What is the Form 02/TNDN - Corporate income tax return applicable to real estate transfer activities under separate declarations in Vietnam?

What is the Form 02/TNDN - Corporate income tax return applicable to real estate transfer activities under separate declarations in Vietnam?

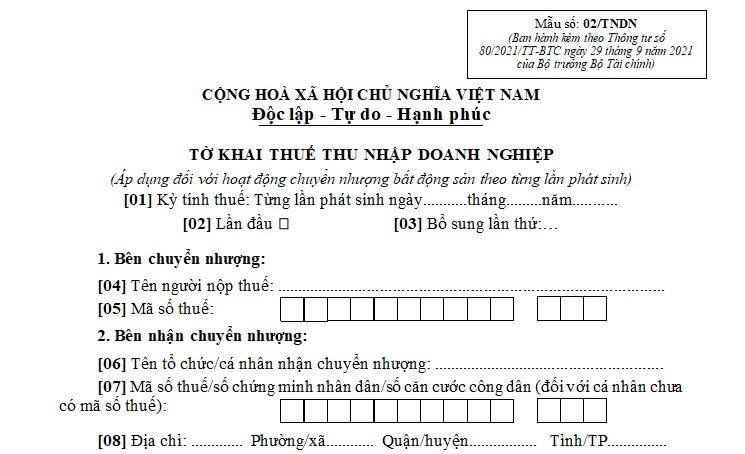

According to Appendix 2 issued together with Circular 80/2021/TT-BTC providing the corporate income tax return form applicable to real estate transfer activities under separate declarations, the form is 02/TNDN as follows:

Download 02/TNDN corporate income tax return form applicable to real estate transfer activities under separate declarations: Here

Form 02/TNDN corporate income tax return applicable to real estate transfer activities under separate declarations in Vietnam (Image from the Internet)

What is the deadline for filing corporate income tax returns applicable to real estate transfer activities under separate declarations in Vietnam?

Based on Article 44 of the Law on Tax Administration 2019, the provisions are as follows:

Deadline for filing tax returns

1. The deadline for filing tax returns for monthly, quarterly declared taxes is stipulated as follows:

a) No later than the 20th day of the following month in the case of monthly declaration and payment;

b) No later than the last day of the first month of the following quarter in the case of quarterly declaration and payment.

2. The deadline for filing tax returns for annually calculated taxes is stipulated as follows:

a) No later than the last day of the third month from the end of the calendar year or fiscal year for annual tax finalization returns; no later than the last day of the first month of the calendar year or fiscal year for annual tax declaration returns;

b) No later than the last day of the fourth month from the end of the calendar year for individual personal income tax finalization returns;

c) No later than December 15 of the prior year for presumptive tax declaration returns for households and individuals subject to presumptive tax; in the case of newly established businesses, the deadline for filing presumptive tax returns is no later than 10 days from the start of the business.

3. The deadline for filing tax returns for incident-based declared and paid taxes is no later than the 10th day from the occurrence of the tax obligation.

4. The deadline for filing tax returns in the event of business cessation, contract termination, or organizational restructuring is no later than the 45th day from the occurrence of the event.

...

Thus, the deadline for filing corporate income tax returns applicable to real estate transfer activities under separate declarations is no later than the 10th day from the occurrence of the tax obligation.

How many days can the filing of tax returns be extended?

Based on the provisions of Article 46 of the Law on Tax Administration 2019 regarding the extension of tax return filing periods as follows:

Extension of tax return filing periods

1. Taxpayers unable to file tax returns on time due to natural disasters, catastrophes, epidemics, fires, unexpected accidents are granted an extension by the head of the directly managing tax authority.

2. The extension period does not exceed 30 days for monthly, quarterly, annual tax returns, or tax returns under separate declarations; 60 days for annual tax finalization returns from the due date of the tax return filing.

3. Taxpayers must submit a written request for an extension to the tax authority before the due date for filing the tax returns, clearly stating the reason for the extension request, with confirmation from the local commune-level People's Committee or Police where the extension-qualifying event occurred as stipulated in Clause 1 of this Article.

4. Within 3 working days from the receipt of the extension request, the tax authority must respond in writing to the taxpayer whether the extension request is accepted or not.

Thus, taxpayers are granted an extension for filing tax returns in cases where they are unable to file on time due to natural disasters, catastrophes, epidemics, fires, unexpected accidents, as approved by the head of the directly managing tax authority.

Note: The extension period does not exceed 30 days for monthly, quarterly, annual tax returns, or tax returns under separate declarations; 60 days for annual tax finalization returns from the due date of the tax return filing.