What is the enterprise information portal in Vietnam? How to check the TIN on the enterprise information portal in Vietnam?

What is the enterprise information portal in Vietnam?

The enterprise information portal, also known as the business information portal, is defined in Clause 4, Article 2 of Decree 47/2021/ND-CP as follows:

The enterprise information portal is an electronic information portal with the domain name http://www.business.gov.vn managed and operated by the Ministry of Planning and Investment.

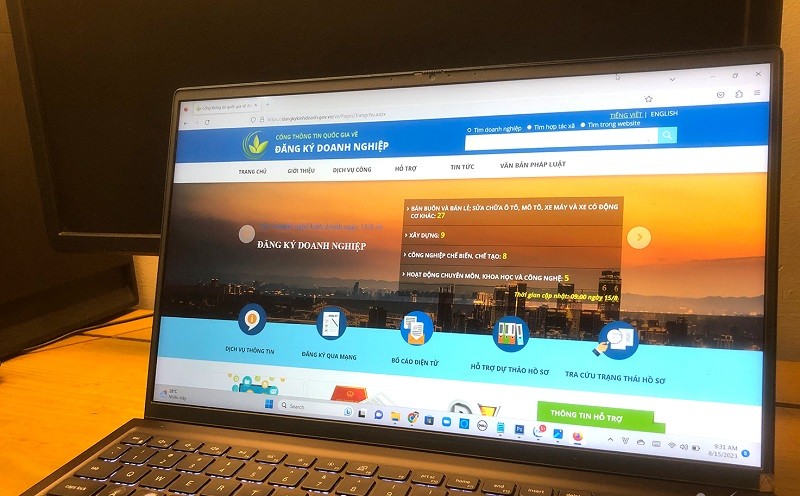

What is the enterprise information portal in Vietnam? How to check the TIN on the enterprise information portal in Vietnam? (Image from the Internet)

What is the enterprise information portal in Vietnam? How to check the TIN on the enterprise information portal in Vietnam? (Image from the Internet)

How to check the TIN on the enterprise information portal in Vietnam?

If you want to know detailed information about a business, including TIN, address, representative, etc., the national enterprise information portal will help you easily resolve this issue.

*Note: Readers can refer to 2 methods for checking TINs below:

Method 1: Checking the TIN on the national enterprise information portal

Detailed instructions:

Step 1: Access the website: Open your web browser and enter the address: https://dangkykinhdoanh.gov.vn/

Step 2: Enter search information: On the main interface of the website, you will see a search box. Enter into this box:

Business name: Enter the full or part of the company name you want to check.

Business ID: If you know the business ID, enter it directly into this box.

Step 3: View results: The system will automatically suggest enterprises that match your search keyword. Choose the business you need to find to see detailed information on the national portal.

Method 2: Check the business TIN on the General Department of Taxation

The General Department of Taxation provides an online information portal to help you easily find information on millions of enterprises nationwide. This website is provided by the Ministry of Finance.

Steps to perform:

Step 1: Access the website: Open your web browser and enter the address: https://tracuunnt.gdt.gov.vn/tcnnt/mstdn.jsp

Step 2: Enter the required information: On the main interface, you will see boxes for entering information. You only need to fill in the information you know; it is not necessary to complete all the boxes. The information you can enter includes:

TIN: If you know the TIN, enter it directly into this box.

Business name: Enter the full or part of the business name.

Address: Enter the main office address of the business.

ID/Identification card of the legal representative: If you know this information, enter it.

Step 3: Click “Search”: After entering the information, click the “Search” button. The system will automatically search and display the results.

Step 4: View results: The search results will include detailed information about the business such as: full name, address, business sector, legal representative, etc.

What are the legal provisions regarding the tax payment deadline for enterprises in Vietnam?

According to Article 55 of the Law on Tax Administration 2019, the deadline for business tax payment is as follows:

Tax Payment Deadline

1. In cases where taxpayers calculate tax, the latest tax payment deadline is the last day of the deadline for filing tax returns. For supplementary tax return filings, the deadline for tax payment is the deadline for filing tax returns of the tax period with errors or omissions.

For corporate income tax, temporary payments are made quarterly, and the latest payment deadline is the 30th of the first month of the subsequent quarter.

For crude oil, the deadline for resource taxes and corporate income tax payment per crude oil sale is 35 days from the selling date for domestically sold crude oil or from the customs clearance date in accordance with the customs law for exported crude oil.

For natural gas, the deadline for resource taxes and corporate income tax payment is monthly.

2. In cases where tax authorities calculate tax, the deadline for tax payment is the date stated in the tax authority's notification.

3. For other budgetary revenues from land, water resource extraction rights, mineral resource fees, registration fees, and business license fees, the deadline follows the regulations of the Government of Vietnam.

4. For exported and imported goods subject to the taxation law, the tax payment deadline is as per the regulations in the Law on Export and Import Tax; in cases of additional payable tax arising after customs clearance or goods release, the additional tax payment deadline is as follows:

a) The deadline for additional tax declarations, payment of assessed amounts, applies according to the initial customs declaration's tax payment deadline;

b) The tax payment deadline for goods requiring analysis or inspection to accurately determine payable taxes; goods without official pricing at the time of customs declaration registration; and goods with actual payments, and value-added fees not yet determined at the time of customs declaration registration follow the regulations of the Minister of Finance.

Thus, according to legal regulations, the quarterly estimated deadline for corporate income tax payment is no later than the 30th of the first month of the subsequent quarter.