What is the Form 02/TAIN-DK resource royalty finalization for oil and gas in Vietnam?

What is the Form 02/TAIN-DK resource royalty finalization for oil and gas in Vietnam?

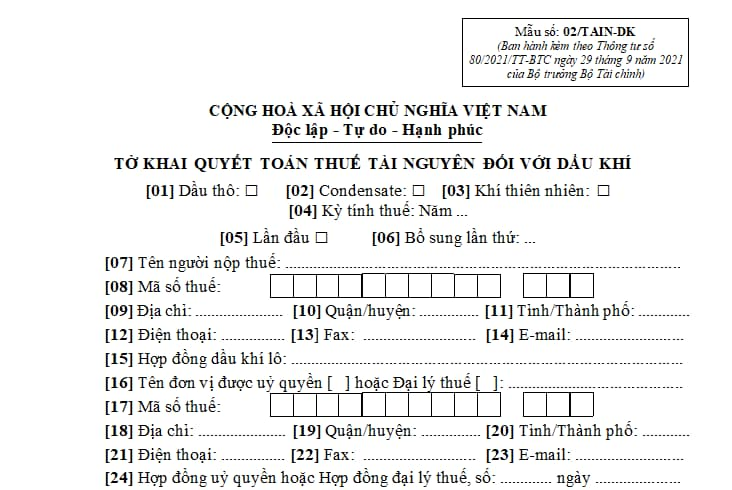

The resource royalty finalization for oil and gas is Form 02/TAIN-DK stipulated in Appendix 2 of Circular 80/2021/TT-BTC, structured as follows:

Download Form 02/TAIN-DK resource royalty finalization for oil and gas: Here

What is the Form 02/TAIN-DK resource royalty finalization for oil and gas in Vietnam? (Image from the Internet)

Is resource royalty for oil and gas declared annualy or quarterly in Vietnam

Based on Clause 6, Article 8 of Decree 126/2020/ND-CP, the provisions are as follows:

Types of taxes declared monthly, quarterly, annually, separately, and tax finalization

...

6. Types of taxes and collections declared annually for finalization or upon cessation of operations, bankruptcy, termination of activities, contract termination, or organizational restructure of enterprises. In cases of conversion of enterprise type (excluding the equitization of state-owned enterprises), if the converting enterprise inherits all tax obligations of the converted enterprise, tax finalization up to the point of conversion decision is not required, and the enterprise finalizes taxes at the end of the year. Specifically as follows:

...

h) resource royalty, corporate income tax, profit share from oil and gas divided to the host country for crude oil and natural gas extraction and sale activities; surplus charges when crude oil prices increase; special tax adjustment for natural gas extraction and sale activities by Vietsovpetro Joint Venture at Block 09.1.

Thus, the resource royalty on oil and gas is an annual tax finalization.

What is the deadline for submitting the resource royalty finalization for oil and gas in Vietnam?

Based on Article 44 of Law on Tax Administration 2019, the provisions are as follows:

Tax declaration dossier submission deadlines

1. The deadline for submitting tax declaration dossiers for taxes declared monthly, quarterly is stipulated as follows:

a) No later than the 20th day of the month following the month in which the tax obligation arises for monthly declarations and submissions;

b) No later than the last day of the first month of the subsequent quarter for quarterly declarations and submissions.

2. The deadline for submitting tax declaration dossiers for taxes calculated on an annual basis is stipulated as follows:

a) No later than the last day of the third month from the end of the calendar year or fiscal year for annual tax finalizations; no later than the last day of the first month of the calendar year or fiscal year for annual tax declaration dossiers;

b) No later than the last day of the fourth month from the end of the calendar year for personal income tax finalizations of individuals directly finalizing tax;

c) No later than December 15 of the preceding year for presumptive tax declaration dossiers of households or individuals paying tax by the presumptive method; in case of new businesses, no later than 10 days from the start of business.

3. The deadline for submitting tax declaration dossiers for taxes declared and paid by occurrence of tax obligation is no later than the 10th day from the date the tax obligation arises.

4. The deadline for submitting tax declaration dossiers in cases of cessation of activities, contract termination, or organizational restructure is no later than the 45th day from the occurrence of the event.

5. the Government of Vietnam stipulates the deadline for submitting tax declaration dossiers for agricultural land use tax; non-agricultural land use tax; land levy; land rent, water surface rent; fee for mineral extraction rights; fee for water resource exploitation rights; registration fee; business license fee; collections into the state budget as per the law on management and use of public assets; cross-border profit reporting.

6. The deadline for submitting tax declaration dossiers for exported and imported goods follows the provisions of the Customs Law.

7. In cases where the taxpayer submits electronic tax declarations on the last day of the deadline period but the tax authority's electronic portal encounters issues, the taxpayer is allowed to submit electronic tax declarations and payment receipts on the next working day when the electronic portal resumes operation.

Therefore, the deadline for submitting the resource royalty finalization for oil and gas is no later than the last day of the third month from the end of the calendar year or fiscal year.