No. 03-DK-TCT for household and individual businesses is as follows:

Download Form 03-DK-TCT taxpayer registration application for household and individual businesses.

What is the Form 03-DK-TCT - taxpayer registration application for household and individual businesses in Vietnam as per Circular 86? (Image from Internet)

Which individual and household businesses shall directly implement taxpayer registration with the tax authority in Vietnam from February 6, 2025?

Based on clause 2 Article 4 of Circular 86/2024/TT-BTC (effective from February 6, 2025) which specifies that individual and household businesses must directly implement taxpayer registration with the tax authority include:

- Foreign individual and household businesses using humanitarian aid funds, non-refundable assistance from abroad to purchase goods, services with value-added tax in Vietnam for non-refundable aid, humanitarian aid

- ODA project owners eligible for value-added tax refunds.

- Foreign individual and household businesses practicing independent business in Vietnam in compliance with Vietnamese law who have income arising in Vietnam or have tax obligations arising in Vietnam.

- Foreign individual and household businesses not residing in Vietnam having e-commerce business activities, businesses based on digital platforms, and other services with organizations, individual and household businesses in Vietnam.

- individual and household businesses with the liability to withhold and pay taxes on behalf of other taxpayers must declare and determine their tax obligations separately from the taxpayer’s obligations according to the provisions of tax management law.

- household and individual businesses engaged in the production, business of goods, services in accordance with the law but not required to register a household business through the business registration authority according to the Government of Vietnam regulations for household businesses; individual businesses from countries sharing land borders with Vietnam conducting purchase, sale, exchange of goods at border markets, border gate markets, markets within border economic zones.

- individual and household businesses with income subject to personal income tax (excluding business individual and household businesses).

- individual and household businesses considered dependents as per the provisions of personal income tax law.

- individual and household businesses entrusted with tax collection by the tax authority.

- Other households and individual and household businesses with obligations to the state budget.

What are regulations on the first-time taxpayer registration deadline in Vietnam?

According to Article 33 of the Tax Administration Law 2019 which regulates the first-time taxpayer registration deadline as follows:

- Taxpayers registering for enterprise, cooperative, business registration, the taxpayer registration deadline aligns with the enterprise, cooperative, business registration deadline as stipulated by law.

- Taxpayers registering directly with the tax agency have a taxpayer registration deadline of 10 working days from the following date:

+ Issuance of a business registration certificate, establishment and operation license, investment registration certificate, or establishment decision;

+ Commencement of business activities for organizations not required to register a business or household and individual businesses required to register business but have not been issued a business registration certificate;

+ Arising obligation to withhold tax and pay tax on behalf of others; organizations paying on behalf of individual and household businesses according to business cooperation contracts, documents;

+ Signing main contractor or subcontractor contracts with foreign contractors declaring tax directly to the tax agency; signing contracts, petroleum agreements;

+ Arising obligations with personal income tax;

+ Arising refund requirements;

+ Arising other obligations with the state budget.

- Organizations, individual and household businesses paying income are responsible for taxpayer registration on behalf of individual and household businesses with income within 10 working days from the arising tax obligation in cases where the individual has no tax code; registration on behalf of dependents of taxpayers not later than 10 working days from the taxpayer's family allowance registration date according to the law in cases where the dependents have no tax code.