What is the Form 01-1/HT - List of invoices and documentary evidence for purchases in Vietnam under Circular 80?

What is the Form 01-1/HT - List of invoices and documentary evidence for purchases in Vietnam under Circular 80?

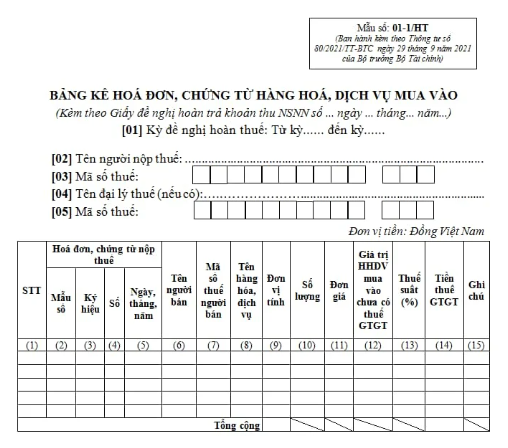

Form 01-1/HT is the List of invoices and documentary evidence for purchases issued in conjunction with Circular 80/2021/TT-BTC.

The 01-1/HT form for the invoice and document list of purchased goods and services is as follows:

Download the 01-1/HT form for the invoice and document list of purchased goods and services

What is the Form 01-1/HT - List of invoices and documentary evidence for purchases in Vietnam under Circular 80? (Image from the Internet)

What are the documents required for the VAT refund application for investment projects in Vietnam?

Based on Clause 1, Article 28 of Circular 80/2021/TT-BTC as amended by Article 2 of Circular 13/2023/TT-BTC, the VAT refund application is specified as follows:

VAT refund application

The VAT refund application as per the provisions of the law on VAT (excluding circumstances such as VAT refunds under international treaties; unrecovered input VAT upon ownership transfers, business conversions, mergers, consolidations, divisions, dissolutions, bankruptcies, terminations as regulated in Articles 30 and 31 of this Circular) includes:

- Request for refund of the state budget payment according to Form No. 01/HT issued with Annex I of this Circular.

- Related documents based on the specific refund case. Specifically:

a) For investment project VAT refund:

a.1) A copy of the Investment Registration Certificate or Investment Certificate or Investment License for cases requiring investment registration certification procedures;

a.2) For projects with construction works: A copy of the Land Use Rights Certificate or land allocation decision or land lease contract from a competent authority; construction permit;

a.3) A copy of the Charter Capital Contribution Document;

a.4) For investment projects of business entities in industries or trades subject to conditional business investment in the investment phase, following legal provisions on investment, specialized laws approved by competent state agencies: A copy of one of the forms of licenses or certificates or documents certifying, approving the conditional business investment industry or trade.

a.5) Invoice and document list of purchased goods and services according to Form No. 01-1/HT issued with Annex I of this Circular, except where the taxpayer has submitted electronic invoices to the tax authority;

a.6) Decision on the establishment of the Project Management Board, Decision assigning project management of the investment project owner, organization and operation regulation of the branch or project management board (if the branch or project management board executes the tax refund).

b) For VAT refunds for exported goods and services:

b.1) Invoice and document list of purchased goods and services according to Form No. 01-1/HT issued with Annex I of this Circular, except where the taxpayer has submitted electronic invoices to the tax authority;

...

Thus, the VAT refund application for investment projects includes the following documents:

- Request for refund of the state budget payment according to Form No. 01/HT issued with Annex I Circular 80/2021/TT-BTC;

- A copy of the Investment Registration Certificate or Investment Certificate or Investment License for cases requiring investment registration certification procedures;

- For projects with construction works: A copy of the Land Use Rights Certificate or land allocation decision or land lease contract from a competent authority; construction permit;

- A copy of the Charter Capital Contribution Document;

- For investment projects of business entities in industries or trades subject to conditional business investment according to legal provisions: A copy of one of the forms of licenses or certificates or documents certifying, approving the conditional business investment industry or trade.

- List of invoices and documentary evidence for purchases according to Form No. 01-1/HT issued with Annex I Circular 80/2021/TT-BTC, except where the taxpayer has submitted electronic invoices to the tax authority;

- Decision on the establishment of the Project Management Board, Decision assigning project management of the investment project owner, organization and operation regulation of the branch or project management board (if the branch or project management board executes the tax refund).

Which authority has the power to decide on tax refunds of Vietnam?

According to Article 76 of the Law on Tax Administration 2019, the authority with the power to decide on tax refunds is stipulated as follows:

- The Director General of the General Department of Taxation, Director of the Provincial/City Department of Taxation under central authority, decides on tax refund cases as prescribed by the tax law.

- The Head of the tax office where the tax refund overpayment dossier is received decides on refunding overpayments as per the provisions of the Law on Tax Administration 2019.

- The Director General of the General Department of Customs, Director of the Department of Customs, and Head of the Customs Sub-department where the refundable tax amount arises decide on tax refunds under tax law provisions.