What is the follow-up appointment form in medical examination and treatment covered by health insurance in Vietnam in 2025? Are health insurance contributions deductible when calculating PIT in Vietnam?

What is the follow-up appointment form in medical examination and treatment covered by health insurance in Vietnam in 2025?

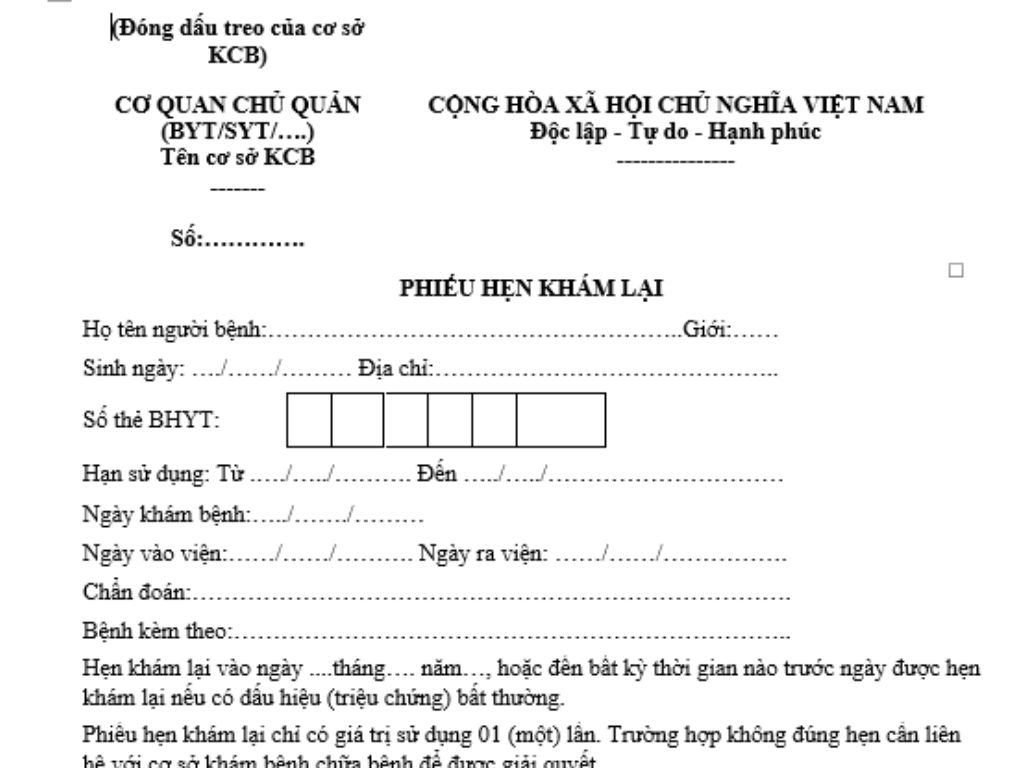

The follow-up appointment form in medical examination and treatment covered by health insurance for the year 2025 is the template in Appendix 5 issued with Circular 01/2025/TT-BYT.

Below is the follow-up appointment form in medical examination and treatment covered by health insurance for the year 2025:

follow-up appointment form in medical examination and treatment covered by health insurance for the year 2025 Download

What is the follow-up appointment form in medical examination and treatment covered by health insurance in Vietnam in 2025? Are health insurance contributions deductible when calculating PIT in Vietnam? (Image from Internet)

Are health insurance contributions deductible when calculating PIT in Vietnam?

According to Clause 2, Article 9 of Circular 111/2013/TT-BTC amended by Article 15 of Circular 92/2015/TT-BTC regulating deductible items when calculating personal income tax, the following:

Deductible Items

Items deductible as guided in this Article are those deducted from the taxable income of individuals before determining taxable income from salaries, wages, and business income. Specifically, as follows:

...

2. Deduction for insurance contributions and voluntary pension funds

a) Insurance contributions include: social insurance, health insurance, unemployment insurance, professional liability insurance for certain professions required to participate in compulsory insurance.

b) Contributions to voluntary pension funds, purchasing voluntary pension insurance

The contribution to a voluntary pension fund or the purchase of voluntary pension insurance can be deducted from taxable income based on actual occurrences but not exceeding one (1) million VND/month for employees participating in voluntary pension products as guided by the Ministry of Finance, including the amount paid by employers on behalf of employees and the amount employees contribute themselves (if any), also applicable when participating in multiple funds. The basis for determining deductible income is a copy of payment receipts (or fee payments) issued by the voluntary pension fund or insurer.

c) Foreign individuals residing in Vietnam, and Vietnamese individuals residing but working abroad with income from business or salaries, wages abroad, who have participated in compulsory insurance in accordance with the regulations of the country where the individual resides or works similarly to the laws of Vietnam such as social insurance, health insurance, unemployment insurance, compulsory professional liability insurance, and other compulsory insurances (if any) can deduct these insurance fees from taxable income from business or salaries when calculating personal income tax.

Foreign individuals and Vietnamese individuals participating in the aforementioned insurance abroad will receive a provisional deduction from income to deduct tax in the year (if there are documents) and calculated on the official amount if the individual makes a tax finalization according to regulations. In case there are no documents for provisional deductions in the year, a one-time deduction will be made when finalizing the tax.

d) Insurance contributions, contributions to a voluntary pension fund for a particular year are deductible in the taxable income of the same year.

đ) Documentary evidence for deductible insurance mentioned above is a copy of the payment receipts by the insurance organization or confirmation from the income paying organization about the amount of insurance deducted or paid (in cases where the income-paying organization pays on behalf).

...

Thus, health insurance contributions (or similar insurance contributions for foreign individuals residing in Vietnam, Vietnamese individuals residing but working abroad with income from business, salaries, wages abroad) will be deductible when calculating PIT.

What types of income are exempt from personal income tax in Vietnam?

Based on Article 4 of the Personal Income Tax Law 2007 (supplemented by Clause 3, Article 2 of the Law on Amendments to the Tax Laws 2014 and Clause 2, Article 1 of the Amendment to the Personal Income Tax Law 2012) regulating exempt individual incomes from personal income tax as follows:

- Income from real estate transfers between spouses; biological parents and natural children; adoptive parents and adopted children; parents-in-law and daughters-in-law; parents-in-law and sons-in-law; paternal grandparents and grandchildren; maternal grandparents and grandchildren; siblings.

- Income from the transfer of houses, residential land use rights, and assets attached to residential land of an individual in cases where the individual only owns one house or residential land.

- Income from the value of land use rights of an individual allocated by the State.

- Income from inheritance, gifts being real estate between spouses; biological parents and natural children; adoptive parents and adopted children; parents-in-law and daughters-in-law; parents-in-law and sons-in-law; paternal grandparents and grandchildren; maternal grandparents and grandchildren; siblings.

- Income of households and individuals directly engaged in agricultural, forestry, salt production, aquaculture, fishing, unprocessed or only preliminarily processed products.

- Income from the conversion of agricultural land allocated by the State for production by households and individuals.

- Income from deposit interest at credit institutions, interest from life insurance contracts.

- Income from remittances.

- Portion of salary for night work, overtime paid higher than for day work as prescribed by law.

- Retirement salaries funded by the Social Insurance Fund; voluntary pension funded monthly by a voluntary pension fund.

- Income from scholarships, including:

+ Scholarships received from the state budget;

+ Scholarships received from domestic and foreign organizations under that organization's scholarship grant program.

- Income from life, non-life insurance contract compensation, worker's compensation, state compensation, and other compensations as prescribed by law.

- Income received from charitable funds permitted or recognized by state authorities, established for non-profit, charitable, humanitarian purposes.

- Income received from foreign aid for charitable, humanitarian purposes in both governmental and non-governmental forms approved by state authorities.

- Income from salaries and wages of Vietnamese seafarers working for foreign shipping lines or Vietnamese shipping lines in international transport.

- Income of individuals as ship owners, individuals authorized to use ships, and individuals working on ships from activities providing goods and services directly serving offshore fishery.