What is the Form 02/TNDN-DK on corporate income tax finalization form for oil and gas in Vietnam?

What is the Form 02/TNDN-DK on corporate income tax finalization form for oil and gas in Vietnam?

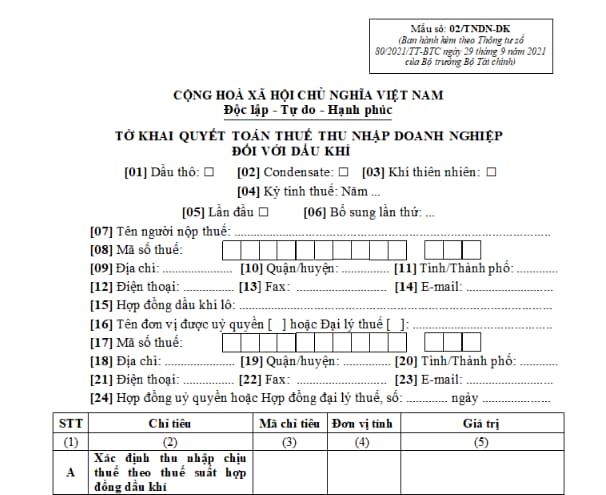

The corporate income tax finalization form for oil and gas is form 02/TNDN-DK, as stipulated in Appendix 2 issued together with Circular 80/2021/TT-BTC, and it appears as follows:

Download the corporate income tax finalization form for oil and gas: Here.

What is the Form 02/TNDN-DK on corporate income tax finalization form for oil and gas in Vietnam? (Image from the Internet)

Is the Corporate Income Tax for oil and gas declared annually?

Based on Clause 6, Article 8 of Decree 126/2020/ND-CP, the regulations are as follows:

Types of taxes declared monthly, quarterly, annually, separately, and tax finalization

...

6. Types of taxes and revenues declared for finalization purposes annually and at the time of dissolution, bankruptcy, cessation of operation, contract termination, or enterprise reorganization. In the case of a change in the type of enterprise (excluding the privatization of State-owned enterprises) wherein the new enterprise inherits all tax liabilities of the previously converted enterprise, it is not necessary to finalize the tax declaration up to the point of the decision on enterprise conversion. The enterprise will finalize the tax declaration at the end of the year. Specifically, as follows:

...

h) Natural resource tax, corporate income tax, the profit share from oil and gas divided to the host country from the exploitation, sales of crude oil and natural gas; additional levy when crude oil prices increase; adjustments to special tax on the exploitation, sale of natural gas by Vietsovpetro Joint Venture at Block 09.1.

Thus, corporate income tax for oil and gas is a type of tax declared annually.

When is the deadline for submitting the corporate income tax finalization for oil and gas in Vietnam?

Based on Article 44 of the Law on Tax Administration 2019, the regulations are as follows:

Deadline for Tax Submission

1. The deadline for submitting tax returns for taxes declared monthly or quarterly is specified as follows:

a) No later than the 20th day of the month following the month in which the tax obligation arises for monthly filings;

b) No later than the last day of the first month of the quarter following the quarter in which the tax obligation arises for quarterly filings.

2. The deadline for submitting tax returns for taxes with an annual tax computation period is specified as follows:

a) No later than the last day of the third month from the end of the calendar year or fiscal year for annual tax finalization returns; no later than the last day of the first month of the calendar year or fiscal year for annual tax returns;

b) No later than the last day of the fourth month from the end of the calendar year for individual income tax finalization returns for individuals directly finalizing their tax;

c) No later than December 15 of the preceding year for tax returns for flat-rate tax businesses and individual businesses paying tax by the flat-rate method; in cases of new businesses, the deadline for submitting tax returns is no later than 10 days from the start of business operations.

3. The deadline for submitting tax returns for taxes declared and paid separately is no later than the 10th day from the occurrence of the tax liability.

4. The deadline for submitting tax returns in case of cessation of activities, termination of contracts, or enterprise reorganization is no later than the 45th day from the date of the event.

5. The Government of Vietnam shall stipulate the deadline for submitting tax returns for agricultural land use tax; non-agricultural land use tax; land levy; land rent, water surface rent; mineral exploitation right fee; water resource exploitation right fee; vehicle registration fee; business license fee; revenues into the state budget as per regulations on the management and use of public property; cross-border profit reports.

6. The deadline for submitting tax returns for exported and imported goods shall follow the provisions of the Customs Law.

7. In cases where taxpayers file tax returns electronically on the last day of the deadline but the tax authority's electronic portal encounters errors, the taxpayers can submit their electronic tax returns and payments on the next working day after the electronic portal resumes operation.

Thus, the deadline for submitting the corporate income tax finalization for oil and gas is the last day of the third month from the end of the calendar year or fiscal year.