What is the excise tax rate for tobacco in Vietnam? What is the latest 2024 application form for excise tax reduction in Vietnam?

What is the latest 2024 application form for excise tax reduction in Vietnam?

The latest 2024 application form for excise tax reduction is form number 01/MGTH issued with Appendix 1 of Circular 80/2021/TT-BTC as follows:

Download the latest 2024 Application form for excise tax reduction .

What is the excise tax rate for tobacco products? What is the latest 2024 application form for excise tax reduction in Vietnam? (Image from the Internet)

What is the excise tax rate for tobacco products in Vietnam?

Based on Article 2 of the excise Tax Law 2008 (amended by Clause 1, Article 1 of the Amended excise Tax Law 2014), subjects to excise tax are regulated as follows:

Taxable subjects

1. Goods:

a) **Cigarettes, cigars, and other products made from tobacco for smoking, inhaling, chewing, sniffing, and sucking;

b) Wine;

c) Beer;

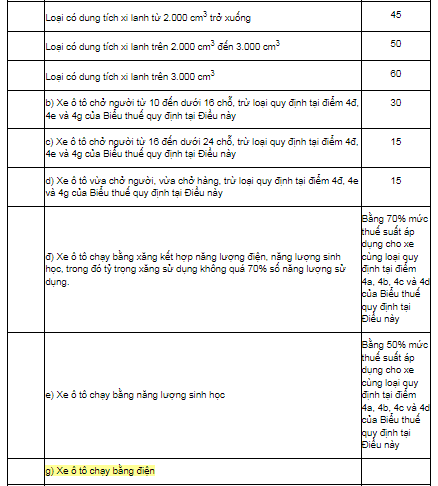

d) Cars with fewer than 24 seats, including vehicles designed for both transporting people and goods with at least two rows of seats, with a fixed partition between the passenger compartment and the cargo compartment;

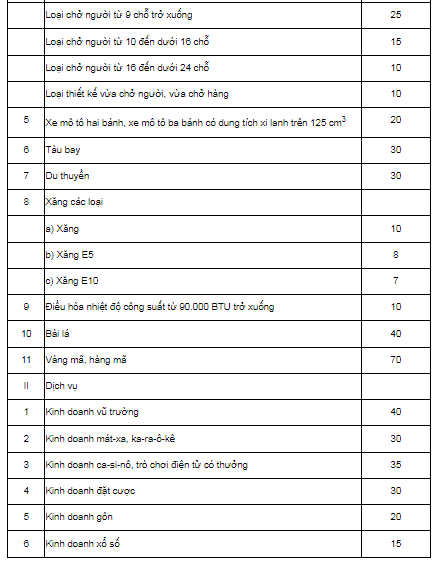

dd) Motorcycles with two or three wheels and an engine cylinder capacity exceeding 125 cm3;

e) Aircraft, yachts;

g) All types of gasoline;

h) Air conditioners with a capacity of 90,000 BTU or below;

i) Playing cards;

k) Paper votive offerings.

2. Services:

a) Discotheque business;

b) Massage, karaoke business;

c) Casino business; electronic games with bonuses, including jackpot, slot machines, and similar devices;

d) Betting business;

dd) Golf business, including membership cards, golf playing tickets;

e) Lottery business.

Additionally, pursuant to Article 7 of the excise Tax Law 2008 (amended by Clause 4, Article 1 of the Amended excise Tax Law 2014), Clause 2, Article 2 of the Law on Value Added Tax, excise Tax, and Tax Administration Amended 2016, and Article 8 of the Law Amending the Law on Public Investment, Law on Investment in the form of Public-Private Partnership, Law on Housing, Law on Bidding, Law on Electricity, Law on Enterprises, Law on excise Tax, and Law on Civil Execution 2022) as follows:

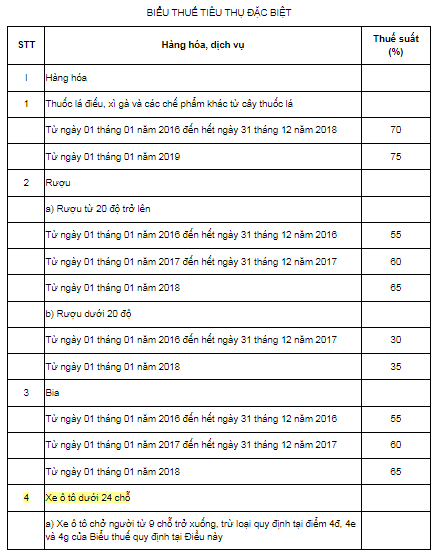

The excise tax rates for goods and services are regulated according to the following excise Tax Tariff:

Thus, it can be seen that since January 1, 2019, the excise tax rate for tobacco products is 75%.

What are the regulations on the refund and deduction of excise tax in Vietnam?

According to Article 6 of Decree 108/2015/ND-CP (amended by Clause 2, Article 1 of Decree 14/2019/ND-CP) as follows:

The excise tax refund is executed according to the regulation at Article 8 of the excise Tax Law 2008.

- In regard to goods temporarily imported and then re-exported as regulated in point a, clause 1, Article 8 of the excise Tax Law 2008, including:

+ Imported goods that have paid excise tax but are warehoused, stored at the port and under the supervision of customs, are re-exported abroad;

+ Imported goods that have paid excise tax to deliver, sell to foreign countries through agents in Vietnam; imported goods to sell to vehicles of foreign companies on routes through Vietnam ports or Vietnam vehicles on international routes as regulated by law;

+ Goods temporarily imported for re-export according to the method of business goods temporarily imported, when re-exported, the paid excise tax amount equivalent to the actually re-exported goods is refunded;

+ Imported goods that have paid excise tax but are re-exported to foreign countries are refunded the paid excise tax amount for the goods returned abroad;

+ Goods temporarily imported for exhibition, introduction of products, or to serve other jobs within a certain period as regulated by law and have paid excise tax, when re-exported, the tax is refunded.

In case goods temporarily imported for re-export, if already actually re-exported within the tax payment period according to the provisions of tax laws on export and import taxes, shall not be required to pay excise tax equivalent to the number of actually re-exported goods.

- Goods used as raw materials, imported for production, processing for export are refunded the paid excise tax equivalent to raw materials used to produce actually exported goods.

- Procedures, dossiers, order and authority to settle the refund of excise tax:

+ Procedures, dossiers, order and authority to settle the refund of excise tax for temporarily imported and re-exported goods as prescribed in clause 1 of this Article are executed according to the regulations on import tax refund.

+ Procedures, dossiers, order and authority to settle the refund of excise tax for goods as raw materials imported for production, processing for export as prescribed.

In case the import declaration has import tax, excise tax requested for refund, the dossier for import tax refund is also the dossier for excise tax refund.

- Manufacturing and trading enterprises reconcile tax when merging, splitting, dissolving, bankrupting, converting ownership form, transferring, selling, contracting, leasing a state enterprise with excess paid excise tax.

- The tax refund prescribed at point d, clause 1, Article 8 of the excise Tax Law 2008 includes:

+ Tax refund according to the decision of the competent authority as prescribed by law;

+ Tax refund according to international treaties to which the Socialist Republic of Vietnam is a member;

+ Tax refund in cases where the paid excise tax is larger than the payable excise tax amount according to laws.