What is the duty-free allowance book template - Template No. 02h2 applicable to diplomatic officials in Vietnam?

What is the duty-free allowance book template - Template No. 02h2 applicable to diplomatic officials in Vietnam?

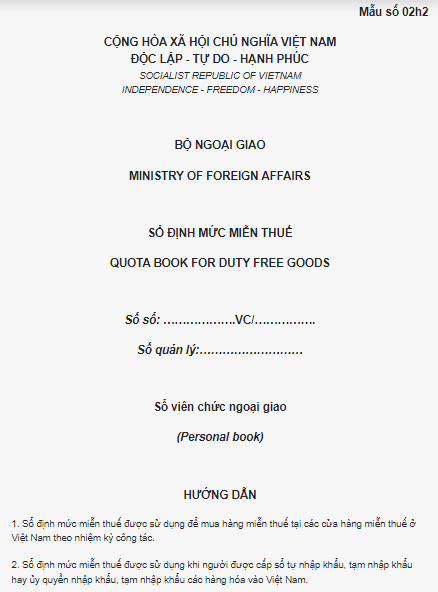

Under Appendix 7 of the forms/templates for tax exemption, tax reduction, tax refund, and non-taxation issued together with Decree 18/2021/ND-CP, the duty-free allowance book template - Template No. 02h2 applicable to diplomatic officials in Vietnam is specified as follows:

Download the duty-free allowance book template - Template No. 02h2 applicable to diplomatic officials in Vietnam.

What is the duty-free allowance book template - Template No. 02h2 applicable to diplomatic officials in Vietnam? (Image from the Internet)

Which authorities have the power to issue duty-free allowance books to diplomatic officials?

Under Point c, Clause 8, Article 5 of Decree 134/2016/ND-CP the procedure for issuing the duty-free allowance books is as follows:

Power to issue the duty-free allowance book or increase allowance therein

Directorate of State Protocol – The Ministry of Foreign Affairs or an agency authorized by the Ministry of Foreign Affairs shall issue duty-free allowance books made in Template No. 02h1 Download or Template No. 02h2 Download or Template No. 02h3 Download to the entities mentioned in Point a and Point b Clause 1 of this Article 1 within 05 working days from the day on which adequate documents are received.

Customs Departments of provinces where the organizations mentioned in Clause 1 of this Article are located shall issue duty-free allowance books Template No. 02h4 Download or Template No. 02h5 Download to the entities mentioned in Point c and Point d Clause 1 of this Article within 05 working days from the day on which adequate documents are received.

The Ministry of Foreign Affairs shall monitor and issue duty-free allowance book to the entities granted diplomatic immunity and privileges mentioned in Point c Clause 1 of this Article if they have been issued with duty-free allowance books by the Ministry of Foreign Affairs before the effective date of this Decree.

The authorities mentioned in this Point shall update General Department of Customs with information in duty-free allowance books via the National Single-window Information Portal after each duty-free allowance book is issued.

Thus, the Directorate of State Protocol – The Ministry of Foreign Affairs or an agency authorized by the Ministry of Foreign Affairs shall issue duty-free allowance books.

What are the procedures for issuing a duty-free allowance book in Vietnam?

Under Clause 8, Article 5 of Decree 134/2016/ND-CP, the procedures for issuing a duty-free allowance book are in Vietnam as follows:

Procedures for issuance of duty-free allowance book or increase of allowance therein

- Application submitted by an organization shall include the following documents:

The written request for issuance of the issuance of the duty-free allowance book or allowance increase (Form No. 01 or Form No. 01a in Appendix VII hereof: 01 original copy;

Notice of the establishment of the representative agency in Vietnam after the duty-free allowance book is issued for the first time: 01 photocopy;

Documents proving completion of re-export, destruction or transfer of the goods in case the entity specified in Point a, Point b Clause 1 of this Article requests additional allowance on automobiles or motorcycles to the duty-free allowance book: 01 photocopy;

The international treaty or agreement between Vietnam’s government and the foreign non-governmental organization which specifies the categories and allowance on duty-free goods: 01 photocopy;

The Prime Minister’s decision on duty exemption if the international treaty or agreement between Vietnam’s government and the foreign non-governmental organization does not specify the categories and allowance on duty-free goods (for the organizations specified in Point c, Point d Clause 1 of this Article): 01 photocopy.

- Application submitted by an individual shall include the following documents:

The written request for issuance of the issuance of the duty-free allowance book or allowance increase (Form No. 02 or Form No 02i in Appendix VII hereof: 01 original copy;

The ID card issued by the Ministry of Foreign Affairs (for the individuals specified in Point a, Point b Clause 1 of this Article: 01 photocopy;

Documents proving completion of re-export, destruction or transfer of the goods in case the entity specified in Point a, Point b Clause 1 of this Article requests additional allowance for automobiles or motorcycles to the duty-free allowance book: 01 photocopy;

The work permit or a legally equivalent document issued by a competent authority if the applicant is a member of an international organization or non-governmental organization (for persons mentioned in Point d Clause 1 of this Article): 01 photocopy;

The international treaty or agreement between Vietnam’s government and the foreign non-governmental organization which specifies the categories and allowance on duty-free goods: 01 photocopy;

The Prime Minister’s decision on duty exemption if the international treaty or agreement between Vietnam’s government and the foreign non-governmental organization does not specify the categories and allowance on duty-free goods (for the entities specified in Point c, Point d Clause 1 of this Article): 01 photocopy.