What is the Form 01/BCTL-DK for the estimated extracted oil and gas output and the temporary tax payment ratio in Vietnam?

Vietnam: What does the temporary declaration dossier for the extracted oil and gas output and the temporary tax payment ratio include?

Based on subheading d of Section 14.1 regulated in Appendix 1 issued with Decree 126/2020/ND-CP, the temporary declaration dossier for the extracted oil and gas output and the temporary tax payment ratio includes:

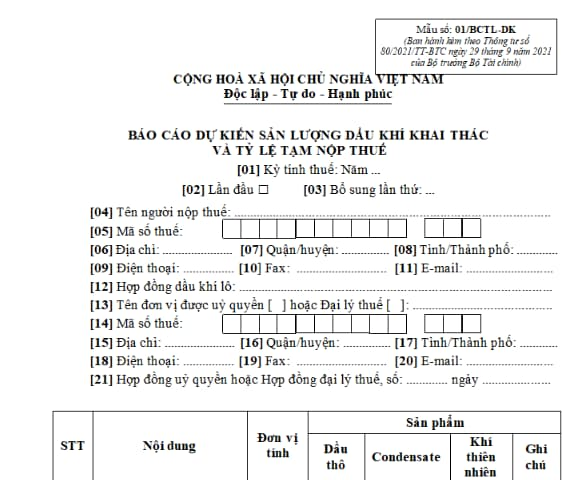

The report on the estimated extracted oil and gas output and the temporary tax payment ratio according to Form 01/BCTL-DK regulated in Appendix II issued with Circular 80/2021/TT-BTC.

What is the Form 01/BCTL-DK for the estimated extracted oil and gas output and the temporary tax payment ratio in Vietnam? (Image from the Internet)

What is the Form 01/BCTL-DK for the estimated extracted oil and gas output and the temporary tax payment ratio in Vietnam?

The report form for the estimated extracted oil and gas output and the temporary tax payment ratio is Form 01/BCTL-DK regulated in Appendix 2 issued with Circular 80/2021/TT-BTC. To be specific:

Download Form 01/BCTL-DK report on the estimated extracted oil and gas output and the temporary tax payment ratio: Here.

Vietnam: When should the temporary declaration for the extracted oil and gas output and the temporary tax payment ratio be submitted?

Based on Clause 4, Article 8 Decree 126/2020/ND-CP regulations are as follows:

Taxes declared monthly, quarterly, yearly, separately, and annual tax finalization declarations

...

4. Types of taxes and other state budget revenues declared based on each occurrence, including:

a) Value-added tax (VAT) of taxpayers as stipulated in Clause 3, Article 7 of this Decree or taxpayers implementing VAT declaration using the direct method on value added according to the law on VAT but incur VAT obligations related to real estate transfer activities.

b) Special consumption tax (SCT) for taxpayers engaged in export activities who have not yet paid SCT at the production stage but then sell domestically. SCT for business establishments purchasing domestically produced automobiles, aircraft, and yachts that are not subject to SCT, but later change their use purpose to be subject to SCT.

c) Taxes on imported and exported goods, including: export tax, import tax, safeguard tax, anti-dumping tax, countervailing tax, SCT, environmental protection tax, VAT. In cases where goods are imported or exported and not declared for each occurrence, guidance from the Ministry of Finance is followed.

d) Resource tax for organizations assigned to sell confiscated resources; non-regular resource extraction licensed by a competent state agency or not required to be licensed under the law.

dd) Non-regular value-added tax and corporate income tax of taxpayers applying the direct method on value added according to the law on VAT and a percentage on revenue according to the law on corporate income tax; except in cases where the taxpayer incurs multiple occurrences in a month, monthly declarations are allowed.

e) Corporate income tax for real estate transfer activities by taxpayers applying the percentage on revenue method according to the corporate income tax law.

g) Personal income tax declared by individuals or declared and paid by organizations and individuals on behalf of individuals for income from real estate transfer; income from capital transfer; income from investment capital; royalty income, franchise income, winnings from abroad; income from inheritance, gifts.

h) Taxes and revenues from leasing assets, business households, and individuals who do not operate a fixed business location and irregular business operation.

i) Registration fee (including cases exempt from registration fees according to the law on registration fees).

k) Environmental protection fee for non-regular mineral extraction approved by a competent state agency or not subject to licensing under the law.

l) Land use fees.

m) Land and water surface rent paid in a lump sum for the entire lease period.

n) VAT, corporate income tax of foreign organizations or individuals operating in Vietnam or earning income in Vietnam (hereinafter referred to as foreign contractors) applying the direct method; corporate income tax of foreign contractors applying a mixed method when Vietnamese parties make payments to foreign contractors. If the Vietnamese party pays foreign contractors multiple times in a month, monthly declarations are allowed instead of reporting each occurrence.

o) Corporate income tax from capital transfer activities by foreign contractors.

p) Corporate income tax on income from participation rights transfer in oil and gas contracts.

The transferring party of participation rights in oil and gas contracts is responsible for declaring and paying taxes on income from the transfer of participation rights in oil and gas contracts. If the transfer changes the ownership of the contractor holding participation rights in oil and gas contracts in Vietnam, the contractor named in the oil and gas contract is responsible for notifying the tax agency of the transfer activity and declaring and paying taxes on behalf of the transferor for the portion of income arising from the oil and gas contract in Vietnam according to regulations.

q) Oil and gas royalties; fees for reading and using oil and gas documents.

r) Surcharges and provisional corporate income tax from the remaining oil of the Vietsovpetro Joint Venture in Lot 09.1 no later than the 10th day from the date the Joint Venture Council decides the remaining oil surplus according to the resolution of each Joint Venture Council meeting but no later than December 31 each year.

s) Temporary declaration of extracted oil and gas output and temporary tax payment ratio no later than December 1 of the preceding tax year.

...

Thus, the deadline for the temporary declaration of extracted oil and gas output and the temporary tax payment ratio is no later than December 1 of the preceding tax year.