What is the Form 01-1/TBVMT for determining the environmental protection tax payable for coal extraction in Vietnam?

What are bases for determination of the environmental protection tax when extracting coal in Vietnam?

The basis for calculating the environmental protection tax for coal is defined in Article 6 of the 2010 Law on Environmental Protection Tax as follows:

Article 6. Basis for Calculating Tax

1. The basis for calculating the environmental protection tax is the taxable quantity of goods and the absolute tax rate.

2. The taxable quantity of goods is defined as follows:

a) For domestically produced goods, the taxable quantity is the quantity of goods produced and sold, exchanged, internally consumed, or gifted;

b) For imported goods, the taxable quantity is the quantity of goods imported.

3. The absolute tax rate for calculating the tax is specified in Article 8 of this Law.

Thus, the basis for determining the environmental protection tax payable for coal extraction is based on the taxable quantity of goods and the absolute tax rate.

Where to download the Form 01-1/TBVMT for determining the environmental protection tax payable for coal extraction in Vietnam?

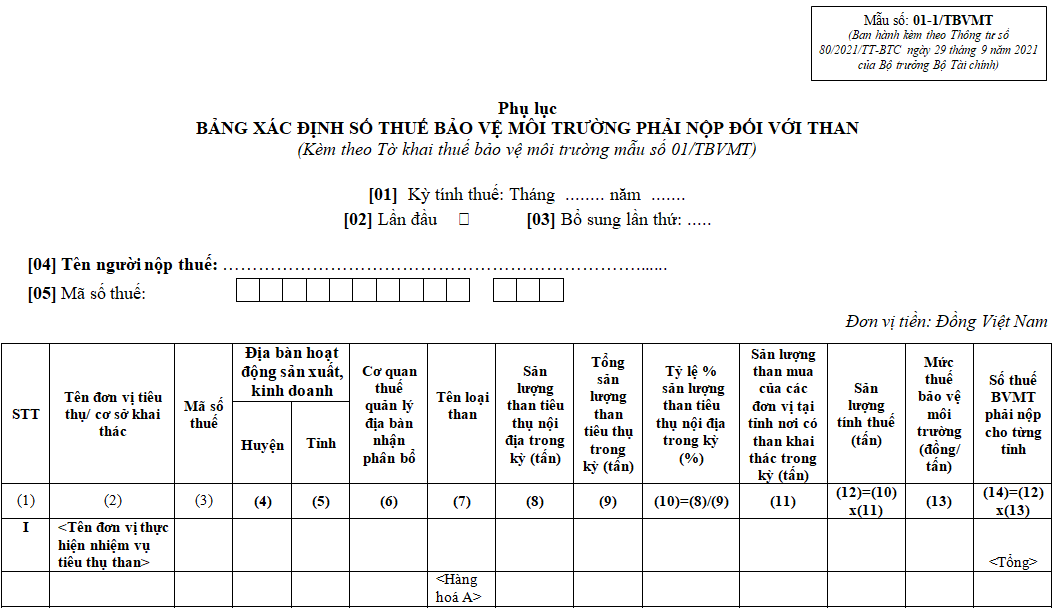

The form for determining the environmental protection tax payable for coal extraction is implemented according to Form 01-1/TBVMT in Section 5, Appendix 2 issued alongside Circular 80/2021/TT-BTC.

DOWNLOAD >>> Form 01-1/TBVMT for determining the environmental protection tax payable for coal extraction

What is the Form 01-1/TBVMT for determining the environmental protection tax payable for coal extraction in Vietnam? (Image from the Internet)

What is the method for allocating the environmental protection tax payable for coal extraction and consumption in Vietnam?

Based on the regulations in Article 16 of Circular 80/2021/TT-BTC on tax declaration, calculation, allocation, and payment of environmental protection tax as follows:

Tax Declaration, Calculation, Allocation, and Payment of Environmental Protection Tax

1. Allocation cases:

a) Fuel under the provisions of point a.2 clause 4 Article 11 of Decree No. 126/2020/ND-CP;

b) Coal extraction and domestic consumption under the provisions of point b clause 4 Article 11 of Decree No. 126/2020/ND-CP.

2. Allocation method:

a) Allocation of environmental protection tax payable for fuel:

The environmental protection tax payable for each province where dependent units are located is the total environmental protection tax payable allocated to each province for fuel products.

The environmental protection tax payable allocated to each province by each fuel product = the environmental protection tax payable for each fuel product on the tax declaration multiplied by (x) the percentage (%) of the volume of each fuel product sold by the dependent unit requiring tax declaration and environmental protection tax calculation over the total volume of each fuel product sold requiring tax declaration and environmental protection tax calculation of the taxpayer.

b) Allocation of environmental protection tax payable for coal extraction and domestic consumption:

The environmental protection tax payable for each province where the coal mining company is located is determined by the following formula:

3. Tax declaration and payment:

a) For fuel:

Dependent units of fuel importers or dependent units of subsidiaries of fuel importers operating in a different provincial area from where the fuel importer or its subsidiaries are headquartered without accounting separately for tax declaration should have the fuel importer or its subsidiary declare the environmental protection tax and submit the tax declaration dossier according to form No. 01/TBVMT, with the appendix for allocating the environmental protection tax payable to localities benefiting from fuel revenue according to form No. 01-2/TBVMT, issued with Appendix II of this Circular, to the directly managing tax authority; the allocated tax amount for each province where dependent units are located should be paid according to the provisions of clause 4 Article 12 of this Circular.

b) For coal extraction and domestic consumption:

Enterprises engaged in coal extraction and domestic consumption through management and assignment to subsidiaries or dependent units for extraction, processing, and consumption should have the unit responsible for coal consumption declare the entire environmental protection tax amount arising from coal extraction and submit the tax declaration dossier according to form No. 01/TBVMT, with the appendix for determining the environmental protection tax payable to localities benefiting from coal revenue according to form No. 01-1/TBVMT, issued with Appendix II of this Circular, to the directly managing tax authority; the allocated tax amount should be paid for each province where coal mining companies are headquartered according to the provisions of clause 4 Article 12 of this Circular.

Thus, the method for allocating the environmental protection tax payable for coal extraction and domestic consumption is regulated as follows:

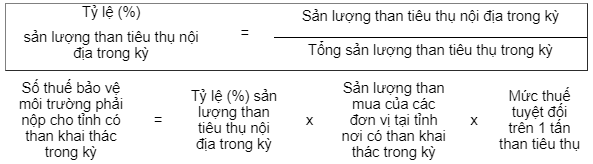

The environmental protection tax payable for each province where the coal mining company is located is determined by the following formula:

The percentage (%) of domestic coal consumption in the period = (Domestic coal consumption in the period) / (Total coal consumption in the period).

| Environmental protection tax payable for provinces with coal extraction in the period | = | Percentage (%) of domestic coal consumption in the period | x | Volume of coal purchased from units in the province with coal extraction in the period | x | Absolute tax rate per ton of consumed coal |