What is the environmental protection tax in Vietnam?

What is the environmental protection tax in Vietnam?

The environmental protection tax is defined in Clause 1, Article 2 of the Environmental Protection Tax Law 2010 as follows:

Interpretation of terms

In this Law, the terms below are construed as follows:

1. Environmental protection tax means indirect-collected tax, collected on products and goods (hereafter referred to as goods) when used to cause negative environmental impacts.

2. absolute tax amount means tax amount prescribed by the amount of money per unit of taxable goods.

3. Taxable-plastic bag means bags; packages are made from polyethylene plastic film unit, its technical name is a porous plastic bag

4. Hydrogen-chlorofluorocarbon liquid (HCFC) means group of substance causing reduction of ozone used as refrigerant.

Thus, the environmental protection tax means indirect-collected tax, collected on products and goods (hereafter referred to as goods) when used to cause negative environmental impacts.

What is the basis for calculating environmental protection tax in Vietnam?

According to Article 6 of the Environmental Protection Tax Law 2010, the environmental protection tax is calculated based on the following factors:

{1} The taxable quantity of goods.

{2} The absolute tax amount.

- The taxable quantity of goods shall be provided for as follows:

+ For goods produced in the country, the taxable quantity of goods is the quantity of goods produced and sold, exchanged, internally consumed, donated;

+ For imported goods, the taxable quantity of goods is the quantity of imported goods.

* Regarding the taxable quantity of goods, it is further guided in Article 3 of Decree 67/2011/ND-CP as follows:

The taxable quantity of goods is determined according to Article 6 of the Environmental Protection Tax Law. In the case of mixed fuels containing fossil-origin gasoline, oil, grease, and biofuel, the taxable quantity only includes the fossil-origin gasoline, oil, grease in the mixed fuel.

* The absolute tax amount for calculating the tax is specified in Article 8 of the Environmental Protection Tax Law 2010 as follows:

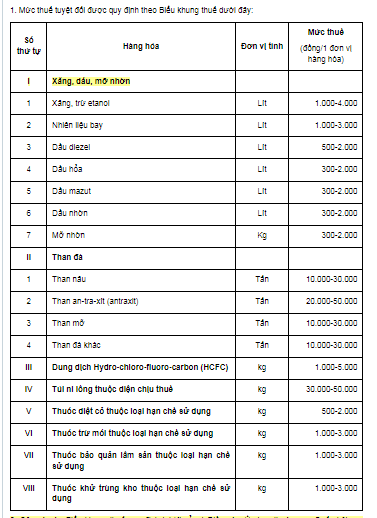

- The absolute tax amount is specified according to the Tax Schedule below:

Table 1

- Based on the above Tax Schedule (Table 1), the Standing Committee of the National Assembly will determine the specific tax amount for each type of taxable goods, ensuring the following principles:

+ The tax amount for taxable goods must be appropriate to the State’s socio-economic development policies at different times.

+ The tax amount for taxable goods must be determined based on the degree of negative impact on the environment.

What is the environmental protection taxable time in Vietnam?

Under Article 9 of the Environmental Protection Tax Law 2010, the environmental protection taxable time is as follows:

- For goods manufactured, sold, exchanged, donated, taxable time is the time transferring the ownership or right to use goods.

- For manufactured goods brought into internal consumption, taxable time is the time when taxable goods brought into use.

- For imported goods, taxable time is the time of registration of customs declarations.

- For gasoline, petroleum produced or imported for sale, taxable time is the time when the business hub of petrol and oil sold.

Additionally, the environmental protection taxable time is also guided by Article 6 of Circular 152/2011/TT-BTC as follows:

- For produced goods sold, exchanged, donated, used for sales promotion or advertising, the tax calculation time is the time of transfer of the goods ownership or use right.

- For produced goods used for internal consumption, the tax calculation time is the time goods are put into use.

- For imported goods, the tax calculation time is the time of registration of customs declarations, except petrol and oil imported for sale as specified in Clause 4 of Article 6 of Circular 152/2011/TT-BTC.

- For petrol and oil produced or imported for sale, the tax calculation time is the time principal petrol and oil traders sell petrol and oil.

What is the time for declaration of the environmental protection tax on imported goods in Vietnam?

According to Article 10 of the Environmental Protection Tax Law 2010, the declaration of taxation, tax calculation, and tax payment for the environmental protection tax is specified as follows:

Tax declaration, tax calculation and tax payment

1. The tax declaration, tax calculation, tax payment for environmental protection on goods produced and sold, exchanged, internally consumed, donated shall be made by the month and the provisions of the law on tax administration.

2. The tax declaration, tax calculation, tax payment for environmental protection on imported goods shall be made at the same to time of import duty declaration and tax payment.

3. Environmental protection tax is only paid once for goods produced or imported.

Thus, according to the aforementioned regulations, the time for declaring the environmental protection tax on imported goods will coincide with the time for declaring and paying import duty.