What is the Form 03-2/TNDN - Appendix on carry-forward of losses submitted with the corporate income tax return in Vietnam?

How do businesses carry forward losses when calculating corporate income tax in Vietnam?

Based on Article 9 of Circular 78/2014/TT-BTC (amended and supplemented by Article 7 of Circular 96/2015/TT-BTC), enterprises shall carry forward losses as follows:

Determination of losses and loss carryforward

1. Losses incurred in a tax period are the negative differences in taxable income before including carried forward losses from previous years.

2. If enterprises incur losses after finalizing taxes, they shall carry forward the entire and continuous amount of the loss to the taxable income (taxable income excluding exempt income) of subsequent years. The continuous period for carrying forward losses shall not exceed 5 years, starting from the year after the year in which the loss arises.

Enterprises shall preliminarily carry forward losses to the income of subsequent quarters after preparing provisional quarterly tax returns and officially in the subsequent year after preparing annual corporate income tax returns.

Example 12: In 2013, Enterprise A incurred a loss of VND 10 billion; in 2014, Enterprise A earned an income of VND 12 billion. Then the entire loss of VND 10 billion incurred in 2013 must be carried forward to the income of 2014.

Example 13: In 2013, Enterprise B incurred a loss of VND 20 billion; in 2014, Enterprise B earned an income of VND 15 billion. Then:

+ Enterprise B must carry forward the entire loss of VND 15 billion to the income of 2014;

+ The remaining loss of VND 5 billion must be continuously monitored and carried forward according to the above-mentioned loss carryforward principle of 2013 to subsequent years but not exceeding 5 years, starting from the year after the year in which the loss arises.

- Enterprises with losses between quarters within the same financial year may offset the previous quarter's losses against the subsequent quarters of that financial year. When finalizing corporate income tax, enterprises determine the annual loss and concurrently carry forward the entire and continuous loss to the taxable income of subsequent years after the loss arises as per the above regulation.

- Enterprises shall self-determine the amount of loss to be deducted from their income according to the above-mentioned principles. If losses arise during the loss carryforward period, such losses (excluding losses carried forward from previous periods) shall be carried forward entirely and continuously but not exceeding 5 years, starting from the year after the year in which the loss arises.

If the competent authority audits or inspects the corporate income tax and determines that the losses carried forward are different from those self-determined by the enterprise, the losses to be carried forward shall be determined based on the audit or inspection conclusions but ensuring that the entire and continuous loss carryforward does not exceed 5 years, starting from the year after the loss arises as regulated.

If after the 5-year period from the year following the year the loss arises, if not all losses are carried forward, such losses shall not be carried forward to the income of subsequent years.

3. Enterprises converting their type of business, merging, consolidating, splitting, dissolving, or going bankrupt must finalize taxes with the tax authority up to the time of the decision on changing the type of business, merging, consolidating, splitting, dissolving, or bankrupting by a competent authority (except in cases where tax finalization is not required as stipulated). The losses of enterprises incurred before conversion, merger, or consolidation must be detailed by the year of occurrence and offset against the income of the same year of the enterprise after conversion, merger, or consolidation or continue to be carried forward to the income of subsequent years of the enterprise after conversion, merger, or consolidation to ensure continuous loss carryforward not exceeding 5 years, starting from the year after the year in which the loss arises.

The losses of enterprises incurred before the split resulting in new enterprises and still within the time limit for loss carryforward as stipulated shall be allocated to the new enterprises formed from the split based on the proportion of equity split.

Enterprises carry forward losses in two cases:

* Enterprises carry forward losses between quarters:

- Enterprises with losses between quarters within the same financial year may offset the previous quarter's losses against subsequent quarters of that financial year.

- When finalizing corporate income tax, enterprises determine the annual loss and carry forward the entire and continuous loss to the taxable income of subsequent years after the year the loss arises as stipulated.

- The carried forward loss must not exceed the income.

* Enterprises carry forward losses to subsequent years:

- Enterprises that incur losses after finalizing taxes shall carry forward the entire and continuous amount of the loss to the taxable income (taxable income excluding exempt income) of subsequent years.

- The continuous period for carrying forward the losses shall not exceed 5 years, starting from the year after the year in which the loss arises. If the losses are not fully carried forward after 5 years, such losses shall not be carried forward to subsequent years.

- If losses arise during the loss carryforward period, such losses (excluding carried forward losses from previous periods) shall be carried forward entirely and continuously but not exceeding 5 years, starting from the year after the year in which the losses arise.

- Enterprises shall preliminarily carry forward losses to the taxable income of subsequent quarters after preparing provisional quarterly tax returns and officially in the subsequent year after preparing annual corporate income tax returns.

- The carried forward loss must not exceed the income.

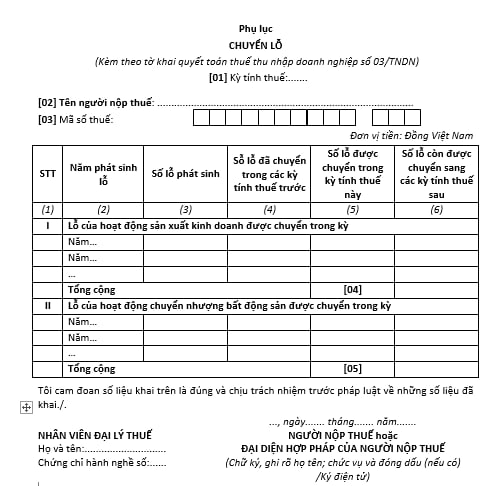

What is the Form 03-2/TNDN - Appendix on carry-forward of losses submitted with the corporate income tax return in Vietnam? (Image from the Internet)

What is the Form 03-2/TNDN - Appendix on carry-forward of losses submitted with the corporate income tax return in Vietnam?

In case of loss carryforward, taxpayers must additionally submit Form 03-2/TNDN Appendix along with the corporate income tax return Form 03/TNDN as stipulated in Appendix II issued together with Circular 80/2021/TT-BTC as follows:

Download Form 03-2/TNDN: Here

What is the maximum period for carrying forward losses for enterprises in Vietnam?

According to Article 16 of the 2008 Law on Corporate Income Tax as amended and supplemented by Clause 10, Article 1 of the 2013 Amended Law on Corporate Income Tax, the regulations on loss carryforward are as follows:

Loss Carryforward

1. Enterprises with losses may carry forward losses to subsequent years; such losses are deductible from taxable income. The maximum period for carrying forward losses shall not exceed five years, starting from the year following the year in which the loss arises.

2. Enterprises with losses from the transfer of real estate, transfer of investment projects, transfer of the right to participate in investment projects after offsetting as stipulated in Clause 3, Article 7 of this Law, if there are remaining losses and enterprises with losses from the transfer of the right to explore and extract minerals may carry forward such losses to subsequent years to the taxable income of that activity. The loss carryforward period is stipulated in Clause 1 of this Article.

Enterprises with losses may deduct the losses incurred during the year from the taxable income for the subsequent year.

The maximum period for carrying forward losses is 5 years, starting from the year following the year in which the losses arise.