What is the electricity and water charge payment statement form for enterprises in Vietnam?

What is the electricity and water charge payment statement form for enterprises in Vietnam?

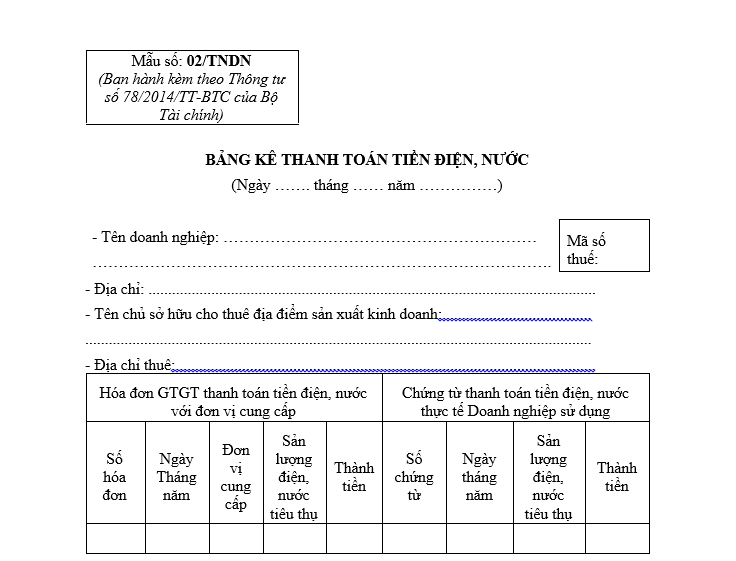

Based on the List of Sample Forms issued with Circular 78/2014/TT-BTC, the electricity and water charge payment statement form for enterprises is Form No. 02: electricity and water charge payment statement issued with Circular 78/2014/TT-BTC.

Form 02 - Electricity and water charge payment statement is as follows:

Form No. 02 - Electricity and water charge payment statement...Download

What is the electricity and water charge payment statement form for enterprises in Vietnam? (Image from the Internet)

Are electricity and water charges deductible in case of paying directly to the supplier of Vietnam?

Based on Clause 2 Article 6 of Circular 78/2014/TT-BTC (amended by Article 4 Circular 96/2015/TT-BTC) stipulates as follows:

Expense items deductible and non-deductible when determining taxable income

...

- Non-deductible expense items when determining taxable income include:

2.1. Expenses that do not meet all the conditions specified in Clause 1 of this Article.

In cases where an enterprise incurs costs related to the value of losses due to natural disasters, epidemics, fires, and other force majeures that are not compensated, such expenses are considered deductible expenses when determining taxable income. Specifically:

The enterprise must clearly determine the total value of losses due to natural disasters, epidemics, fires, and other force majeures as prescribed by law.

The portion of the loss value due to natural disasters, epidemics, fires, and other force majeures not compensated is determined by subtracting the value that insurers or other organizations/individuals must compensate according to legal regulations from the total value of the loss.

a) Documentation for assets and goods lost due to natural disasters, epidemics, fires to be included in deductible expenses is as follows:

- A record of the value of assets and goods lost, prepared by the enterprise.

The record must clearly specify the value of assets and goods lost, causes, liabilities of organizations and individuals for the losses; types, quantities, values of recoverable goods (if any); an inventory sheet of lost goods with confirmation from the enterprise's legal representative who signs and takes responsibility before the law.

- Insurance compensation documents accepted by the insurance agency (if any).

- Documents stipulating the liability of organizations and individuals required to compensate (if any).

b) Goods damaged due to changes in natural biochemical processes, expired goods not compensated are included in deductible expenses when determining taxable income.

Documentation for goods damaged due to changes in natural biochemical processes, expired goods included in deductible expenses is as follows:

- A record of the value of damaged goods prepared by the enterprise.

The record must clearly specify the value of damaged goods, causes; types, quantities, values of recoverable goods (if any) along with an inventory sheet of damaged goods with confirmation from the enterprise's legal representative who signs and takes responsibility before the law.

- Insurance compensation documents accepted by the insurance agency (if any).

- Documents stipulating the liability of organizations and individuals required to compensate (if any).

c) The above documentation is kept at the enterprise and presented to the tax authority upon request.

...

2.15. Payment of electricity and water charges under contracts signed directly with electricity and water charge suppliers by household or individual property owners renting production and business premises without sufficient documentation in any of the following cases:

a) Cases where enterprises renting production and business premises pay electricity and water charge charges directly to electricity and water charge suppliers without invoices and rental contracts for production and business premises.

b) Cases where enterprises renting production and business premises pay electricity and water charge charges to the property owner without documentation matching the actual consumption and rental contract for production and business premises.

Therefore, when an enterprise rents a headquarters or office where the owner directly signs the electricity and water charge contract with the supplier and there are no payment invoices and rental contracts, the payment of electricity and water cannot be deducted from corporate income tax.

Are electricity and water charges deductible in case of paying to the premises lessor in Vietnam?

Based on Clause 2 Article 6 of Circular 78/2014/TT-BTC (amended by Article 4 Circular 96/2015/TT-BTC) stipulates as follows:

Expense items deductible and non-deductible when determining taxable income

...

- Non-deductible expense items when determining taxable income include:

...

2.15. Payment of electricity and water charges under contracts signed directly with electricity and water charge suppliers by household or individual property owners renting production and business premises without sufficient documentation in any of the following cases:

a) Cases where enterprises renting production and business premises pay electricity and water charge charges directly to electricity and water charge suppliers without invoices and rental contracts for production and business premises.

b) Cases where enterprises renting production and business premises pay electricity and water charge charges to the property owner without documentation matching the actual consumption and rental contract for production and business premises.

As such, if there is no documentation of electricity and water charge payments matching the actual consumption and rental contract for production and business premises when the enterprise pays utilities to the lessor, the enterprise cannot deduct the electricity and water charge payment from corporate income tax.