What is the environmental protection tax rate for coal in Vietnam?

Which entities are subject to environmental protection tax in Vietnam?

According to Article 3 of the Law on Environmental Protection Tax 2010, Article 1 of Circular 152/2011/TT-BTC *amended by Article 1 of Circular 159/2012/TT-BTC), subjects to environmental protection tax include:

- Gasoline, oil, lubricants, including:

+ Gasoline, except ethanol;

+ Jet fuel;

+ Diesel oil;

+ Kerosene;

+ Mazut oil;

+ Lubricating oil;

+ Lubricants.

The gasoline, oil, and lubricants specified in this section are fossil-based gasoline, oil, and lubricants (hereinafter collectively referred to as gasoline) sold in Vietnam, excluding bio-products (such as ethanol, vegetable oil, animal fat…).

For mixed fuels containing biofuels and fossil-based gasoline, the environmental protection tax is only calculated on the fossil-based gasoline portion.

- Coal, including:

+ Brown coal;

+ Anthracite (anthraxit);

+ Fat coal;

+ Other coal.

- Hydro-chloro-fluoro-carbon (HCFC) solution is a group of substances that deplete the ozone layer used as refrigerants in cooling equipment and in the semiconductor industry, produced domestically, imported separately or contained in imported electrical cooling devices.

- Polythene bags subject to tax.

Polythene bags subject to tax (plastic bags) are thin plastic bags, containing mouths, bottoms, and walls and capable of holding products, made from single resin such as HDPE (high-density polyethylene resin), LDPE (low-density polyethylene), or LLDPE (linear low-density polyethylene resin), excluding prepackaged goods and polythene bags that meet environmental standards. These standards are certified by competent authorities according to regulations of the Ministry of Natural Resources and Environment.

- Herbicides restricted in use.

- Termiticides restricted in use.

- Forestry product preservatives restricted in use.

- Warehouse disinfectants restricted in use.

- When necessary, the Standing Committee of the National Assembly considers and stipulates the addition of taxable subjects suitable for each period.

What is the environmental protection tax rate for coal in Vietnam? (Image from the Internet)

What is the environmental protection tax rate for coal in Vietnam? (Image from the Internet)

What is the environmental protection tax rate for coal in Vietnam?

According to Article 8 of the Law on Environmental Protection Tax 2010, the tax tariff framework is regulated as follows:

The absolute tax amount is regulated according to the following Tax Tariff Framework:

| No. | Goods | Unit | Tax rate (VND/unit) |

|---|---|---|---|

| I | Gasoline, oil, lubricants | ||

| 1 | Gasoline, except ethanol | Liter | 1,000-4,000 |

| 2 | Jet fuel | Liter | 1,000-3,000 |

| 3 | Diesel oil | Liter | 500-2,000 |

| 4 | Kerosene | Liter | 300-2,000 |

| 5 | Mazut oil | Liter | 300-2,000 |

| 6 | Lubricating oil | Liter | 300-2,000 |

| 7 | Lubricants | Kg | 300-2,000 |

| II | Coal | ||

| 1 | Brown coal | Ton | 10,000-30,000 |

| 2 | Anthracite (anthraxit) | Ton | 20,000-50,000 |

| 3 | Fat coal | Ton | 10,000-30,000 |

| 4 | Other coal | Ton | 10,000-30,000 |

| III | Hydro-chloro-fluoro-carbon (HCFC) solution | kg | 1,000-5,000 |

| IV | Polythene bags subject to tax | kg | 30,000-50,000 |

| V | Herbicides restricted in use | kg | 500-2,000 |

| VI | Termiticides restricted in use | kg | 1,000-3,000 |

| VII | Forestry product preservatives restricted in use | kg | 1,000-3,000 |

| VIII | Warehouse disinfectants restricted in use | kg | 1,000-3,000 |

The environmental protection tax rates for coal are as follows:

Brown coal: 10,000-30,000 VND/ton

Anthracite (anthraxit): 20,000-50,000 VND/ton

Fat coal: 10,000-30,000 VND/ton

Other coal: 10,000-30,000 VND/ton

Note: Based on the prescribed Tax Tariff Framework, the Standing Committee of the National Assembly stipulates specific tax rates for each type of taxable goods ensuring the following principles:

+ The tax rate for taxable goods must conform to the State’s socio-economic development policy in each period;

+ The tax rate for taxable goods must be determined based on the environmental impact of the goods.

What documents are required for environmental protection tax declaration in Vietnam?

According to sub-section 21, section 2 of Administrative Procedures issued with Decision 1462/QD-BTC 2022, the documents for environmental protection tax declaration include:

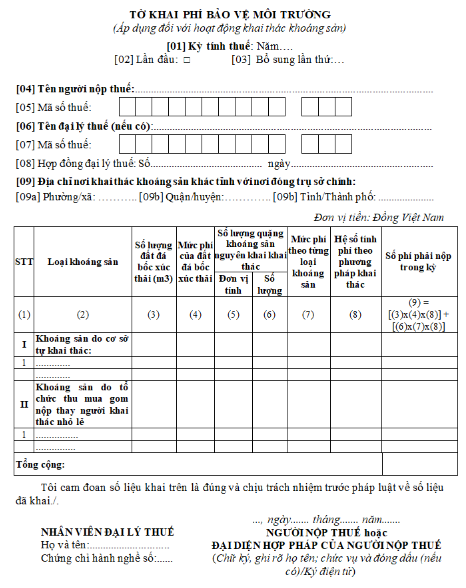

- The environmental protection tax declaration form no. 01/TBVMT according to Appendix 1 of the Tax Declaration Document List issued with Decree 126/2020/ND-CP and Circular 80/2021/TT-BTC.

- Appendix table determining the environmental protection tax payable for localities entitled to revenue from coal, form no. 01-1/TBVMT according to Appendix 1 of the Tax Declaration Document List issued with Decree 126/2020/ND-CP and Circular 80/2021/TT-BTC (in cases where the taxpayer allocates the environmental protection tax on gasoline to each locality where dependent units are headquartered as regulated);

- Appendix table allocating the environmental protection tax payable for localities entitled to revenue from gasoline, form no. 01-2/TBVMT according to Appendix 1 of the Tax Declaration Document List issued with Decree 126/2020/ND-CP and Circular 80/2021/TT-BTC (in cases where the taxpayer determines the tax payable to each locality where the company exploiting coal is headquartered as regulated).

Number of documents: 01 set

What contents are included in the Form 01/PBVMT - Environmental Protection Tax Declaration in Vietnam?

Form 01/PBVMT - Environmental Protection Tax Declaration is prescribed in Appendix 2 issued with Circular 80/2021/TT-BTC, as follows:

Download Form 01/PBVMT - Environmental Protection Tax Declaration: Here

Notes on environmental protection tax declaration in mineral exploitation activities as follows:

Indicators [09a], [09b], [09c]:

- Declare the location information where the taxpayer has mineral exploitation activities different from where the main office is located as per the regulation at Point i, Clause 1, Article 11 of Decree 126/2020/ND-CP, dated October 19, 2020, of the Government of Vietnam. In cases where the taxpayer has mineral exploitation activities in multiple districts, the declaration is made as follows:

+ If the Tax Department manages revenue collection, the taxpayer declares 01 representative district where mineral exploitation activities arise.

+ If the Regional Tax Department manages revenue collection, the taxpayer declares 01 representative district under the Regional Tax Department where mineral exploitation activities arise.