What is the Form 01/DK-TDKTT - Application for conversion from monthly declaration to quarterly declaration of taxes in Vietnam?

What are regulations on tax period of PIT and CIT in Vietnam?

According to Clause 6, Article 3 of the Law on Tax Administration 2019, the definition of the tax period is as follows:

Interpretation of terms

...

6. The tax period is the duration for determining the amount of tax payable to the state budget as prescribed by tax law.

The tax period is the duration for determining the amount of tax payable to the state budget.

- Personal Income Tax (PIT) period:

According to the provisions of Article 7, Personal Income Tax Law 2007 (amended by Clause 3, Article 1 of the Amended Personal Income Tax Law 2012) regarding the personal income tax period:

- The tax period for resident individuals is stipulated as follows:

+ The tax period by year applies to income from business; income from wages and salaries;

+ The tax period by each time of income generation applies to income from capital investment; income from capital transfer, except for income from securities transfer; income from real estate transfer; income from prizes; income from royalties; income from franchise; income from inheritance; income from gifts;

+ The tax period by each time of securities transfer or by year for income from securities transfer.

- The tax period for non-resident individuals is calculated by each time income is generated for all taxable incomes.

- Corporate Income Tax (CIT) period:

According to Article 5 of the Law on Corporate Income Tax 2008 regarding the corporate income tax period, it is as follows:

- The corporate income tax period is determined by the calendar year or fiscal year, except in the case of applying the corporate income tax period by each time income is generated.

- The corporate income tax period by each time income is generated applies to foreign enterprises as follows:

+ Foreign enterprises having a permanent establishment in Vietnam pay taxes on taxable income generated in Vietnam that is not related to the activities of the permanent establishment;

+ Foreign enterprises without a permanent establishment in Vietnam pay taxes on taxable income generated in Vietnam.

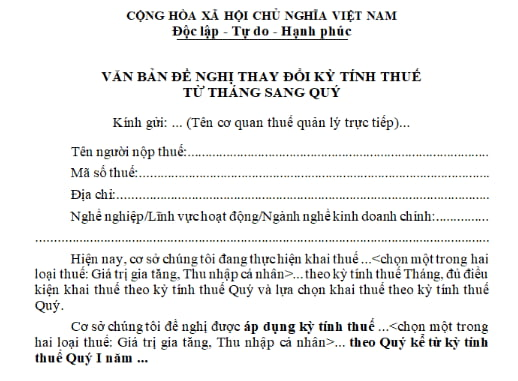

What is the Form 01/DK-TDKTT - Application for conversion from monthly declaration to quarterly declaration of taxes in Vietnam? (Image from Internet)

What is the Form 01/DK-TDKTT - Application for conversion from monthly declaration to quarterly declaration of taxes in Vietnam?

The form application for conversion from monthly declaration to quarterly declaration of taxes is Form 01/DK-TDKTT Appendix 2 issued together with Circular 80/2021/TT-BTC. Specifically, as follows:

Download Form 01/DK-TDKTT - Application for conversion from monthly declaration to quarterly declaration of taxes: Here

When are taxpayers granted an extension for submitting tax declarations in Vietnam?

According to the provisions of Article 46 of the Law on Tax Administration 2019 regarding the extension for submitting tax declarations, it is as follows:

Extension for submitting tax declarations

1. Taxpayers unable to submit tax declarations on time due to natural disasters, catastrophes, epidemics, fires, unexpected accidents are granted an extension for submitting tax declarations by the head of the directly managing tax agency.

2. The extension period does not exceed 30 days for the monthly, quarterly, annual tax declarations, and tax declarations by each time a tax obligation arises; 60 days for the submission of tax finalization declarations from the end of the submission deadline of the tax declaration.

3. The taxpayer must send a written request for an extension to the tax agency before the deadline for submitting the tax declaration, clearly stating the reason for the extension, with confirmation from the commune-level People's Committee or Police of the place where the case arises as stipulated in Clause 1 of this Article.

4. Within 03 working days from the receipt of the written extension request, the tax agency must respond in writing to the taxpayer about whether or not the extension request is accepted.

Hence, taxpayers are granted an extension for submitting tax declarations in case they are unable to submit tax declarations on time due to natural disasters, catastrophes, epidemics, fires, unexpected accidents, and are granted an extension by the head of the directly managing tax agency.

Note: The extension period does not exceed 30 days for the monthly, quarterly, annual tax declarations, and each time a tax obligation arises; 60 days for the submission of tax finalization declarations from the end of the submission deadline of the tax declaration.