What is the Form 01/TNDN-DK on declaration of payable corporate income tax temporarily calculated for oil and gas in Vietnam?

What is the Form 01/TNDN-DK on declaration of payable corporate income tax temporarily calculated for oil and gas in Vietnam?

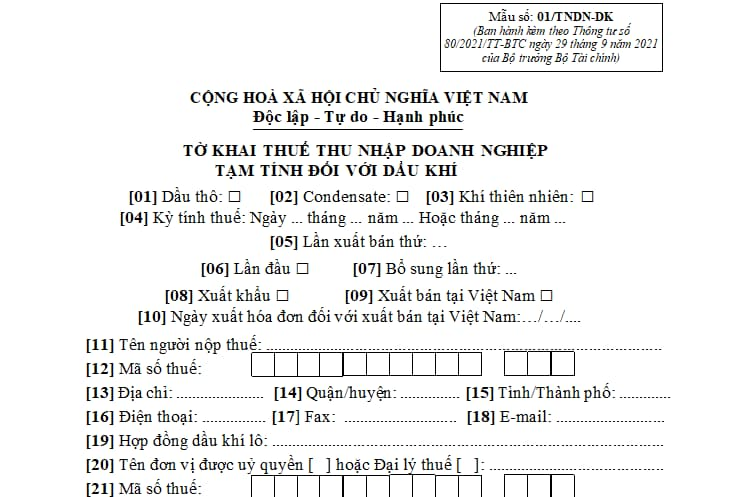

The form for the declaration of payable corporate income tax temporarily calculated for oil and gas is Form 01/TNDN-DK, stipulated in Appendix 2 issued with Circular 80/2021/TT-BTC, and has the following format:

Download Form 01/TNDN-DK on declaration of payable corporate income tax temporarily calculated for oil and gas: Here.

What is the Form 01/TNDN-DK declaration of payable corporate income tax temporarily calculated for oil and gas in Vietnam? (Image from the Internet)

When is the declaration of payable corporate income tax temporarily calculated for oil and gas applicable in Vietnam?

According to Clauses 1 and 5, Article 8 of Decree 126/2020/ND-CP, the provision is as follows:

Tax types declared monthly, quarterly, annually, per each occurrence of tax obligation, and tax settlement declaration

1. The types of taxes and other revenues belonging to the state budget managed and collected by the tax authorities declared on a monthly basis include:

a) Value-added tax, personal income tax. In cases where taxpayers meet the criteria stipulated in Article 9 of this Decree, they may opt for declaring quarterly.

b) Special consumption tax.

c) Environmental protection tax.

d) Resource tax, except for resource tax stipulated in Point e of this clause.

dd) Fees and charges belonging to the state budget (excluding fees and charges collected by the representative offices of the Socialist Republic of Vietnam abroad in accordance with Article 12 of this Decree; customs fees; transit fees for goods, luggage, and vehicles).

e) For activities of exploiting and selling natural gas: resource tax; corporate income tax; special taxes for the Vietnam-Russia Joint Venture "Vietsovpetro" in Block 09.1 following the Agreement between the Government of the Socialist Republic of Vietnam and the Government of the Russian Federation signed on December 27, 2010, on continued cooperation in geological exploration and exploitation of oil and gas on the continental shelf of the Socialist Republic of Vietnam within the framework of the Vietnam-Russia Joint Venture "Vietsovpetro" (hereinafter referred to as the Vietsovpetro Joint Venture in Block 09.1); host country’s share of gas profits.

2. Types of taxes and other revenues belonging to the state budget declared quarterly include:

a) Corporate income tax for foreign airlines and foreign reinsurance companies.

b) Value-added tax, corporate income tax, personal income tax for credit institutions or third parties authorized by credit institutions to exploit secured assets while waiting for disposal to declare on behalf of taxpayers with secured assets.

c) Personal income tax for organizations and individuals paying income subject to tax withholding as per the law on personal income tax, where such organizations and individuals pay value-added tax quarterly and choose to declare personal income tax quarterly; individuals with income from wages and salaries directly declaring tax with tax authorities and opting to declare personal income tax quarterly.

d) Other taxes and revenues belonging to the state budget declared by organizations and individuals on behalf of other individuals, where such organizations and individuals declare value-added tax quarterly and choose to declare tax on behalf of other individuals quarterly, except as stipulated in Point g Clause 4 of this Article.

dd) Surcharges when crude oil prices fluctuate (excluding oil and gas activities of the Vietsovpetro Joint Venture in Block 09.1).

...

5. Declaring per each sale for activities of exploiting and selling crude oil, including: resource tax; corporate income tax; special tax and surcharge when crude oil prices fluctuate for the Vietsovpetro Joint Venture in Block 09.1; host country’s share of oil profits. The deadline for submitting tax declaration dossiers and other payments stipulated in this Clause per each sale is 35 days from the date of crude oil sale (including crude oil sold domestically and crude oil exported). The sale date is the date of completion of crude oil delivery at the point of receipt.

...

Therefore, the declaration of payable corporate income tax temporarily calculated for oil and gas is applicable in the following 02 cases:

- Declaring provisional corporate income tax per each sale for activities of exploiting and selling crude oil (excluding oil and gas activities of the Vietsovpetro Joint Venture in Block 09.1).

- Declaring provisional corporate income tax monthly for activities of exploiting and selling natural gas (excluding oil and gas activities of the Vietsovpetro Joint Venture in Block 09.1).

How to determine the tax period for corporate income tax for oil and gas exploration and exploitation in Vietnam?

According to Article 16 of Circular 36/2016/TT-BTC, the tax period for corporate income tax for oil and gas exploration and exploitation is determined as follows:

- The corporate income tax period is a calendar year. In cases where taxpayers apply a fiscal year different from the calendar year as approved by the Ministry of Finance, the tax period is the fiscal year.

- The first corporate income tax period is calculated from the first day of oil and gas exploration and exploitation until the end of the calendar year or the end of the fiscal year.

- The final corporate income tax period is calculated from the beginning of the calendar year or the beginning of the fiscal year until the end of the oil contract.

- In cases where the first tax period and the final tax period are shorter than 03 months, they may be combined with the next tax period or the first corporate income tax period or the final corporate income tax period not exceeding 15 months.