What is the form 02/NCCNN on e-tax declaration for foreign suppliers in Vietnam?

What is the form 02/NCCNN on e-tax declaration for foreign suppliers in Vietnam?

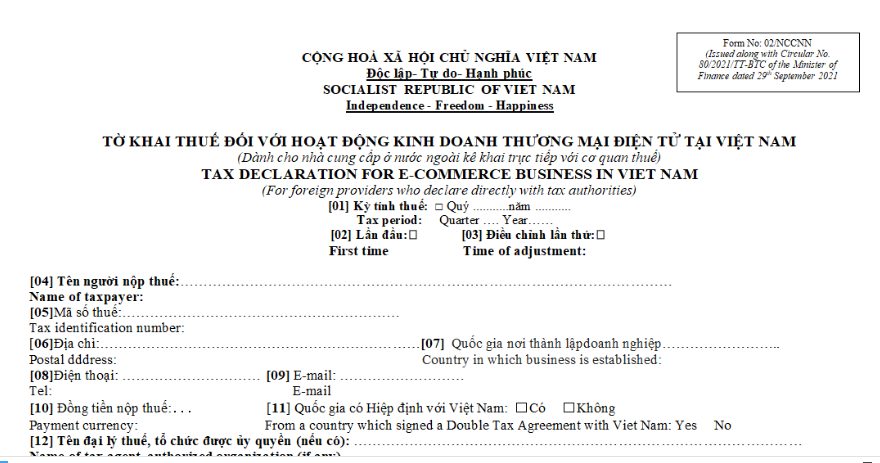

The e-tax declaration form for foreign suppliers as specified in Form No. 02/NCCNN issued together with Appendix 1 of Circular 80/2021/TT-BTC.

Download the e-tax declaration form 02/NCCNN for foreign suppliers here

What is the form 02/NCCNN on e-tax declaration for foreign suppliers in Vietnam? (Image from Internet)

How do foreign suppliers declare taxes in Vietnam?

Pursuant to clauses 3, 4, and 5 of Article 77 of Circular 80/2021/TT-BTC, the principles for determining revenue arising in Vietnam for tax declaration and calculation are as follows:

First, the types of information used to determine transactions of organizations and individuals purchasing goods and services arising in Vietnam include:

+ Information related to payment by organizations or individuals in Vietnam, such as credit card information based on the bank identification number (BIN), bank account information, or similar information that the organization or individual uses to make payments to the foreign supplier.

+ Information about the residence status of the organization (or individual) in Vietnam (payment address, delivery address, home address, or similar information that the purchasing organization or individual declares to the foreign supplier).

+ Information about the access by organizations (or individuals) in Vietnam, such as the national telephone area code of the SIM card, IP address, fixed telephone line location, or similar information of the purchasing organization or individual.

- When determining a transaction arising in Vietnam for tax declaration and calculation, the foreign supplier must implement as follows:

+ Use two non-conflicting information sources, including one related to payment by the organization (or individual) in Vietnam and one about the residence status or access information of the organization or individual in Vietnam mentioned above.

+ In cases where payment information related to the organization or individual cannot be collected or conflicts with other information, the foreign supplier is permitted to use two non-conflicting information sources, including one about the residence status and one about access information of the organization or individual in Vietnam.

At the same time, the foreign supplier uses the e-transaction authentication code issued by the directly managing tax authority to authenticate when declaring and adjusting.

- After the foreign supplier declares taxes and adjusts declarations (if any), the managing tax authority issues and informs the foreign supplier of the identification code of the amount payable to the state budget as the basis for the foreign supplier to pay taxes.

- Foreign suppliers are responsible for storing the information used to determine transactions by organizations and individuals purchasing goods and services arising in Vietnam as stipulated in clause 3 of this Article for inspection and audit by tax authorities. Storage is carried out according to the related provisions of the 2019 Law on Tax Administration.

Additionally, if the foreign supplier is from a country or territory that has signed a tax agreement with Vietnam, they shall follow the procedures for tax exemption and reduction according to the Double Tax Avoidance Agreement as stipulated in Article 62 of Circular 80/2021/TT-BTC.

What are principles for determining revenue arising in Vietnam for tax declaration and calculation?

Based on Article 77 of Circular 80/2021/TT-BTC, the contents regarding direct tax declaration and calculation by foreign suppliers are as follows:

Direct Tax Declaration and Calculation by Foreign Suppliers

...

3. Principles for determining revenue arising in Vietnam for tax declaration and calculation are as follows:

a) The types of information used to determine transactions of organizations and individuals purchasing goods and services arising in Vietnam are as follows:

a.1) Information related to payment by organizations or individuals in Vietnam, such as credit card information based on the bank identification number (BIN), bank account information, or similar information used by the organization or individual to pay the foreign supplier.

a.2) Information about the residence status of the organization (or individual) in Vietnam (payment address, delivery address, home address, or similar information declared by the purchasing organization or individual to the foreign supplier).

a.3) Information related to access by organizations (or individuals) in Vietnam, such as the national telephone area code of the SIM card, IP address, fixed telephone line location, or similar information of the purchasing organization or individual.

b) When determining a transaction arising in Vietnam for tax declaration and calculation, the foreign supplier must implement as follows:

b.1) Use two non-conflicting information sources, including one related to payment by the organization (or individual) in Vietnam and one about the residence status or access information of the organization or individual in Vietnam as stated above.

b.2) In cases where payment information related to the organization or individual cannot be collected or conflicts with other information, the foreign supplier is permitted to use two non-conflicting information sources, including one about the residence status and one about access information of the organization or individual in Vietnam.

Thus, foreign suppliers pay value-added tax and corporate income tax according to the percentage method calculated on revenue.

The determination of revenue arising in Vietnam for tax declaration and calculation is carried out in accordance with the above-mentioned provisions.