What is the Form 01/NDAN: Request form for tax payment in instalments in Vietnam?

What is the Form 01/NDAN: Request form for tax payment in instalments in Vietnam?

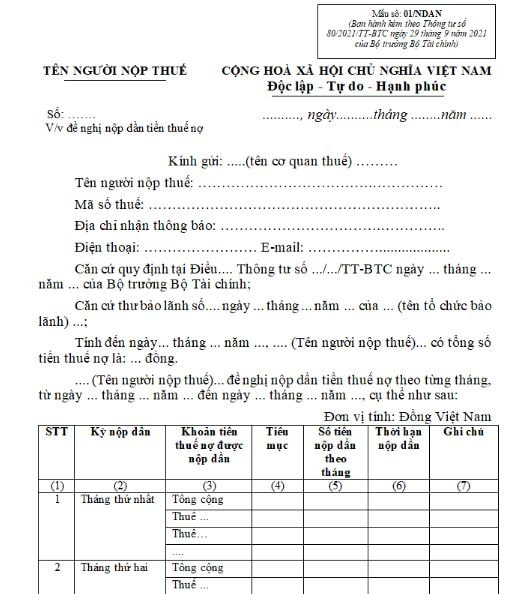

The request form for tax payment in instalments is prescribed in Form No. 01/NDAN issued with Appendix 1 of Circular 80/2021/TT-BTC as follows:

Download Form 01/NDAN - Request form for tax payment in instalments: Here

Form 01/NDAN: How to submit the request form for tax payment in instalments? (Image from the Internet)

Procedure for processing the application for tax payment in instalments?

Pursuant to Clause 1, Article 66 of Circular 80/2021/TT-BTC regarding the procedure for processing the application for tax payment in instalments as follows:

Tax payment in instalments

1. Procedure for processing the application for tax payment in instalments

a) The taxpayer prepares the application for tax payment in instalments as stipulated in Clause 2 of this Article and submits it to the directly managing tax authority.

b) In case the application for tax payment in instalments is incomplete according to regulations, within 03 working days from the date of receipt of the application, the tax authority must notify in writing using form No. 01/TB-BSTT-NNT issued with Decree No. 126/2020/ND-CP requesting the taxpayer to clarify or supplement the application.

In case the application for tax payment in instalments is complete, within 10 working days from the date of receipt of the application, the tax authority shall issue:

b.1) A notice of disapproval of the tax payment in instalments using form No. 03/NDAN issued with Appendix I of this Circular in case a guarantee letter showing signs of illegitimacy is detected, while concurrently issuing an official letter using form No. 05/NDAN issued with Appendix I of this Circular to the guarantor for verification. The guarantor shall send the verification result to the tax authority within the timeframe stipulated by law;

b.2) A decision approving the tax payment in instalments using form No. 04/NDAN issued with Appendix I of this Circular for cases entitled to tax payment in instalments.

Thus, the tax payment in instalments is carried out as follows:

Step 1: Submitting the application

The taxpayer prepares the application for tax payment in instalments and submits it to the directly managing tax authority.

Step 2: Reviewing the application

- In case the application for tax payment in instalments is incomplete according to regulations, within 03 working days from the date of receipt of the application, the tax authority must notify in writing requesting the taxpayer to clarify or supplement the application.

- In case the application for tax payment in instalments is complete, the tax authority will decide to approve or disapprove the tax payment in instalments.

Step 3: Delivering the result

Within 10 working days from the date of receipt of the application, the tax authority shall issue:

+ A notice of disapproval of the tax payment in instalments using form No. 03/NDAN issued with Appendix I of this Circular in cases where a guarantee letter showing signs of illegitimacy is detected, while concurrently issuing an official letter to the guarantor for verification. The guarantor shall send the verification result to the tax authority within the timeframe stipulated by law;

+ A decision approving the tax payment in instalments for cases entitled to tax payment in instalments.

What is the amount of tax payment in instalments in Vietnam?

Pursuant to Clause 3, Article 66 of Circular 80/2021/TT-BTC stipulates as follows:

Tax payment in instalments

...

3. Number of installments and amount of tax arrears to be gradually paid

a) The amount of tax arrears to be gradually paid is the outstanding tax amount calculated up to the time the taxpayer requests for gradual payment, but does not exceed the guaranteed tax arrears amount by the financial institution.

b) The taxpayer is allowed to pay the tax arrears gradually within a period of no more than 12 months and within the validity period of the guarantee letter.

c) The taxpayer is allowed to gradually pay the tax arrears monthly, ensuring that each installment is not lower than the average monthly tax payment in instalments. The taxpayer must self-assess the resulting late payment interest to pay along with the tax arrears to be gradually paid.

4. Deadline for tax payment in instalments

The deadline for tax payment in instalments is the last day of the month. If the taxpayer does not pay or pays insufficiently or the guarantor has not fulfilled the obligation to pay on behalf within 05 working days from the due date, the tax authority shall issue form No. 02/NDAN issued with Appendix I of this Circular to the guarantor to request the guarantee obligation according to the law, and concurrently notify the taxpayer.

The amount of tax arrears to be gradually paid is the outstanding tax amount calculated up to the time the taxpayer requests for gradual payment, but does not exceed the guaranteed amount of tax arrears by the financial institution.