What is the Form 02/XD-PNTT on declaration of increase in tax declared monthly compared to quarterly declared tax in Vietnam?

What is the Form 02/XD-PNTT on declaration of increase in tax declared monthly compared to quarterly declared tax in Vietnam?

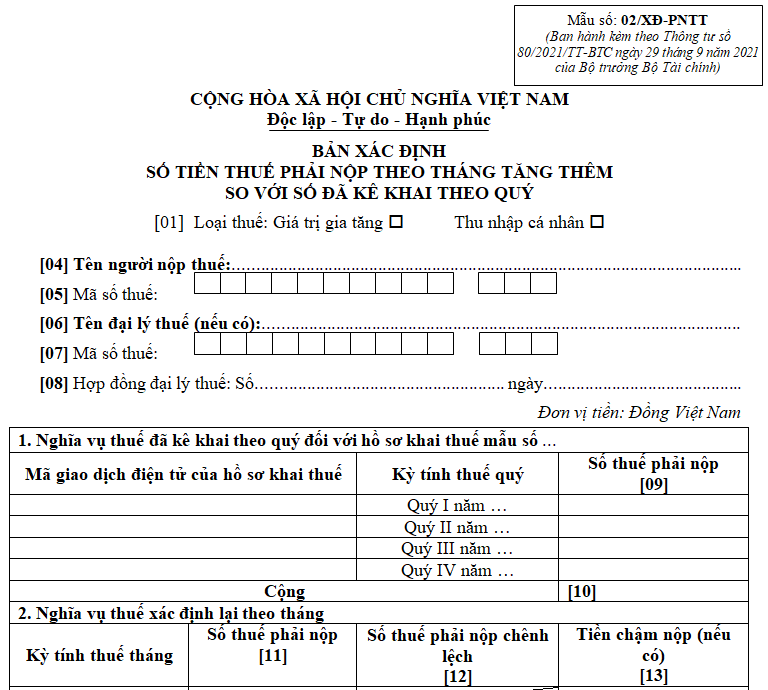

The Form declaration of increase in tax declared monthly compared to quarterly declared tax is Form No. 02/XD-PNTT issued together with Circular 80/2021/TT-BTC as follows:

Download the Form declaration of increase in tax declared monthly compared to quarterly declared tax here.

What is the Form 02/XD-PNTT on declaration of increase in tax declared monthly compared to quarterly declared tax in Vietnam? (Image from Internet)

When must the declaration of increase in tax declared monthly compared to quarterly declared tax be submitted in Vietnam?

According to the provisions of Clause 2 Article 9 Decree 126/2020/ND-CP as follows:

Criteria for Quarterly Tax Declarations for VAT and Personal Income Tax

...

2. Taxpayers are responsible for self-determining whether they should declare taxes quarterly.

a) Taxpayers who meet the criteria for quarterly tax declarations may choose to declare taxes monthly or quarterly for the entire calendar year.

b) In case taxpayers who are currently declaring taxes monthly meet the conditions for quarterly tax declarations and choose to switch to quarterly tax declarations, they must submit a written request as prescribed in Appendix I issued together with this Decree to the directly managing tax authority no later than January 31 of the year they begin quarterly tax declarations. If after this deadline the taxpayer does not send a written request to the tax authority, the taxpayer will continue to declare taxes monthly for the entire calendar year.

c) In case taxpayers self-detect that they do not meet the conditions for quarterly tax declarations, they must declare taxes monthly from the first month of the subsequent quarter. Taxpayers do not need to resubmit the monthly tax declaration dossiers for previous quarters but must submit the declaration of increase in tax declared monthly compared to quarterly declared tax as prescribed in Appendix I issued together with this Decree and must calculate late payment interest as prescribed.

d) In case the tax authority detects that the taxpayer does not meet the conditions for quarterly tax declarations, the tax authority must determine the additional amount of monthly tax to be paid compared to the amount declared by the taxpayer and must calculate late payment interest as prescribed. Taxpayers must declare taxes monthly from the time they receive the notification from the tax authority.

Thus, when taxpayers self-detect that they do not meet the conditions for quarterly tax declarations, they must declare taxes monthly from the first month of the subsequent quarter and submit the declaration of increase in tax declared monthly compared to quarterly declared tax, simultaneously, must calculate late payment interest.

Note: Taxpayers do not need to resubmit the monthly tax declaration dossiers for previous quarters. Monthly tax declarations are implemented from the first month of the next quarter.

What are the criteria for quarterly tax declarations for personal income tax in Vietnam?

According to the provisions of Article 9 Decree 126/2020/ND-CP as follows:

Criteria for Quarterly Tax Declarations for VAT and Personal Income Tax

1. Criteria for quarterly tax declarations

a) Quarterly VAT declarations apply to:

a.1) Taxpayers liable for monthly VAT declarations under Point a Clause 1 Article 8 of this Decree, with total annual revenue from sales of goods and services of 50 billion VND or less, are eligible to declare VAT quarterly. The revenue from sales of goods and services is determined as the total revenue on VAT tax returns for the tax periods in the calendar year.

In case taxpayers centralize tax declarations at the head office for subsidiaries or business locations, the revenue from sales of goods and services includes the revenue of the subsidiaries or business locations.

a.2) In case taxpayers newly start operations and business, they may choose to declare VAT quarterly. After operating for 12 months, from the next calendar year, they will base on the revenue of the preceding calendar year (12 months) to declare VAT monthly or quarterly.

b) Quarterly personal income tax declarations are as follows:

b.1) Taxpayers liable for monthly personal income tax declarations under Point a Clause 1 Article 8 of this Decree, who meet the conditions for quarterly VAT declarations, can choose to declare personal income tax quarterly.

b.2) Quarterly tax declarations are determined once from the first quarter in which the tax obligation arises and are applied consistently throughout the calendar year.

...

Thus, according to the above regulations, the criteria for quarterly tax declarations for personal income tax are specified as follows:

- Taxpayers liable for monthly personal income tax declarations, if they meet the conditions for quarterly VAT declarations, can choose to declare personal income tax quarterly.

- Quarterly tax declarations are determined once from the first quarter in which the tax obligation arises and are applied consistently throughout the calendar year.