What is the e-commerce tax declaration form in Vietnam?

What is E-commerce Tax in Vietnam?

Based on Clause 1, Article 3 of Decree 52/2013/ND-CP on e-commerce activities, defined as follows:

E-commerce activities involve conducting a part or the entirety of the commercial activity process electronically, connected to the Internet, mobile telecommunications, or other open networks.

Additionally, based on Point e, Clause 1, Article 2, Chapter I of Circular 40/2021/TT-BTC, which stipulates the subjects of application, including e-commerce activities, specifically those individuals earning income from products, services, and digital information content as per e-commerce laws.

From this, it can be inferred that individuals conducting business sales on e-commerce platforms are subjects to declare and pay taxes. This is referred to as E-commerce Tax.

In simpler terms, these are the types of taxes that individuals and organizations conducting business over the internet are required to pay to the state (for example, selling on e-commerce platforms like Shopee, Lazada, Tiktok...).

What is e-commerce tax? What is the e-commerce tax declaration form in Vietnam? (Image from the Internet)

What is the e-commerce tax declaration form in Vietnam?

The e-commerce tax declaration form in Vietnam is issued together with Circular 80/2021/TT-BTC as follows:

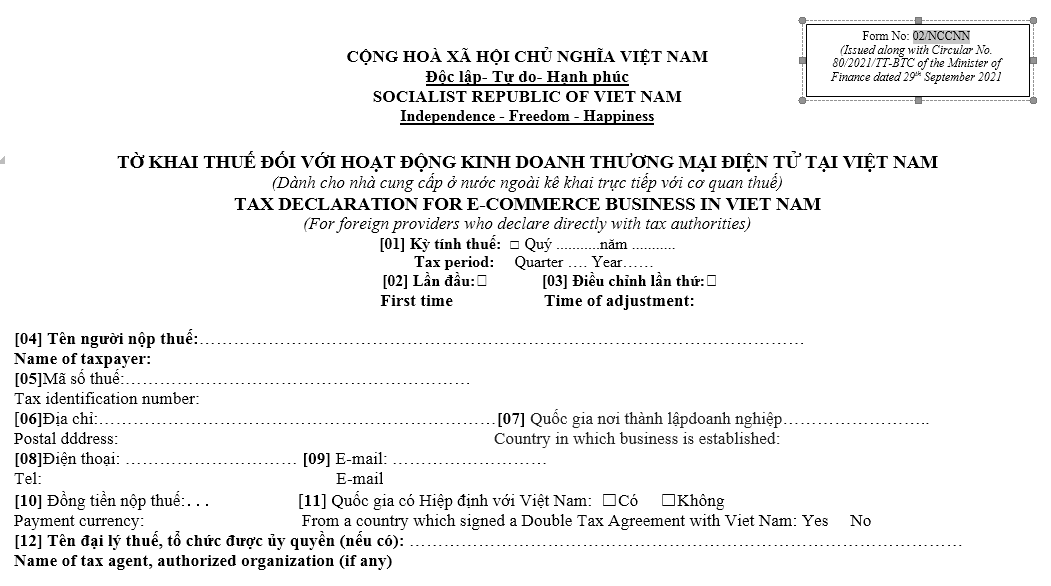

- The tax declaration form for e-commerce business activities in Vietnam for foreign suppliers to declare directly with the tax authority is as follows:

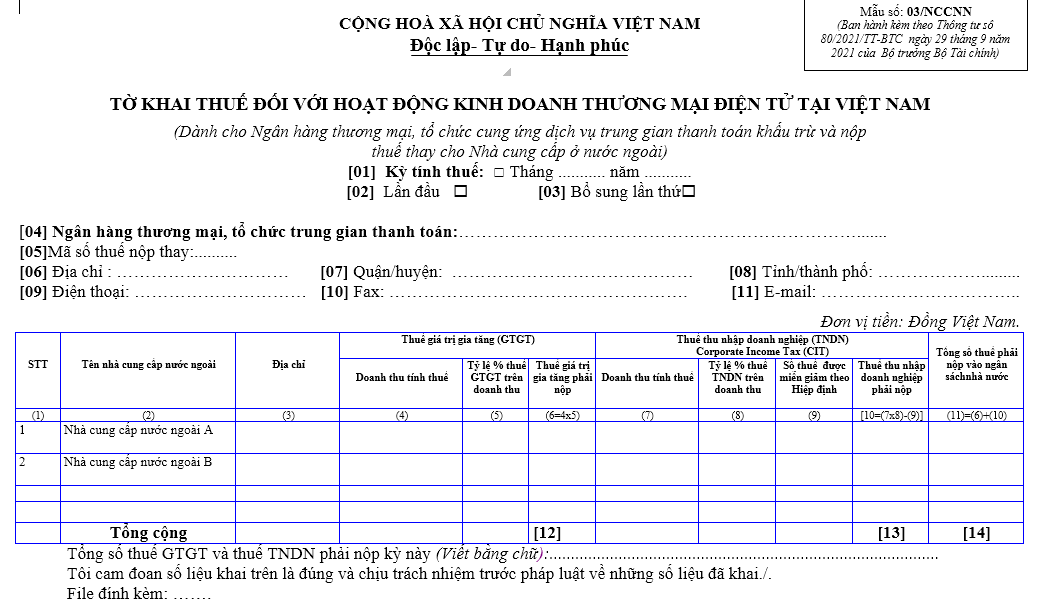

- The tax declaration form for e-commerce business activities in Vietnam for commercial banks, intermediaries providing payment services to withhold and pay taxes on behalf of foreign suppliers is as follows:

Additionally, the tax management for organizations and individuals involved in e-commerce business activities in Vietnam is regulated under Article 73 of Circular 80/2021/TT-BTC. This states that organizations and individuals involved in tax management for e-commerce business activities, digital platform businesses, and other services of foreign suppliers without a permanent establishment in Vietnam include:

- Foreign suppliers without a permanent establishment in Vietnam involved in e-commerce activities, digital platform businesses, and other services with organizations or individuals in Vietnam (hereinafter referred to as foreign suppliers).

- Organizations and individuals in Vietnam purchasing goods or services from foreign suppliers.

- Organizations and tax agents operating under Vietnamese law authorized by foreign suppliers to perform taxpayer registration, tax declaration, and tax payment in Vietnam.

- Commercial banks, intermediaries providing payment services, and any organizations or individuals with rights and obligations related to e-commerce business activities, digital platform businesses, and other services of foreign suppliers.

What are the principles of e-commerce activities in Vietnam?

The principles of e-commerce activities are specified in Article 26 of Decree 52/2013/ND-CP as amended by Points a and b, Clause 8, Article 1 of Decree 85/2021/ND-CP as follows:

- Principle of freedom and voluntary agreement in e-commerce transactions:

Participants in e-commerce activities have the right to freely agree, in compliance with the law, to establish rights and obligations in the transaction. This agreement serves as the basis for resolving disputes arising during the transaction process.

- Principle of determining the scope of business activities in e-commerce:

If merchants, organizations, or individuals engage in selling goods, providing services, and promoting commerce on e-commerce websites without specifying geographic limitations, these business activities are deemed to be conducted nationwide.

- Principle of determining obligations regarding consumer rights protection in e-commerce activities:

+ Owners of e-commerce websites selling goods and sellers on websites providing e-commerce services must comply with the provisions of the Consumer Protection Law 2010 when providing goods and services to customers;

+ Customers on websites providing e-commerce services are consumers of e-commerce services and consumers of goods and services provided by sellers on these websites;

+ In cases where merchants or organizations providing e-commerce services offer information about a seller’s goods and services to consumers on e-commerce websites, these merchants or organizations act as a third party in providing information under consumer protection laws.

- Principle of doing business in goods and services with conditional business licenses through e-commerce.

E-commerce activities involving goods and services with restricted business licenses must comply with the relevant legal provisions.

- Participants in e-commerce activities are obligated to comply with the law regarding information security, cybersecurity, and other related legal regulations.