What is the Form 01/TK-SDDPNN - Non-agricultural land use tax declaration form in Vietnam?

What is the Form 01/TK-SDDPNN - Non-agricultural land use tax declaration form in Vietnam?

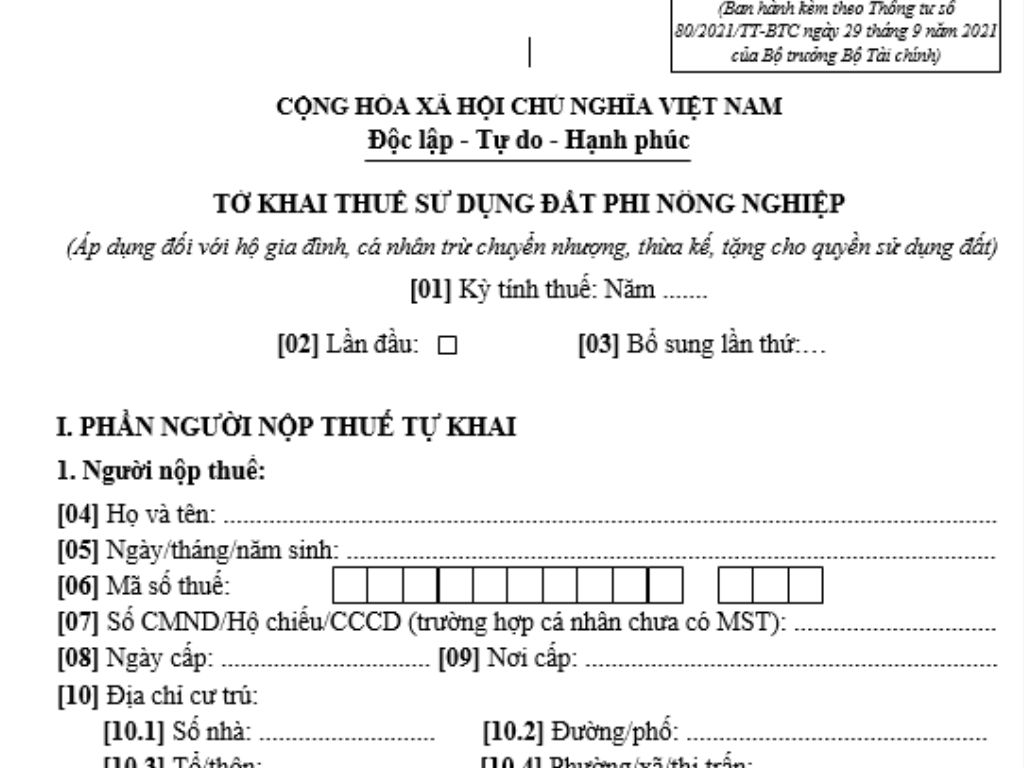

The non-agricultural land use tax declaration form (applicable to households, individuals excluding transfer, inheritance, donation of land use rights) is Form 01/TK-SDDPNN issued together with Circular 80/2021/TT-BTC.

Below is the latest non-agricultural land use tax declaration form applicable to households, individuals as follows:

Latest non-agricultural land use tax declaration form 01/TK-SDDPNN Download

What is the Form 01/TK-SDDPNN - Non-agricultural land use tax declaration form in Vietnam? (Image from the Internet)

What are cases where Vietnamese citizens exempt from non-agricultural land use tax?

Pursuant to Article 9 of the 2010 Law on Non-Agricultural Land Use Tax, the cases under which Vietnamese citizens are exempt from non-agricultural land use tax include:

[1] Land for investment projects in specially incentivized investment fields;

Investment projects in areas with extremely difficult socio-economic conditions;

Investment projects in incentivized investment fields in areas with difficult socio-economic conditions;

Land used by enterprises with more than 50% of the labor force being war invalids and sick soldiers.

[2] Land used by private investment facilities in activities in the fields of education, vocational training, healthcare, culture, sports, and environment.

[3] Land for constructing houses for the disadvantaged, solidarity houses, facilities for nurturing the elderly, the disabled, orphans; facilities for social disease treatment.

[4] Residential land within the limit in areas with extremely difficult socio-economic conditions.

[5] Residential land within the limit for people active in the revolution before August 19, 1945;

- Residential land within the limit for war invalids of category 1/4, 2/4;

- Residential land within the limit for those receiving policies as 1/4, 2/4 categorized war invalids;

- Residential land within the limit for sick soldiers of category 1/3;

- Residential land within the limit for People’s Armed Forces Heroes;

- Residential land within the limit for Heroic Vietnamese Mothers;

- Residential land within the limit for parents, caregivers of martyred soldiers when they were young;

- Residential land within the limit for spouses of martyred soldiers;

- Residential land within the limit for the children of martyred soldiers receiving monthly allowances;

- Residential land within the limit for revolution participants affected by Agent Orange; persons affected by Agent Orange in difficult family circumstances.

[6] Residential land within the limit of poor households as defined by the Government of Vietnam.

[7] Households and individuals whose homestead land is expropriated within the year according to approved planning, are exempt from taxation for the year of the actual seizure regarding land at the expropriated location and land at the new residence.

[8] Land with garden houses acknowledged by competent authorities as a historical-cultural relic.

[9] Taxpayers facing difficulties due to force majeure if damages to land and houses on land exceed 50% of the taxable value.

What is the deadline for submitting the first-time non-agricultural land use tax declaration dossier in Vietnam?

Based on sub-item 2.4 Section 2 of Official Dispatch 7211/CTTPHCM-TTHT in 2023 which guides the deadline for submitting the first-time non-agricultural land use tax declaration dossier as follows:

Non-Agricultural Land Use Tax Declaration:

...

Deadline for submitting the non-agricultural land use tax declaration dossier:

According to clause 3, Article 10 of Decree No. 126/2020/ND-CP regulating the deadline for submitting non-agricultural land use tax declaration dossiers:

a) For organizations:

- Initial declaration: The deadline is no later than 30 days from the date the non-agricultural land use tax obligation arises.

- During the stabilization cycle, organizations are not required to re-declare non-agricultural land use tax annually if there are no changes in taxpayers and factors leading to a change in the tax payable.

- Declaration is required when changes occur that alter the tax calculation basis leading to a change in tax due, and supplementary declaration when errors affecting the tax payable are discovered in the tax declaration submitted: The deadline is no later than 30 days from the date of change occurrence.

- Supplementary tax declaration is applied for cases where changes in tax computation bases occur leading to a change in tax due; when errors are found in the tax declaration submitted affecting the tax due.

b) For households, individuals:

- Initial declaration: The deadline is no later than 30 days from the date the non-agricultural land use tax obligation arises.

- Annually, households and individuals are not required to re-declare if there are no changes in taxpayers and other factors that affect the tax due.

- Declaration is required when changes occur that affect the tax calculation basis (excluding changes in the price of 1 square meter of land as regulated by the provincial People's Committee) leading to a change in the tax due: The deadline is no later than 30 days from the date of change occurrence.

- Supplementary declaration when errors affecting tax payable are found follow the regulations in Article 47 of the Tax Management Law.

- Consolidated filing: The latest submission deadline for consolidated declarations is March 31 of the calendar year following the tax year.

....

Thus, the latest deadline for tax declaration submission is 30 days from the date the non-agricultural land use tax obligation arises.