What is the Form 01/TNS-DK on Declaration of revenue from oil and gas commissions, fees for reading and using oil and gas documents in Vietnam?

What is the Form 01/TNS-DK on Declaration of revenue from oil and gas commissions, fees for reading and using oil and gas documents in Vietnam?

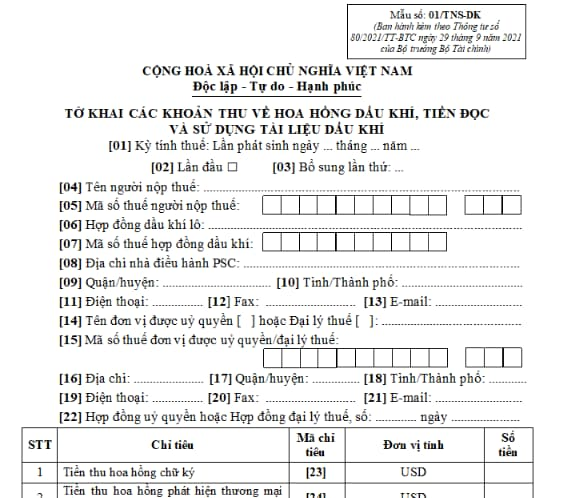

The Declaration form of revenue from oil and gas commissions, and fees for reading and using oil and gas documents is Form No. 01/TNS-DK stipulated in Appendix 2 issued along with Circular 80/2021/TT-BTC, in the following format:

Download the Declaration form of revenue from oil and gas commissions, and fees for reading and using oil and gas documents: Here.

What is the Form 01/TNS-DK on Declaration of revenue from oil and gas commissions, fees for reading and using oil and gas documents in Vietnam? (Image from Internet)

How to declare revenue from oil and gas commissions, fees for reading and using oil and gas documents in Vietnam?

Based on clause 4 Article 8 of Decree 126/2020/ND-CP stipulated as follows:

Types of Tax Declarations on a Monthly, Quarterly, Annual Basis, Each Occurrence of Tax Obligation, and Tax Finalization Declaration

...

4. Taxes and other revenues of the state budget declared for each occurrence of tax obligation, including:

a) Value-added tax of taxpayers as prescribed in clause 3 Article 7 of this Decree or taxpayers declaring VAT based on added value according to the direct method on added value as prescribed by VAT law but incur VAT obligations on real estate transfer activities.

b) Special consumption tax of taxpayers who export and have not yet paid special consumption tax at the production stage, but subsequently do not export and sell domestically. Special consumption tax for business establishments purchasing cars, airplanes, yachts produced domestically, which are not subject to special consumption tax but subsequently change their usage to be subject to special consumption tax.

c) Taxes on exported and imported goods including: export tax, import tax, safeguard tax, anti-dumping tax, anti-subsidy tax, special consumption tax, environmental protection tax, value-added tax. In case exported or imported goods are not required to be declared on each occurrence, they shall comply with the guidance of the Ministry of Finance.

d) Resource taxes of organizations assigned to sell held or confiscated resources; organizations exploiting resources occasionally, that have been licensed by competent state authorities or are not required to be licensed according to law.

dd) Value-added tax, corporate income tax not incurred regularly of taxpayers applying the direct method on added value according to value-added tax law and the rate on revenue according to corporate income tax law; except for cases where taxpayers incur taxes frequently in a month, they can declare monthly.

e) Corporate income tax on real estate transfer activities of taxpayers applying the rate on revenue according to corporate income tax law.

g) Personal income tax declared directly by individuals or on behalf of others for income from real estate transfer; income from capital transfer; income from capital investment; income from copyright, franchising, winnings from abroad; income from inheritance, gifts.

h) Taxes and revenues from individuals renting properties, households, individual businesses without fixed business locations and irregular businesses.

i) Registration fees (including cases exempted from registration fees according to registration fee law).

k) Environmental protection fees for non-regular mineral exploitation activities that have been licensed by competent state authorities or do not require a license according to law.

l) Land use fees.

m) Land and water surface rent paid once for the entire lease period.

n) Value-added tax, corporate income tax of foreign organizations, individuals doing business in Vietnam or having income in Vietnam (referred to as foreign contractors) applying the direct method; corporate income tax of foreign contractors applying the hybrid method when the Vietnamese party pays foreign contractors. If the Vietnamese party pays foreign contractors multiple times in a month, they can declare monthly instead of declaring each occurrence.

o) Corporate income tax from foreign contractors' capital transfer activities.

p) Corporate income tax for income from transferring rights to participate in oil and gas contracts.

The transferee of the rights to participate in the oil and gas contract is responsible for declaring and paying tax on the income from the transfer. In cases where the transfer changes the owner of the contractor holding the participating interest in the oil and gas contract in Vietnam, the contractor named in the oil and gas contract in Vietnam is responsible for notifying the tax authority of the transfer and declaring and paying tax on behalf of the transferee for any income related to the oil and gas contract in Vietnam as prescribed.

q) Oil and gas commissions; fees for reading and using oil and gas documents.

...

Thus, revenue from oil and gas commissions, and fees for reading and using oil and gas documents are declared for each occurrence.

What is the deadline for submitting declarations on revenue from oil and gas commissions, fees for reading and using oil and gas documents in Vietnam?

Based on Article 44 of the Law on Tax Administration 2019 stipulated as follows:

Tax Declaration Submission Deadlines

1. The deadline for submitting tax declarations on taxes declared monthly, quarterly is as follows:

a) No later than the 20th day of the following month in which the tax obligation arises for declarations and payments made monthly;

b) No later than the last day of the first month of the following quarter in which the tax obligation arises for declarations and payments made quarterly.

2. The deadline for submitting tax declarations on taxes computed annually is as follows:

a) No later than the last day of the third month from the end of the calendar year or fiscal year for annual tax finalization declarations; no later than the last day of the first month of the calendar year or fiscal year for annual tax declarations;

b) No later than the last day of the fourth month from the end of the calendar year for personal income tax finalization declarations directly made by individuals;

c) No later than December 15 of the previous year for fixed tax declarations of household, individual businesses paying tax based on a fixed rate; in cases of newly established household, individual businesses, the deadline for submitting fixed tax declarations is no later than 10 days from the start of business.

3. The deadline for submitting tax declarations on taxes declared and paid based on each occurrence of tax obligation is no later than the 10th day from the occurrence of the tax obligation.

...

Thus, the deadline for submitting declarations on revenue from oil and gas commissions, and fees for reading and using oil and gas documents is no later than the 10th day from the occurrence of the tax obligation.